Global Economy Not In Strong Recovery, Due To Stagnant Hiring In US, Trade Misreporting In China, And Market Levels After Inflation Adjustment

Stronger-than-expected economic reports and record-setting market levels got a big "hurrah" from investors in the past week. But some experts believe there's some irrational exuberance happening and bullishness could do with a reality check. A number of analyses are saying that the global recovery is actually faltering.

"Signs that global growth was picking up early this year have faded during the spring," Andrew Kenningham, senior global economist with Capital Economics, said. He points to a variety of factors contributing to activity slowing down around the world, and three additional reports back him up.

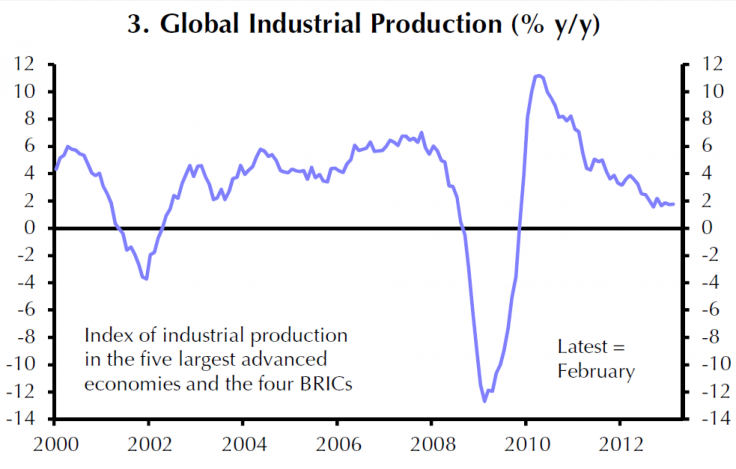

Production Is Not Producing

Global production indicators suggest that growth accelerated in the first quarter when compared with the weak end to 2012. However, growth in the U.S. and China was lower than expected. Overall GDP declined further in February, according to Kenningham.

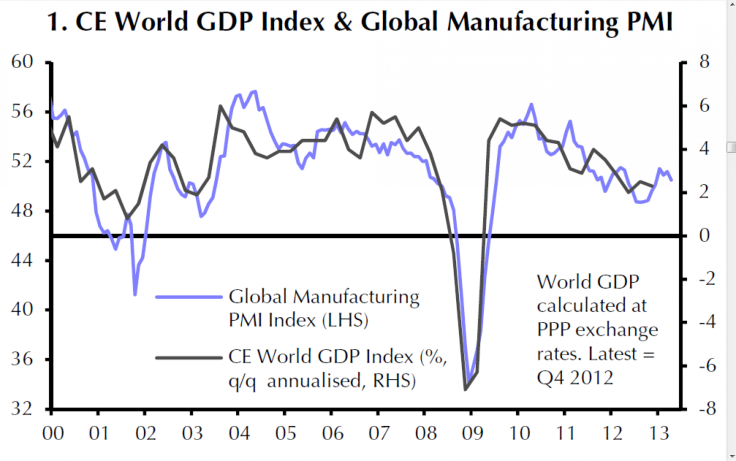

Fewer Orders In Order

Business indicators also dropped for the U.S. and China during April. The manufacturing index dropped to its lowest level so far this year and the services PMI dropped more sharply to its lowest level in 10 months, according to Kenningham. Furthermore, forward-looking new orders and new export orders indices both declined in April relative to March, dipping down close to the break-even 50-mark.

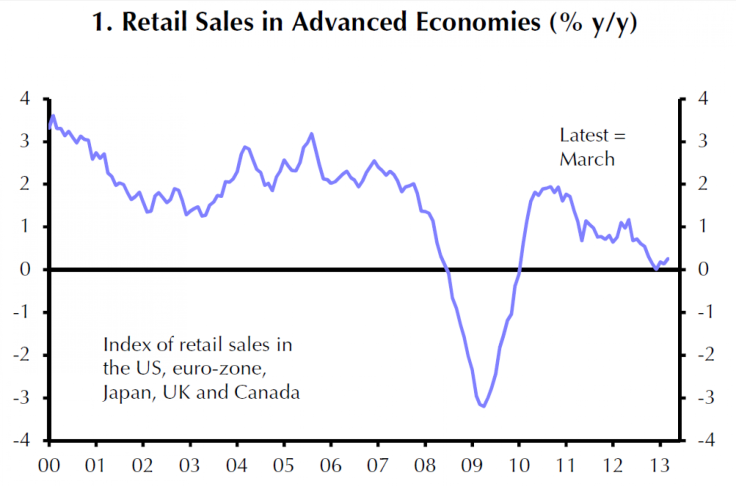

Consumer Drag

Consumer indicators confirm that retail sales in advanced economies are stagnant. Consumer confidence remained low in the U.S. and euro-zone in April. In Japan, however, confidence has risen, reflecting optimism that “Abenomics” will kick-start the economy (3). But it is no higher than it was during 2004-07, when actual consumption growth remained fairly low. Global new-car sales were roughly unchanged in March from a year previously (6) as strong growth in China was offset by falling sales elsewhere.

