Gun Sales Before & After Newtown Shootings: Newtown Anniversary [CHARTS]

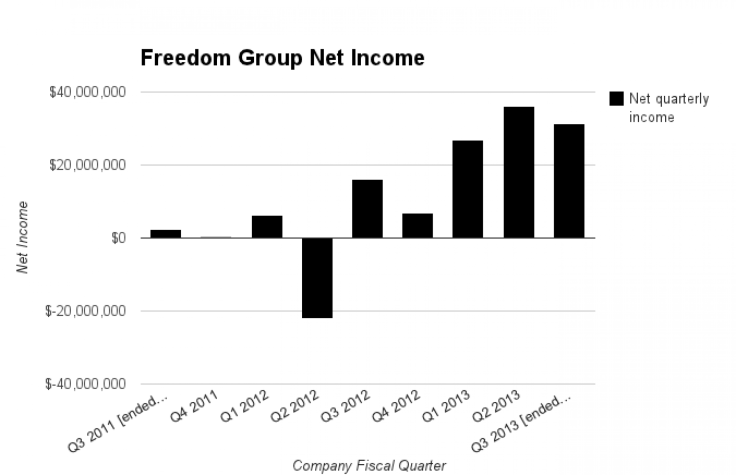

Gun sales at three major U.S. firearms makers soared in the wake of the Dec. 14, 2012, Newtown school slaughter, setting new company records and decisively beating 2012 sales.

The sales jump came as federal and state lawmakers debated gun control legislation, which sent many gun buyers to stores in anticipation of tighter regulations. Federal gun control legislation ultimately failed, but bans on so-called assault weapons and stricter background checks were proposed.

