Health insurance rates soar in California

While the House of Representatives is moving towards repealing the national healthcare reform law passed last year, residents of the nation's largest state are facing another round of health insurance rate hikes.

Blue Shield of California, which raised rates twice in the last quarter of 2010, plans another rate hike for March 1, 2011 for its 193,000 policyholders. The increases would average between 30 and 35 percent, and the three rate hikes in six months mean an increase in the cost of health insurance by as much as 59 percent.

For families, there are few things as painful as a 59 percent health insurance rate increase, said Doug Heller, from the Santa Monica-based advocacy group, Consumer Watchdog.

Consumer Watchdog is calling on Californians to support state legislation to give the state Department of Insurance the same power to regulate the health insurance industry as it now has over the automobile and home insurance industries.

If a car insurance company or a home insurance company want to raise their rates, even just two or three percent, they have to open their books and prove that the rate increase is appropriate, Heller said. The health insurance industry, on the other hand, in this state, and in most states, can pretty much do whatever they want.

California's new Insurance Commissioner Dave Jones has called upon Blue Shield to delay the rate increase, while admitting that he does not have sufficient power to stop it.

Many Californians will no doubt be surprised to learn that the Insurance Commissioner does not have the legal authority to reject excessive health insurance premium increases, said Jones, a former state lawmaker. I have fought hard to give the Insurance Commissioner this authority for the last six years. I have authored strong legislation to give the Insurance Commissioner the authority to reject excessive premium increases, only to see it defeated in the Legislature by conservative legislators.

Jones called it stunning that the company would seek to impose such massive premium increases on policyholders during these troubling economic times.

Blue Shield issued a statement defending the proposed increase.

Our individual market medical costs are rising rapidly due to higher provider prices, increased utilization, and the fact that healthier people are dropping coverage during a bad economy, the statement read, adding that even with these rate increases, Blue Shield of California expects to lose tens of millions of dollars on its individual healthcare business in both 2010 and 2011.

U.S. Secretary of Health and Human Services Kathleen Sebelius said in a release that her department has reached out to California Insurance Commissioner Dave Jones and know he is doing everything in his power to help consumers. We stand ready to assist him and the people of California in any way that we can.

It is unclear what the federal government could do for California and Blue Shield policyholders in this instance.

Some have incorrectly claimed that these increases were the result of the health care law. Nothing could be further from the truth, Sebelius said, adding that the practice of insurers imposing these kinds of rate increases without public scrutiny would be the wave of the future without the Affordable Care Act. If the law were repealed, we would be left with few tools to protect consumers against these kinds of rate increases.

Blue Shield also stated that the proposed rate increases have almost nothing to do with the federal health reform law. These rates reflect trends that were building long before health reform.

The insurer said that health reform will help slow down this trend by expanding coverage, which will keep healthier people in the system, and through quality and cost containment initiatives such as the Independent Payment Advisory Board, Center for Medicare and Medicaid Innovation, Patient-Centered Outcomes Research Institute and other incentives for prevention and coordinated health care.

Some provisions of the federal Affordable Care Act have already been implemented, including a medical loss ratio of 80 percent to 20 percent, which means that an insurer must spend at least 80 percent of the premium dollar on actual healthcare, with the other 20 percent permissible for profits and administrative costs, such as salaries and advertisement.

Consumer Watchdog President Jamie Court said that the 80/20 federal rule does not help without state regulation.

With the 80/20 requirement it is likely that Blue Shield and others will increase payouts to medical providers in order to increase premiums and their own total income, Court said.

Californians are not the only ones about to suffer through huge price spikes, Court said. Blue Shield's announcement foreshadows what we'll be seeing around the country in every state that refuses to take on the insurance industry and enact real regulation.

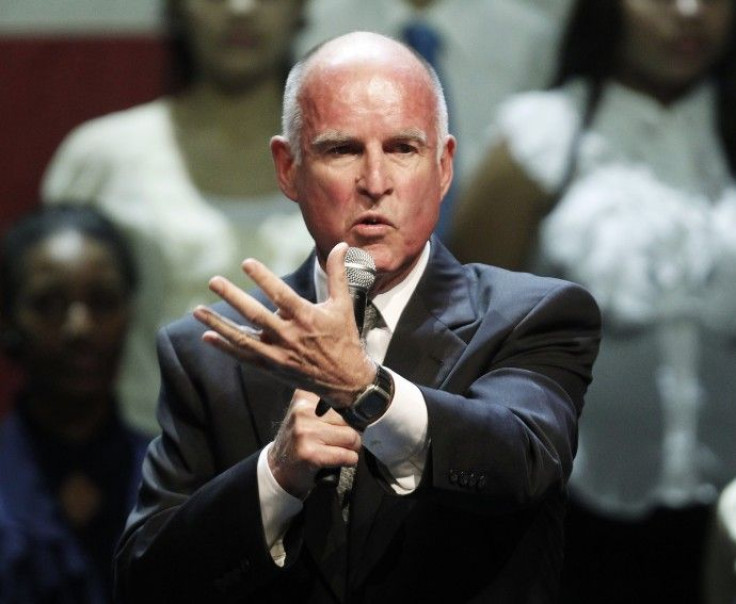

Newly inaugurated Gov. Jerry Brown has yet to make a public statement on the issue, although advocates are pressing him to take on the insurance lobby and push for tighter regulations.

Sebelius said there is federal money available, through the ACA, to assist states in setting up insurance rate review mechanisms to improve oversight and transparency.

© Copyright IBTimes 2024. All rights reserved.