General Motors (GM) Tab To Uncle Sam Is $9.7 Billion So Far, Says TARP Special Inspector General

And that doesn’t include Ally Financial, GM’s former financial operation

The special inspector general for the Troubled Asset Relief Program released its quarterly report Tuesday, providing the latest comprehensive snapshot of where we are with TARP, how much U.S. taxpayers are owed and how much they will never recover.

“The largest losses from TARP are expected to come from housing programs and from assistance to AIG and the automotive industry,” said the complex and footnote-laden document.

Specifically, the biggest losses go the government-sponsored Freddie Mac and Fannie Mae mortgage lenders, to writeoffs related to the largest single TARP beneficiary, New York-based American International Group (NYSE:AIG), and to two of the Detroit 3 automakers, especially General Motors Co. (NYSE:GM) and Detroit-based Ally Financial Inc., formerly GM’s internal financing arm that was spun off in the wake of the 2009 auto industry crisis.

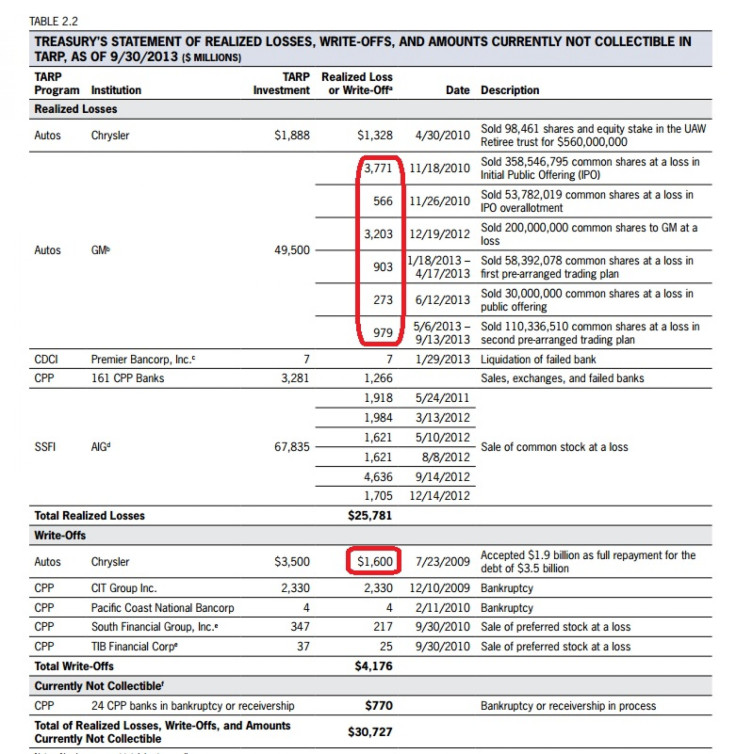

As of Sept. 30, taxpayers were still owed $53.4 billion of the $421.2 billion put forward by the Treasury Department by Oct. 3, 2010, when its authority to invest under TARP expired. Of that, $30.7 billion has been lost for good so far, including $9.3 billion in direct government welfare to AIG, the big insurer whose stock has risen 54 percent over the past five years and paid out its first dividend (money paid to shareholders to encourage them to keep holding stock) in five years last month.

GM still owes about $15 billion and has paid back $35.2 billion. The U.S. Treasury still holds about 100 million shares of GM, but GM’s stock has never approached the value it was expected to rise to following its return to the stock exchange in 2010.

Basically what this means is that taxpayers were given a bag of GM stock and told that the value of the equity would rise over time as GM continued its recovery. But each time the government has sold a share of GM stock as it tries to exit from owning part of the world’s second-largest automaker, the estimated value of the remaining stock needed to recover 100 percent of the TARP funds goes up.

GM owed the taxpayer about $15 billion as of mid-September. As this chart above shows, the government has already written off $9.7 billion as it has sold shares at a loss. The government wants to be fully out of GM ownership by the end of the first quarter of next year. In order to recover 100 percent of what GM owes the taxpayer through the sale of the remaining shares, GM’s stock would have to be worth $148 per share. It closed Wednesday at $36.08.

So what is the grand total for the taxpayer bill for bailing out the auto industry? Chrysler LLC cost $1.6 billion. GM's current estimated loss is $9.7 billion. In other words, the cost of rescuing GM and Chrysler will easily top $11 billion. Oh, and then there’s the $14.6 billion Ally Financial still owes the taxpayer.

Read the full report here.

© Copyright IBTimes 2024. All rights reserved.