Gold Prices Won’t Stay High When Fed Begins Reducing Its Bond Buying, Says Barclays, Which Expects 'Tapering' In December

Despite their recent spike, gold prices will begin eroding next year if the Federal Reserve reduces its $85 billion per month bond purchases in December and interest rates rise as expected, Barclays analysts reported Friday.

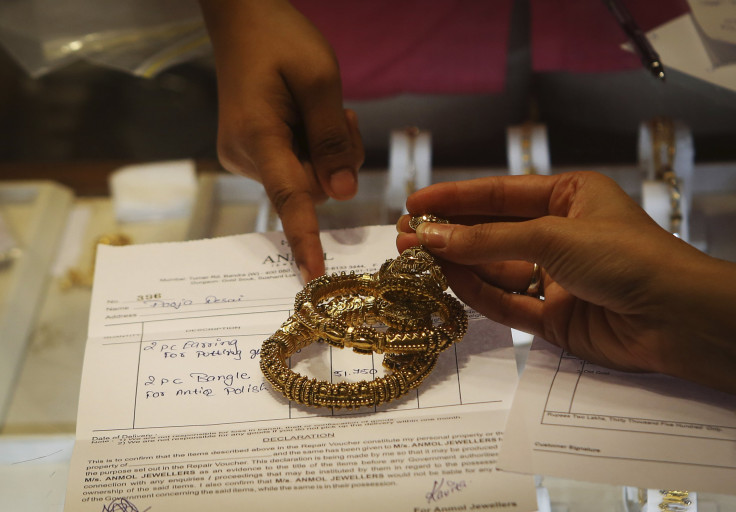

Gold prices jumped after the Fed’s surprise move not to taper its asset purchases and a period of strong gold consumption in India. Stock markets strengthened, and the dollar weakened.

Much of the financial world expected the U.S. central bank to announce earlier this month that it was beginning its so-called "tapering." However, the Federal Reserve said the opposite, that it would postpone a reduction of its bond buying. Barclays economists believe gold prices will still lose support from a key positive influence, low interest rates.

They expect the Fed to reduce its asset purchases from $85 billion to $70 billion per month in December and end the asset purchase program in June 2014, three months later than previously expected.

© Copyright IBTimes 2024. All rights reserved.