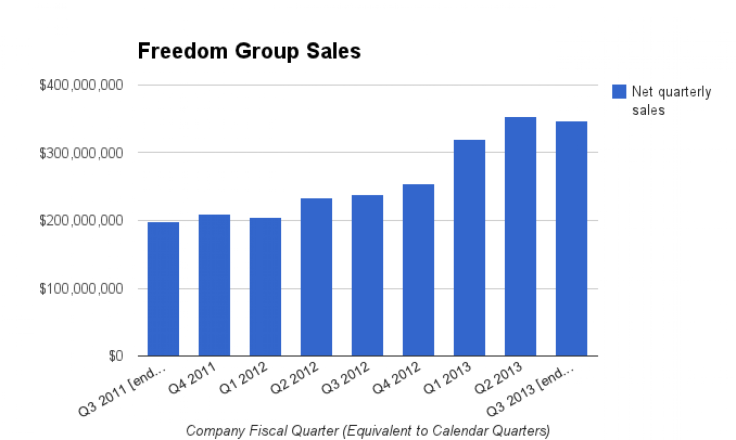

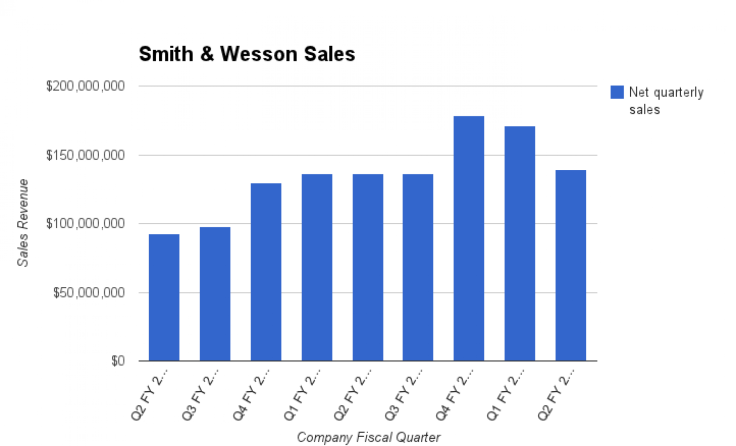

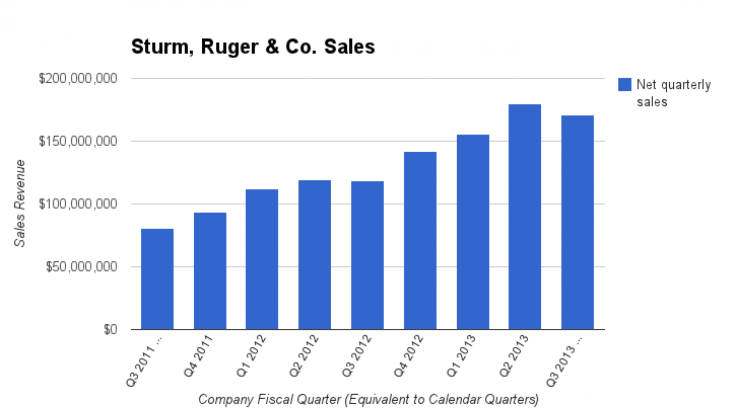

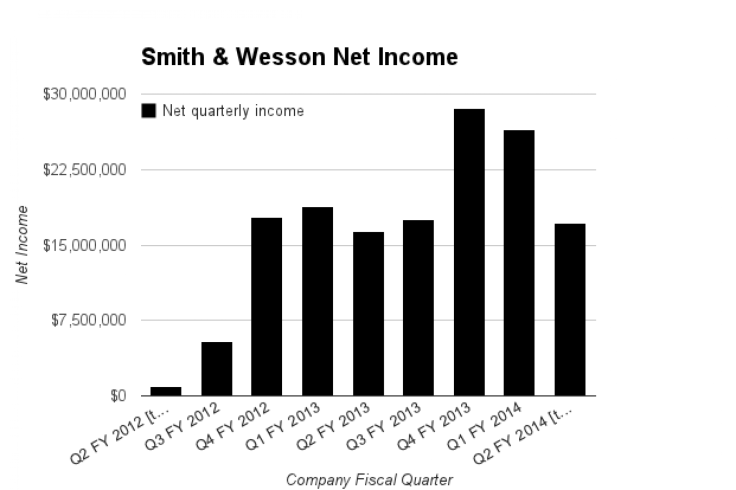

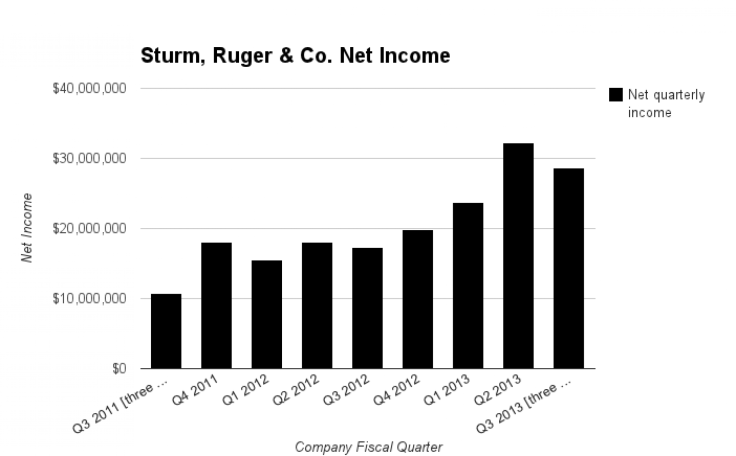

These charts illustrate sales and net income, or profits, at Smith & Wesson Holding Corp. (NASDAQ:SWHC), Sturm, Ruger & Company (NYSE:RGR) and Freedom Group Inc. based on their quarterly filings. (Although net sales may include items other than guns, Sturm & Ruger, for instance, says 99 percent of its sales revenue comes from firearms.)

Smith & Wesson sells many pistols and revolvers to police around the world, alongside the popular newer M&P polymer guns, made of light plastic. Smith & Wesson controls 17 percent of the $2 billion U.S. market for handguns, according to a November 2013 company presentation. Sturm & Ruger are known for their Ruger rifles and semi-automatic pistols, while the Freedom Group sells Remington rifles and the Bushmaster assault rifle, which was used in the Newtown shootings.