China Is Exaggerating Its Trade

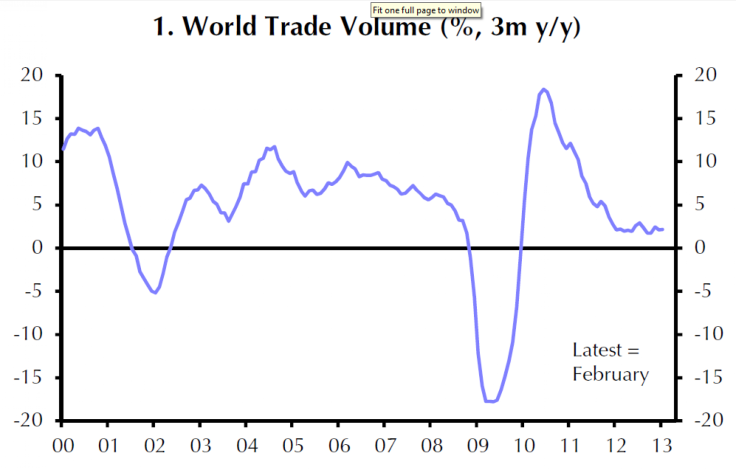

The global volume of world trade is sluggish, rising by less than 2 percent during the latest three-month period compared to the same stretch in the previous year.

"This is substantially slower than the average growth rate recorded before the global financial crisis," said Kenningham. "Moreover, there was a small fall in the new export orders component of the global manufacturing PMI last month."

One example is in China, where trade stimulus efforts by Chinese authorities have been less effective than expected. Chinese authorities reported stronger than expected imports and exports, yet Noruma, an Asian-based investment bank and financial services group, said the reason is because traders are overcharging recipients in Hong Kong in order to avoid strict regulations that the mainland imposes to control the influx of cash.

"We believe exports to destinations like Hong Kong, a major financial hub, are likely being over-invoiced in an attempt to circumvent capital controls and bring foreign capital into China," said Nomura's Zhiwei Zhang.

Zhang's analysis says the growth in trade doesn't indicate recovery, instead it reflects the continuing inflow of money at a spiked level during April. China's Foreign Exchange department responded by cracking down on the practice of misreporting in the trade sector, reinforcing Zhang's view that the trade growth has been artificially high in 2013 because firms overreported the value of their exports.

Hiring Is Either Down Or Stagnant

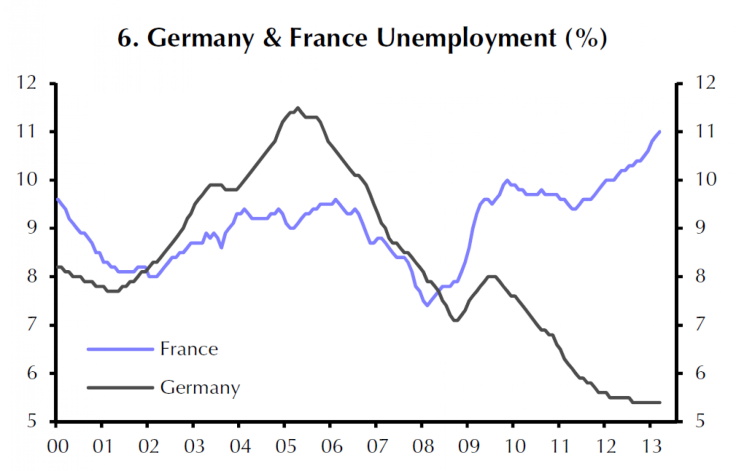

Aggregate figures can mask big regional differences, says Kenningham. The employment component of the PMIs indicates that the labor market remains weakest in the euro zone yet when evaluated separately it becomes clear that there is a stark difference between German and French labor markets.

While the U.S. employment level is at a stronger level than the euro zone's, the fiscal squeeze is slowing the U.S. economy, Kenningham says. Employment numbers that the U.S. government released May 7 show that, despite layoffs and voluntary quitting being down, actual hiring remains virtually stagnant.

David R. Rosenberg, chief economist for Toronto money management firm Gluskin Sheff & Associates Inc., said the numbers in this week's Job Openings and Labor Turnover Summary from the Labor Department are the "exact opposite" of what one would expect given the previous week's nonfarm payroll report and the upward revisions that went along with it.

Rosenberg noted that job openings fell 55,000 in March and have fallen now in three of the past four months. Further, new hires tumbled 192,000 in March, offsetting almost all of the increases of January and February. "For all the talk of how the U.S. economy is hanging in, the reality is that conditions remain extremely sluggish," said Rosenberg.

Stocks Aren't Doing That Great

Kenningham says inflation has dropped recently in the major advanced economies, which can impact markets unexpectedly. A report by Yale University finance professor Robert Shiller says that in inflation-adjusted terms, the S&P 500 hit its all-time high in early 2000, at the top of the Internet bubble. So if measured in today's dollars, the S&P would have passed the 2000 mark prior to when the bubble burst, not today. It would need to climb another 24 percent from where it stands today to truly break a record.

© Copyright IBTimes 2024. All rights reserved.