Gold Price Crashes; Biggest Two-Day Plunge In 30 Years; 12-Year Bull Market Appears Finished

Gold prices posted their biggest two-session drop in 30 years Monday as retail investors and large institutional speculators capitulated to a six-month downdraft that accelerated in the last week into bear market territory. The violence of Monday’s plunge reinforced the view that the 12-year bull market in gold is finished.

In New York trading, a troy ounce of gold closed at $1,360.60, a more than 9 percent plunge and the most extreme drop since 1983.

By the close of trading Monday the price was off more than 13 percent, or more than $200 per ounce, from last Thursday’s closing price of $1,564.90.

“Gold has just experienced its biggest two-day rout in 30 years," said HSBC Securities analyst James Steel. “The double-digit fall on Friday and Monday means it has now lost over a quarter of its value since it peaked at $1,921 per ounce in September. By definition, the more than 20 percent fall in gold means that the bull market dating from 2001 is over.”

Analysts attributed the crash to numerous causes.

“The trigger for the slump in the gold price since Friday appears to have been aggressive selling by speculative traders, rather than any change in the fundamental drivers,” said Julian Jessop, head of commodities research for Capital Economics. “Gold has also been caught up in the broad-based weakness in commodity markets, including oil and industrial metals, due to softer U.S. and Chinese (economic) data.”

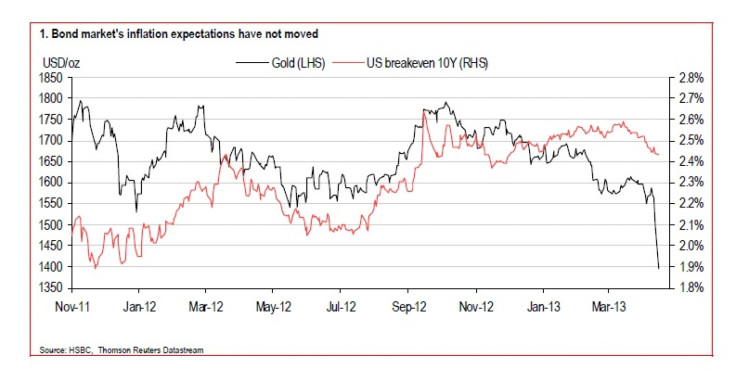

The release of minutes from the last Federal Open Market Committee meeting led to speculation that the Fed might scale back on its $85 billion per month bond purchases later in the year. Such a turn of events would mean that the price of bonds would fall, forcing up interest rates and thus making bonds more attractive than gold.

“Rising real yields could also reduce the attractiveness of assets like gold, which pay no income. But, if anything, the income U.S. data have made it less likely that monetary stimulus will be withdrawn any time soon,” said Jessop, referring to the anemic March job creation report from the Labor Department.

Other analysts pointed to rumors that Cyprus may sell its gold reserves as a part of its financial reconstruction, last week’s recommendation by Goldman Sachs to short the yellow metal and the size of the sell orders, which indicated that major players were capitulating to the five-month-old slide in the price of gold.

“We are drawn to the reports of some unusually large sell orders on the U.S. gold futures market on Friday,” said Jessop. “Of course, you would expect plenty of selling in any market when prices are falling sharply, so this is not necessarily telling us anything about causation. But it does seem reasonable to conclude that the gold price has been hit by heavy speculative selling, which may only be temporary. We do not expect the current weakness to be sustained, provided the risk of an escalation of the euro-zone crisis remains high and the global recovery is still fragile.”

The price crash of the last two days may stem from several causes.

“Some of these reasons are more powerful than others,” Steel said. “None of them in isolation truly explains the violence of the move.”

Shares of gold miners, including the largest ones, were crushed.

Toronto-based Barrick Gold Corporation (NYSE:ABX), the world’s largest gold miner, closed down more than 12 percent, while Kinross Gold Corp. (NYSE:KGC) ended more than 14 percent down.

The SPDR Gold Trust (NYSEArca:GLD), the world’s largest gold exchange-traded fund, dropped 8.8 percent.

The downdraft hammered silver assets, too. The price of the gray metal lost 11 percent to end Monday’s trading at $23.35 per ounce. The iShares Silver Trust, an exchange-traded fund that holds silver (NYSEArca:SLV), closed down 12.6 percent

© Copyright IBTimes 2024. All rights reserved.