Health Care: Walk-In Retail Clinics Burgeoning Source Of Treatment

Past the gold lettering and up the escalator inside a Trump building in Manhattan’s Financial District, a waiting room for patients beckons beyond a rack of contact lens solutions in the back of a Duane Reade pharmacy store. No appointment necessary, a sign promises. This is not a doctor’s office but a walk-in retail medical clinic, one of more than 1,700 that have opened across the nation in recent years.

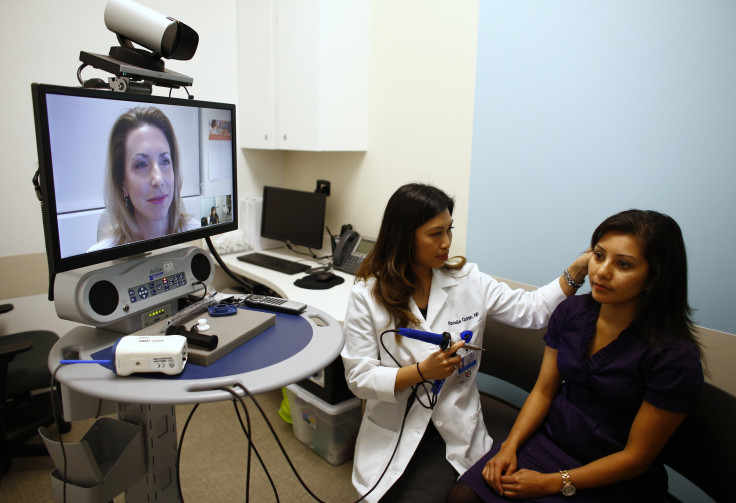

No longer are retail pharmacies merely places to purchase medicine. Now, they are sources of medical care, too. Major retailers in the U.S. are increasingly offering health care services in the form of walk-in retail clinics in their stores. This market-driven phenomenon has been widely hyped as more patients seek faster and more convenient care, but health care experts have expressed doubt these clinics’ have the ability to provide health care to those who need it most.

Pharmacies and retailers like CVS, Walgreens, Target and similar stores boasted 1,760 retail health clinics in the U.S. as of September, according to one estimate, and their numbers were expected to reach 2,800 this year. CVS has more than 960 retail clinics in 31 states and the District of Columbia, and 500 of those opened in the last three years, CVS spokesman Brent Burkhardt said. The company projects 1,500 clinics by 2017 -- a meteoric rise given the company ran only 22 retail clinics in 2004. Walgreens has the second-highest number of retail clinics, with 432 clinics in 23 states. The blossoming trend saw one panel devoted to discussing the “walk-in clinic revolution” during Forbes’ annual health care forum in 2013.

For patients, convenience is the major draw of walk-in retail clinics, which are also structured to charge less than urgent care centers. The shorter waiting times and longer opening hours, especially compared with doctors’ offices, are appealing for those with acute but curable ailments like ear infections or minor cuts. Burkhardt estimated about half of patients who visit MinuteClinic, the name for CVS retail clinics, go during evening, weekend and holiday hours.

For retailers, opening a retail clinic makes smart tactical business sense. Faced with a shortage of doctors, an aging population and a swell in demand for medical care because of the increase in Americans insured under the Affordable Care Act, health care providers have been swamped in recent years. The Association of American Medical Colleges estimates by 2020, physician shortages will soar to 130,600, with primary care physicians comprising 45,000 of those.

A smart business move

When the first retail clinics were launched, the original goal wasn’t to provide better care than a doctor’s office but rather to make care more accessible, said Dr. Kaveh Safavi, managing director for global healthcare business at the consulting firm Accenture. These days, retail clinics tend to offer three types of care: urgent, chronic and primary. “There are different theories about what services should be provided,” Safavi said, and “people haven’t exactly clarified what the purpose of the retail clinic is.”

What is not debated, however, is the business opportunity these clinics present to retailers. “Either you’re making money because of the visits themselves or because of the things people are purchasing before or after visits,” Safavi said. “It’s really about real estate for primary care. All you want is physical proximity to patients.” Overall, he suggested clinics could have a positive impact on the health care landscape because “if you can give people, when their doctor can’t see them, [a place] that is not the emergency room, overall that’s a long-term benefit.”

Staffed by physicians’ assistants and nurse practitioners, retail health clinics can scoop up patients who want quick treatment for relatively minor issues. Some clinics have also expanded services to include some aspects of preventative care, like immunizations, and to manage chronic conditions like diabetes. The model is promising enough that even Whole Foods, which has been struggling with poor sales in recent years, is considering opening medical clinics in its stores although a company spokesperson said it had not yet “finalized a model or location for this concept.”

For CVS, revenues from its MinuteClinics saw a 11.4 percent year-over-year increase in the first quarter of 2014. Walgreens spokesman Jim Cohn would not share how much of an increase in sales the company attributed to health care customers who then make other purchases. However, “the expectation is that patients who come into the store to see a health care clinic provider would also purchase other items while there,” he said in an email.

The first retail clinic was established in the Minneapolis-St.Paul area in 2000. Run by QuickMedx, it eventually was bought by CVS to become a MinuteClinic. It was cash only, offering testing and treatment for strep throat, mono and minor infections. Retail clinics have evolved since then, but they remain different from urgent care centers, which have certified physicians on staff and can do more testing, like X-rays.

Catering to a specific population

Dr. Yasmin Meah, director of the East Harlem Health Outreach Partnership, a free clinic run by students at the Icahn School of Medicine at Mount Sinai in New York, said her clinic’s patients were too impoverished and in too poor health to seek out care at retail clinics. “In general, retail clinics are not an option for patients who come to free clinics,” she said, as most come without health insurance and with chronic illnesses that for years have not been well monitored. “For the uninsured, I don’t know if these are going to be a great access point” for health care, she said of retail clinics. “If they went to a clinic, their care would be so fragmented, and the context of their illness wouldn’t be accounted for.”

Patients who do look to retail clinics for care tend to be relatively healthy. That means retail clinics could be important points of access, especially in rural areas.

“The idea that retail clinics are preferentially serving those who are usually underserved is not borne out in the data,” said Dr. Ateeve Mehrotra, an adjunct policy analyst at Rand Corp. and an associate professor in the Department of Health Care Policy at Harvard Medical School in Massachusetts.

If a genuinely sick person went to a retail clinic instead of a doctor or the emergency room, money would be saved, he said. But if a person went to a retail clinic for an ailment that a clinic or doctor couldn’t cure, like a cold, then they would increase spending. Like at doctors’ offices, “the majority of the conditions that are being treated at a retail clinic are self-limiting illnesses that would’ve gotten better on their own,” he said. No concrete answers have been found, he said, but “that is one of the concerns I have.”

© Copyright IBTimes 2024. All rights reserved.