Google-Motorola Deal: Nokia, RIM Could be Next Acquisition Targets

Google on Monday struck a $12.5 billion all-cash deal to buy Motorola Motorola Mobility (NYSE:MMI) to defend its Android ecosystem.

Without this acquisition, it would have been difficult for Motorola Mobility to survive as it is getting squeezed between iPhone on the high-end and low price Asian Android phones which sell for less than $20.

It is not only Motorola that is hurt by the above trend. Finland-based Nokia Corp. (NYSE:NOK) and Canada's Research In Motion Ltd. (NASDAQ:RIMM) face the same challenges.

The ultimate question remains now is what lies ahead of them. Nokia has been partnered with Microsoft and is set to launch Windows Phone 7 smartphones in the fourth quarter or early 2012.

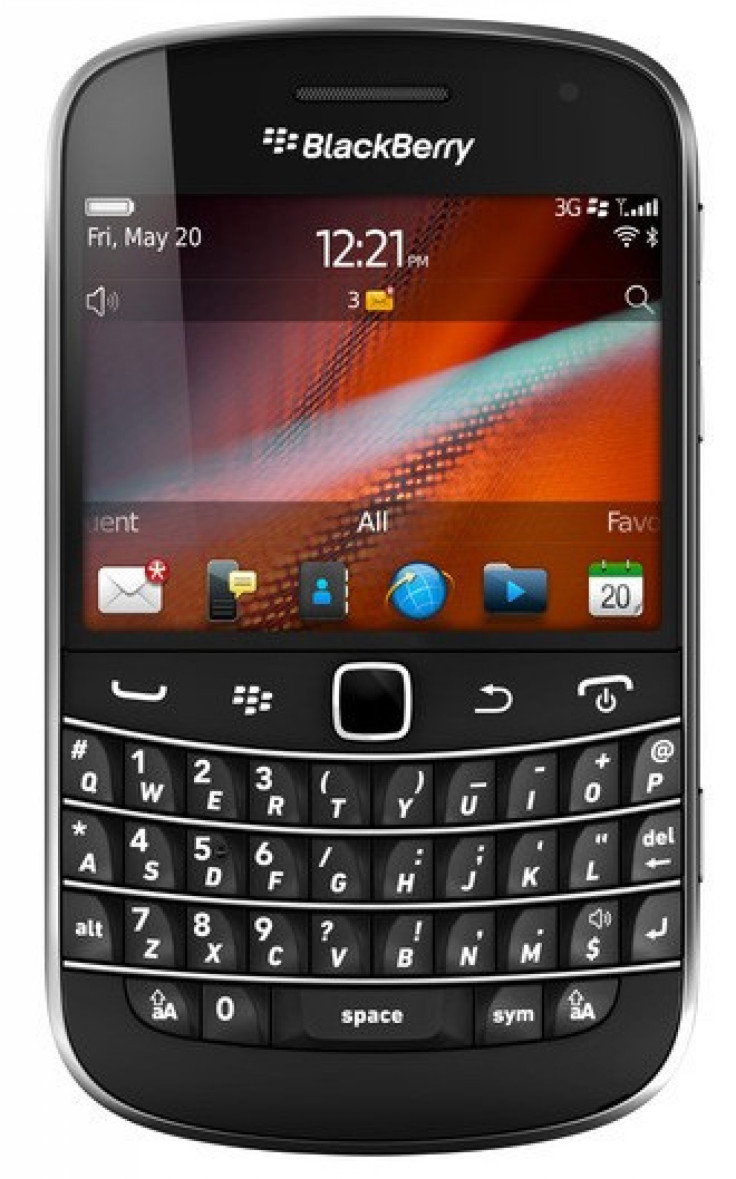

On the other hand, BlackBerry-maker RIM has been reinventing itself amid strict competition. Recently, RIM said it is launching seven BlackBerry 7 handsets starting in mid to late August, representing its largest product cycle historically -- which is twice broader than last year's BlackBerry 6 product cycle.

Currently, investors are speculating that the Google-Motorola deal will spur other handset deals and Nokia and RIM could be potential acquisition targets.

"In our view, with RIM and Nokia struggling with holes in their portfolios and the stock prices under severe pressure over the past year, we believe these two companies could be the most obvious acquisition targets in the space," Ticonderoga Securities analyst Brian White wrote in a note to clients.

However, White said he would not expect interest from a traditional handset vendor but possibly a broader IT company.

Wall Street analysts say that Microsoft would be more pressured by the Google-Motorola deal to buy Nokia.

"We believe the acquisition of Motorola by Google may increase the pressure on Microsoft to acquire a hardware vendor rather than just partnering with Nokia," Susquehanna Financial analyst Jeffrey Fidacaro wrote in a note to clients.

The proposed deal may raise the possibility of Nokia being bought by Microsoft. However, Microsoft oversees Nokia's software and internally the software giant typically shuns acquisitions if it can achieve its goals via partnership.

"MSFT likely wouldn't want to disrupt the current OEM relationships it has, like Google has done," RBC analyst Mike Abramsky wrote in a note to clients.

In this scenario, Abramsky said RIM may be more attractive as a takeout candidate. However, its struggles may give an acquirer pause.

Abramsky estimates $14.4 billion enterprise value for RIM or $33/share or 34 percent premium. From an industry consolidation perspective this may make RIM more interesting, but from Google's perspective, Motorola using Android made it a better fit plus of course Google wanted the Motorola Mobility's patent portfolio.

RIM's focus on its own OS, its proprietary message-centric hardware, enterprise focus, its mobile data sync-oriented patent portfolio, and its recent struggles may have made it a less favorable takeout versus Motorola Mobility.

However, Abramsky said, for some possible acquirers such as Hewlett-Packard Co. (NYSE:HPQ), International Business Machines Corp. (NYSE:IBM) and Android OEMs like Samsung, RIM could be viewed more attractive in light of pending industry consolidation.

As Apple moves to iCloud and furthers its competitive advantage of tightly integrated hardware and software, Google could now emerge as a strong competitor with a strong ecosystem, which puts increased pressure on the other major mobile operating system platforms from Microsoft, Research in Motion and HP's webOS.

© Copyright IBTimes 2024. All rights reserved.