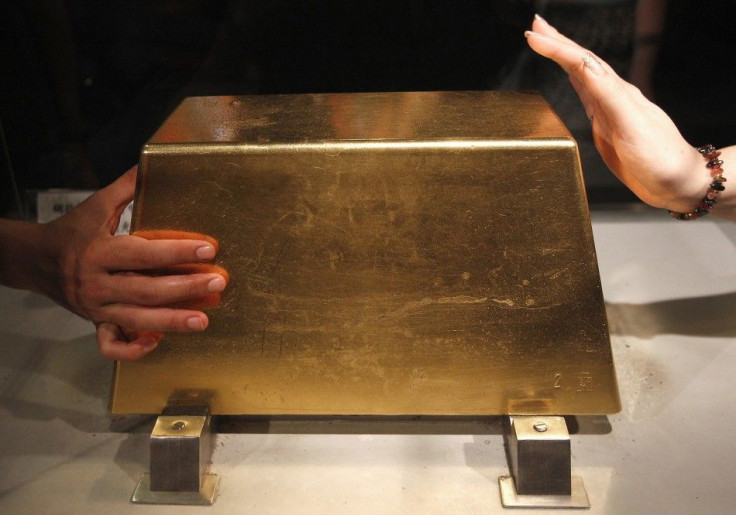

Gold Steady Above $1,800 as Traders Await Fed News

Gold held steady above $1,800 an ounce on Wednesday ahead of the outcome of a Federal Reserve policy meeting at which the U.S. central bank is expected to unveil its next steps to revive the world's largest economy.

The Federal Open Market Committee (FOMC) is widely expected to signal that it will rebalance its portfolio of Treasury holdings in favour of longer-dated debt, which should help it anchor longer-dated interest rates, rather than embark on a another multi-billion round of government bond buying, or quantitative easing.

Gold has been a major beneficiary of the Fed's QE programmes, having gained more than 40 percent since the central bank's most recent round of bond-buying, which ran from November 2010 to June this year.

While few in the market expect QE3, any measures that keep U.S. rates low in the face of a struggling economy should support gold in the longer-run.

Spot gold was last up 0.1 percent on the day at $1,805.10 an ounce by 1125 GMT, having nearly eased the week-to-date decline that was apparent the day before.

So far this month, gold is down by 0.7 percent and set for its first monthly fall since June, but on a quarterly basis, it is set for its strongest gain since 1986 as consumers and investors alike remain undeterred by near-record highs.

I was among the ones who thought a nice correction down to $1,700 would be very good for the market. But it looks like every time we got close to $1,760, the size of the physical demand was large enough to take the gold higher, said MKS Finance head of trading Afshin Nabavi.

We will have to wait until the FOMC. I don't think there will be any possibility of QE3, but probably they will mention the bonds (rebalancing) and already the dollar is benefiting from it this morning.

Ordinarily, a pick-up in the dollar would act as a headwind to gold, but this inverse correlation has eroded this month and the two assets have been positively correlated for 11 straight trading days, the longest such stretch in seven months.

In the latest sign that U.S. growth has stalled, new construction of U.S. homes fell more than expected in August, keeping pressure on President Barack Obama to do more to help the economy.

The expectation of some sort of easing from the Fed and poor economic data will make it difficult for gold to break sharply below $1,800, said Li Ning, an analyst at Shanghai CIFCO Futures.

RUNAWAY BULLS

Highlighting the bullishness within the gold market, an annual survey of gold investors and analysts at the world's largest bullion traders event showed participants believe the price will rise beyond $2,000 an ounce in the next year, although it will not match the record-breaking 50 percent surge of the last 12 months.

With no let up seen in the financial markets uncertainty that fanned the safe-haven investment spree, bullion is expected to rise to $2,019 an ounce by November 2012, according to an anonymous survey of delegates at the conclusion of the London Bullion Market Association's annual conference on Tuesday. That is about 12 percent above current levels.

Silver rose by 1.1 percent to $40.11 an ounce, mimicking the steady tone of the gold market.

In fundamental news for silver, imports into key consumer China rose to two-month highs in August, but at 314,706 kg, they were down by a third year-on-year and below both the monthly average of 316,865 kgs for this year and the 2010 monthly average of 436,777 kgs.

The Chinese data also showed a 9 percent yearly rise in imports of palladium to five-month highs. The metal is used primarily in catalytic converters in gasoline-powered vehicles and China, home to the world's largest car market, is a key source of demand.

Spot palladium was last up 0.2 percent on the day at $713.23 an ounce, while platinum was up 0.7 percent at $1,783.24 an ounce.

© Copyright Thomson Reuters 2024. All rights reserved.