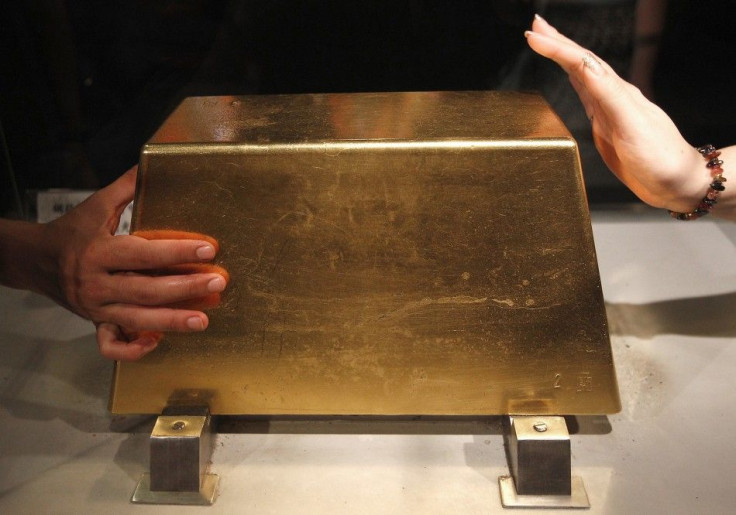

Gold Prices Slump 2 Percent ahead of German Vote on Bailout Fund

Silver closes down 4.47 percent

Gold prices slumped 2 percent Wednesday, and silver fell twice as much, as investors braced for a key vote on the future of the European bailout fund and readjusted portfolios ahead of the fourth quarter's start.

German lawmakers were set to vote Thursday on expanding the European Financial Stability Facility to $600 billion from $340 million. All 17 members of the Eurozone must approve the expansion but the support of Germany, Europe's strongest economy, is critical.

A negative vote Thursday could doom any bailout fund expansion plans and also any hopes of keeping Greece from defaulting. Should the vote succeed, as is expected, it would boost optimism about Europe's economy and draw investors into equities -- and away from precious metals. The prospect of passage led some gold investors to sell ahead of Thursday's vote.

Other gold investors sold to restore their portfolio's preferred asset allocations before Friday's start to the fourth quarter. Those allocations have changed over the course of the third quarter, which ends Friday: Gold began the third quarter around $1,500 and rose through early September when it reached more than $1,900.

A strengthening dollar and increased buying of U.S. Treasuries encouraged the sale of precious metals.

U.S. stocks, meanwhile, followed European equities lower.

Gold on the Comex fell $34.40 to $1,618.10, a 2.08 percent decline from $1,652.50. Gold for immediate delivery fell $42.75 to $1,603.33.

Silver on the Comex fell $1.40 to $30.13, a 4.47 percent decline from $31.54. Silver for immediate delivery fell $1.35 to $29.86.

© Copyright IBTimes 2024. All rights reserved.