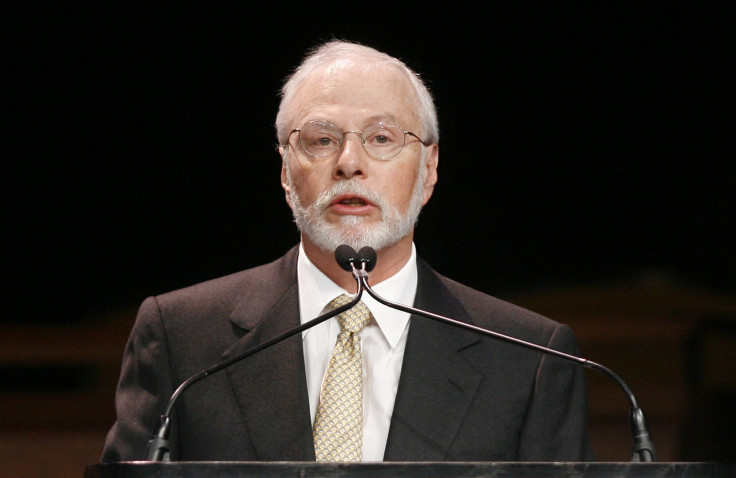

Hedge Fund Manager Paul Singer Is On A Roll: Says Financial Institutions Ignore The Law In ‘Thousands of Subtle Ways’ While Prosecutors Do Nothing

Republican powerbroker and hedge fund manager Paul Singer is on a roll this month and he seems to have a little something for both sides of the aisle.

On one hand Singer, whose funds manage about $21 billion in assets, took a populist swipe at the world’s largest finance institutions, claiming theyre breaking laws and not being prosecuted. On the other hand: he railed against any efforts to raide the federal minimum wage or index it to inflation.

The comments came ahead of U.S. President Barack Obama’s State of the Union Address in which hourly wages was a major focus.

The latest round of “major hedge fund manager speaks and the world listens” began when Singer, founder and CEO of New York-based Elliot Management Corp., gave a speech at the World Economic Forum in Davos on Jan. 22 lambasting the massive debt purchasing by central banks that has distorted stock and bond prices.

The outspoken critic of quantitative easing, the U.S. Dodd-Frank financial stability act and the opacity in risk disclosure by major banks said little has been done to make the global financial system safer from the effects of “too big to fail” risk-taking in the financial markets.

Singer told the Davos crowd that banks and regulators alike are peddling false security with claims that the global system is more secure today than it was in 2008 when the subprime mortgage crisis shattered the global financial system and economy.

Now Singer’s letter to shareholders is being distributed and its main thrust seems to be a blunt accusation that financial institutions are breaking laws and prosecutors are doing nothing to stop them. “Lawlessness is a slippery slope,” the letter states, according to valuewalk.com’s Mark Melin, who reportedly obtained a copy of Singer’s 2013 letter to shareholders. “If . . . a law is ignored in thousands of subtle ways, then over time the rule of law will be replaced by corruption and whim.”

In other words, Singer seems to think that banks are not only too big to fail (and therefore willing to take greater risk for the benefit of their shareholders knowing the taxpayer is there to provide liquidity if investments turn sour) but they’re also engaging in actual law breaking with impunity.

“Laws are not self-executing,” Singer wrote, echoing sentiments from other fund managers and high-rolling investors that the government isn’t doing enough to criminally prosecute individuals inside financial institutions.

Singer’s strong words might sound like something you would expect Noam Chomsky or Pete Seeger to say, but keep in mind that Singer has been a Republican strategist and was a big supporter of Mitt Romney’s bid for the presidency. In 2013 his funds had over $21 billion in assets under management through Elliot Associates L.P. and Elliot International Limited.

Singer took a less populist stand on hourly wage workers in the same letter to investors, dated Jan. 27. Singer is firmly in the camp that claims raising the minimum wage would destroy jobs and hurt the working poor, the very group it's claimed to help.

His remarks preceded President Obama’s Tuesday State of the Union Address during which he announced a minimum wage hike for, to $10.10 an hour. He also unveiled plans to index future increases to inflation.

"Put bluntly, these policies would destroy jobs and cause companies and even entire industries to move elsewhere,” Singer wrote in his letter, according to CNBC. “These movements are politically motivated–a way for politicians to fake compassion," Singer wrote in a letter to investors of his $23.3 billion Elliott Management on Jan. 27.”

The current federal minimum wage is $7.25 an hour, though federal contractors are currently required to pay their employees a prevailing wage rate under the 1931 Davis-Bacon Act, That wage varies by region, but it’s higher than the federal minimum rate, albeit usually not much higher than the federal minimum.

As reported in IBTimes during the 2013 State of the Union Address, the federal minimum wage rate lost 17 percent of its value between 1974 and 2009, thanks to inflation. If you were flipping burgers for the federal minimum wage of $2 an hour in the early 70s, it would be equivalent to $9.45 an hour today, adjusted for inflation.

Singer launched his business with $1.3 million in loans from friends and family in 1977, according to Forbes. A year before Singer launched his fund the federal minimum wage was raised to $2.30 an hour, which is equivalent to $9.42 an hour in 2013 dollars. The minimum wage rate was tripled since the late 70s, but hasn’t kept up with the cost of living since the late 1960s.

© Copyright IBTimes 2024. All rights reserved.