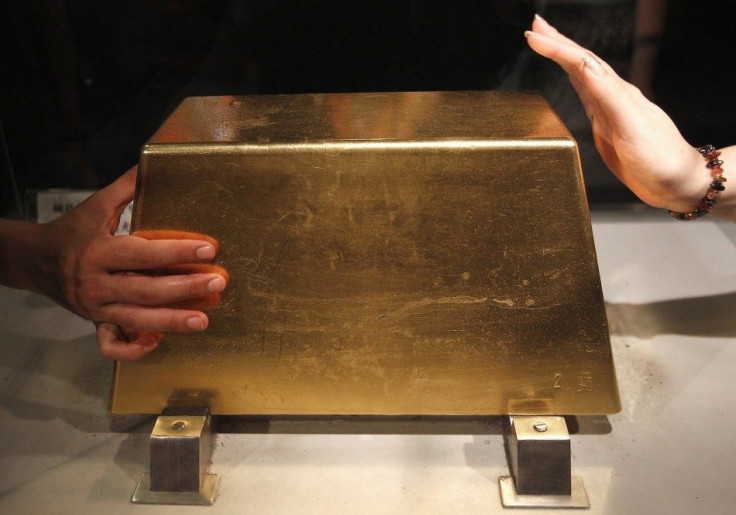

Gold Price Falls 3 Percent, Losing Safe-Haven Cred to Dollar

Gold prices fell about 3 percent Friday, setting up the third weekly decline for a commodity that has recently been touted as the pre-eminent safe haven.

But as Greece sidles increasingly toward default and U.S. economic data keeps suggesting a double-dip recession, the safe haven to which investors are actually fleeing is the dollar, now at a seven-month high.

Gold's recent lack of appeal has resulted in a 13.6 percent decline since the yellow metal, which has been steadily climbing for 11 years, hit a high of $1,921.16 earlier this month.

The dollar has strengthened in all of this and everyone is derisking and putting money into the dollar because of the deteriorating economic outlook, Soozhana Choi, head of commodity research in Asia at Deutsche Bank in Singapore, told Reuters.

We saw massive derisking across the board, and gold as well as other commodities weren't unscathed.

The latest downdraft among precious metals started Wednesday after the Federal Reserve issued one of its most dire outlooks for the economy and warned bluntly that global financial institutions were in danger.

Stock markets weren't impressed with the U.S. central bank's response to its own outlook and plunged, along with gold and other commodities.

By Thursday a full-on rout was under way as investors around the world, en masse, piled into U.S. Treasuries. That chopped the bond's interest rate, which moves inversely to its price, to a level not seen since the middle of the last century.

Despite the stampede into the greenback, investors and analysts are beginning to assess when greed will trump the fear.

Gold has been caught up in the overall flight to the exit, but in a normal, sensible world, we should expect to see some support from the fear and trepidation investors are facing, Nick Trevethan, senior commodities strategist at Australia & New Zealand Banking Group Ltd., told Bloomberg.

Gold on the New York futures market was recently down $50.30 to $1,691.40, a loss of 2.87 percent from the previous day's close. At one point in electronic trading it was down more than 3 percent. Gold for immediate delivery fell $58.89 to $1,691.73.

Silver on the New York futures market fell $3.85 to $32.73, a loss of 10.39 percent from the previous day's close. Silver for immediate delivery declined $5.07 to $32.96.

© Copyright IBTimes 2024. All rights reserved.