Greek debt restructuring 'inevitable'

The Greek government submitted a revised 2011 budget to the Parliament on Thursday, pledging to prune the deficit to 7.4 percent of the gross domestic product (GDP), ensuring substantial bailout funds will flow without hiccups from the IMF and the ECB.

However, desperate measures to squeeze through the tough austerity net might still not keep the threat of an eventual debt restructuring out of the door, analysts have said.

Analysts pointed out that the new fiscal tightening measures, which would effectively save the government 5.1 billion euro compared to this year, will hardly be enough to redeem the economy from messy public finance in the medium term and chances of a government debt restructuring still remained strong.

The Greek Government’s 2011 budget should be enough to ensure that it can continue to tap its €110bn bailout facility, but it does nothing to improve the medium-term outlook for the economy and public finances, wrote Ben May, an economist at Capital Economics in a note on Thursday.

May says the medium-term outlook remains grim because the economy’s projected growth figures are far from positive and that the ratio of debt -to-GDP is slated to run away to a whopping 170 percent.

We expect the economy to contract by 4 percent or so in 2011, weaker than the Government’s forecast for a 3 percent fall (revised from 2.6 percent). And with the economy likely to remain in recession well beyond 2012, we think that the debt to GDP ratio could eventually exceed 170 percent of GDP, implying that a restructuring of government debt is eventually all but inevitable.

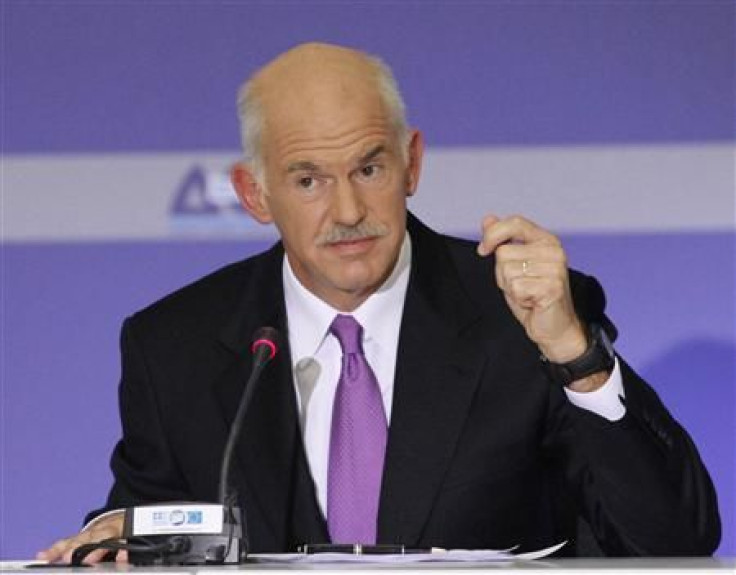

However, Greek Prime Minister George Papandreou has categorically ruled out a restructuring, saying Athens will not default on its $406 billion debt.

The government has said the 2009 public debt figure has been revised upward from 115 percent of the GDP to 127 percent. A further ballooning of the deficit will put additional strains on the budget and put hurdles in Greece's plan to adhere to the bailout terms.

For now, Athens can be certain that IMF, EC and ECB will release the third tranche of loans from its bailout facility in January.

Meanwhile, the European Union and Greece denied Austrian finance minister's claim that the release of the third tranche of the bailout funds will be delayed to January as the creditors needed time to assess documents.

The Government has also made it clear that it has enough funds to cover its total financing needs until the end of January.

© Copyright IBTimes 2024. All rights reserved.