Freedom Group made $932 million in sales in 2012, while Smith & Wesson sold $587 million worth of equipment from April 2012 to April 2013. Sturm Ruger weighed in as the smallest by sales, with $492 million in 2012, according to company filings. All these figures are significantly up from 2010 and 2011 sales.

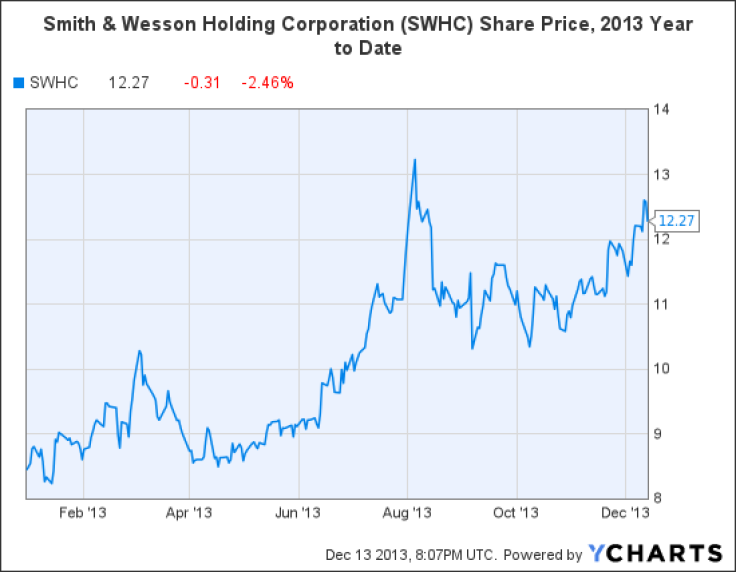

Lastly, company share prices have done well, as investors quickly recognized the impact of gun control legislation on hesitant buyers and longtime gun enthusiasts. (The Freedom Group is privately held.)

Investors also showed interest on Twitter after Smith & Wesson reported better than expected quarterly earnings earlier this week. Smith & Wesson earned more in the fiscal year to April 2013 than in its past four years combined, according to the Wall Street Journal.

I know what Santa is getting you for Xmas; total NICS Background Checks in Nov up 7.5% from Oct to 1,813,643, $RGR $SWHC $CAB

- Ben Silverberg (@silverjet2) December 13, 2013"Shooting is like the new bowling," says Wall Street analyst in sad $SWHC commentary on eve of Sandy Hook anniversary.http://t.co/6FvbC5otke

- Jeffrey Goldfarb (@jgfarb) December 11, 2013According to a May 2013 Pew poll, nearly three quarters of Americans back some form of gun control legislation, though only 43 percent believed it could pass in 2013. About 54 percent of those polled supported a ban on assault weapons.

Smith & Wesson and the Freedom Group Inc. earned recognition from the powerful National Rifle Association lobby, after they became donors of over $1 million in May 2013. They were inducted into the NRA’s "Golden Ring Of Freedom," according to a report by the nonprofit Violence Policy Center.

"The stock market is having record success right now,” Jennifer Fiore, executive director of another gun control advocacy group, Campaign to Unload, told IBTimes. “There are myriad places to invest that aren’t complicit in the deaths of 30,000 Americans every year."

The three companies didn’t return requests for comment or declined to comment.

Josh Sugarmann, the Violence Policy Center’s executive director, told IBTimes that U.S. gun ownership has fallen to about a third of households, down from about half in the 1980s. He cited University of Chicago and New York Times data.

“The NRA and the industry are expert at exploiting any outside event to increase gun sales, whether it’s the passage of legislation, Bill Clinton’s election, Y2K, or 9/11,” Sugarmann told IBTimes. “And there’s a very willing clientele that follows their lead.”

There’s now a “glut of guns” on the market, he continued, and sales are starting to slow. He cited lower monthly figures from the National Instant Criminal Background Check System recently, an industry gauge of gun sales.

© Copyright IBTimes 2024. All rights reserved.