Gold Prices To Fall Further, Will Recover Only By Q2 2019

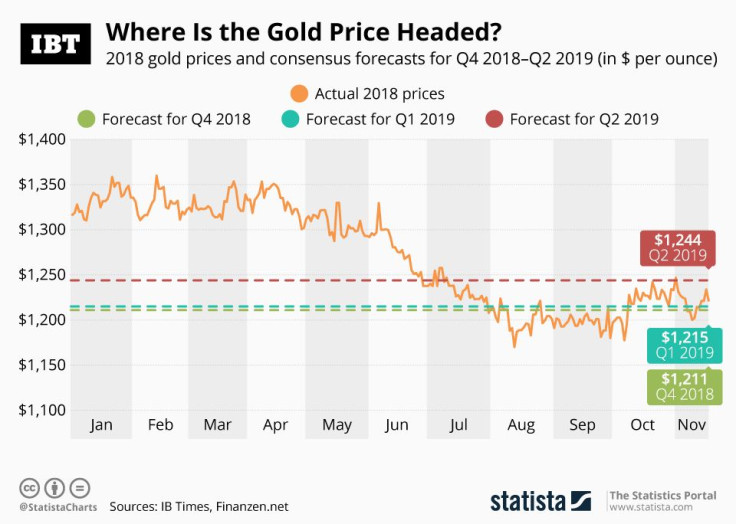

(Updates story to add a chart with IBT Poll consensus forecasts.)

Gold will continue to struggle as a stronger U.S. dollar, rising trade tensions and weak seasonal demand weigh on prices but expect it to be back in favor with investors by the second quarter of 2019.

In an interview with International Business Times, Robert Zukowski, technical analyst at Continuum Economics, said he expects gold to continue to fall this year before bottoming out in the end of first quarter 2019. “Both fundamentals and technicals line up in the same direction, which is bearish on gold,” he said.

Zukowski sees gold at $1,180 per ounce by end 2018. The precious metal is expected to breach the the low point it hit in August and bottom out at $1,125 per ounce at the end of first quarter 2019, followed by a correction that will see prices bounce back toward $1,250 around mid-2019, he added.

In a recent poll conducted by IBT, consensus forecasts from 11 analysts including Zukowski see gold trading at $1,211 per ounce at the end of the fourth quarter. Lackluster demand is expected to continue through first quarter 2019 when the precious metal is seen at $1,215 per ounce. Prices of the bullion are expected to rise in the second quarter 2019 to $1,244 per ounce per the consensus estimates.

Gold was last trading at $1,227.15 per ounce Wednesday. It hit a 2018-low of $1,160.06 per ounce on Aug. 15 and touched a peak of $1,243.32 per ounce on Oct. 26.

“This range we've had in gold, kind of building between, say, $1,250 on the upside and $1,160 on the downside, I think that range is eventually going to break the downside,” Zukowski said.

The analyst pointed out that $1,235 -- a 200-week moving average for gold -- is a key resistance level and the bullion has failed to comfortably breach that level. “We had that breakdown below the 200-week moving average in July and then we rallied back to it and started to sell off again. So, that’s key resistance of $1,235 to, say, $1,250,” he said.

Zukowski said a stronger dollar -- currently indicating a medium-term bull trend -- is one of the main factors weighing on gold and it is expected to continue putting downward pressure on prices.

He expects the dollar index to range between 98 and 98.5 in the short term. “As we start pushing into the new year, we can still take a run at 100 spot,” he added.

“I think that 100 spot is very feasible over the next couple of months, with the risk to 102 and that could be where the dollar index starts to run into some trouble around the 102-103 zone. And if we do start to top out there, that's going to coincide with the next gold bottom,” he said.

The dollar index last traded at 96.85 Tuesday.

“President Donald Trump is a wildcard on both sides of the aisle, for upside risks and downside risk,” Zukowski said. If the dollar keeps getting stronger then it may attract President Trump’s attention and his reaction will have an impact on prices, he said.

“As long as the trade tensions are in place, I think that precious and base metals will probably still continue to go lower with the dollar moving higher,” Zukowski added.

He said seasonalities are also putting downward pressure on gold prices. “Gold has kind of moved sideways here, but the seasonality starts to look bearish again for January to March. So I think that's another kind of downside pressure over the next couple of months.”

“Toward the middle of next year, seasonality will start picking up and start looking bullish for gold, especially around the July to September time period,” he said.

© Copyright IBTimes 2024. All rights reserved.