Goldman Sachs: 40 Stocks To Own In Early 2014

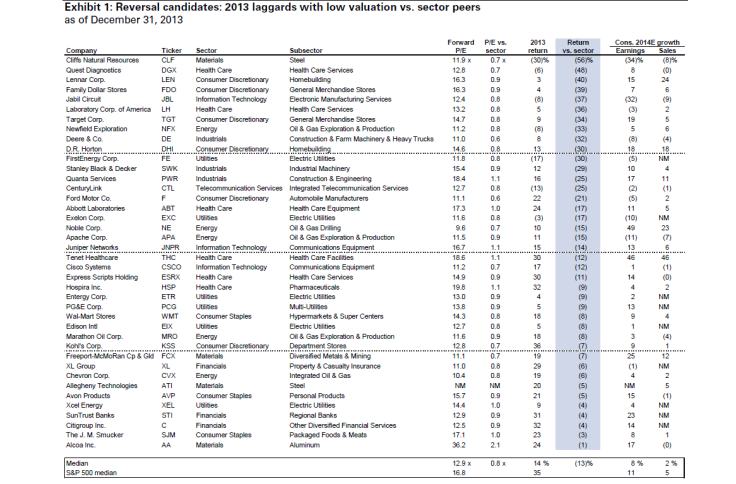

Goldman Sachs Group Inc. (NYSE:GS) has released a chart listing strong U.S. stocks for early 2014. The global investment bank selected companies with low valuations that are viewed as “laggards," since those tend to perform well in the first quarter of a year, according to the report.

“We identify 40 candidates to outperform in early 2014. These stocks lagged peers during the rally in 2013 and have attractive valuation relative to their sectors.” Prominent companies include Wal-Mart Stores Inc. (NYSE:WMT), Chevron Corporation (NYSE:CVX), Cisco Systems Inc. (NASDAQ:CSCO), Citigroup Inc. (NYSE:C) and Deere & Company (NYSE:DE).

“Historical example suggests that 2013 laggards should outperform early in 2014. This general trend should hold in 2014 specifically given our forecast of accelerating economic growth and fading macro risks,” wrote Goldman analysts in its note. “Buying stocks with low valuation is a proven strategy over the long term and especially effective in 1Q.”

Goldman notes that its chosen stocks underperformed relative to sector rivals and also were within the cheapest fifth of stocks in their universe, given five different metrics.

These stocks yielded a median return of 14 percent in 2013, compared to a 35 percent median return for the benchmark S&P 500 index. The companies chosen were forecast by Wall Street analysts to grow earnings by 8 percent, in median, relative to 11 percent earnings growth predicted in the overall S&P 500.

Past losers in Goldman’s list include Wal-Mart, Cisco and Deere, which faced tough times in 2013. Wal-Mart struggled to grow sales in its U.S. stores, while Cisco lost significant business in China. Deere may face a slump in 2014 as corn prices fall and farmers look set to buy less farm equipment, after enjoying years of an agricultural boom.

U.S. equity markets broke several records in 2013. Analysts expect a strong showing this year, too, though it’s likely to be less pronounced than the double-digit percentage gains in major U.S. equity indices in 2013.

© Copyright IBTimes 2024. All rights reserved.