GAAR: India May Not Go For Retro-Taxing Of Overseas M&A

A committee which was formed to give recommendations on the implementation of the controversial general anti-avoidance rules (GAAR) provisions in India released its draft guidelines Thursday night. The draft guidelines have clarified that the GAAR will not be applied retrospectively.

GAAR, which was introduced in the budget in March, has been much criticized by the industry and investors for its anti-investment friendly provisions. The new tax rules, intended to eliminate tax evasion by companies by routing their investments through tax havens, lacked clarity in several aspects and investors feared its misuse.

The provisions in GAAR like retro-taxing created panic among investors that reflected in Indian capital and Forex markets through the high foreign fund outflow. Though the government deferred its implementation by a year to 2013, it virtually spoiled the investor sentiment towards the economy.

In the draft guidelines issued Thursday, the government sought to allay the investors' concerns over retro-taxing and other issues.

On Invoking the GAAR and Retro Taxing provisions: The ministry's draft guidelines clarify that there won't be any retro-taxing and GAAR provisions will be invoked only if a Foreign Institutional Investor (FII) opts to take advantage of tax treaties.

Where an FII (foreign institutional investor) chooses to take a treaty benefit, GAAR provisions may be invoked in the case of the FII, but would not in any case be invoked in the case of the non-resident investors of the FII, says the draft guidelines.

The ministry has also suggested having an income threshold for invoking GAAR while making clear that the provisions of GAAR will apply to the income accruing or arising to the taxpayers on or after 01.04.2013.

Interplay between SAAR and GAAR: Allaying concerns that there can be interplay between the Anti-Avoidance Rules (SAAR) and Specific General Anti-Avoidance Rules (GAAR), the draft guidelines said: While SAARs are promulgated to counter a specific abusive behavior, GAARs are used to support SAARs and to cover transactions that are not covered by SAARs. Under normal circumstances, where specific SAAR is applicable, GAAR will not be invoked. However, in an exceptional case of abusive behavior on the part of a taxpayer that might defeat a SAAR, as illustrated in Example No. 16 in Annexure E (or similar cases), GAAR could also be invoked.

On the Application of Section 96(2): One of the contentious provisions in GAAR was that even if only a part of the business arrangement is to obtain a tax benefit, the tax authorities will treat the whole arrangement as an impermissible arrangement, according to section 96(2).

However, now the draft guidelines recommend that where only a part of the arrangement is impermissible, the tax consequences of 'Impermissible Avoidance Arrangement' will be limited to only that part of the arrangement.

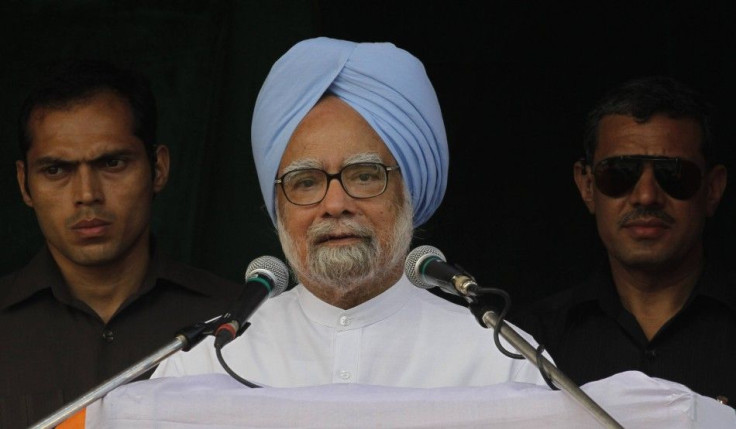

The draft guidelines are not yet seen by Prime Minister Manmohan Singh, who assumed the charge of the Finance Ministry after Pranab Mukherjee resigned from the post. Finance ministry sources have revealed that the guideline will be finalized in consultation with the Prime Minister. However, with Singh making it clear that he would make all efforts to get back the foreign funds and revive economic growth, the concerns over the provisions of GAAR are expected to be addressed soon.

Analysts expressed satisfaction over the government move to clarify on GAAR.

Some clarifications are a welcome step. It remains to be seen how the guidelines are implemented, said N. C. Hegde, a Mumbai-based partner at Deloitte Touche Tohmatsu India, according to a Bloomberg report.

The government's initiative to sort out the concerns over GAAR is crucial in regaining the FII confidence. Experts feel though there still exists some doubts on the provisions of the controversial act, steps taken now are in right direction towards clearing them.

© Copyright IBTimes 2024. All rights reserved.