Here's Why Bitcoin Is Plunging Again Today

This article originally appeared in the Motley Fool.

Leading cryptocurrency bitcoin (BTC-USD) has had a rough start to 2018. The price of one bitcoin has fallen from more than $13,000 at the beginning of the year to a low of $7,882 Friday morning. It has since rebounded, but bitcoin and other major cryptocurrencies are still well in the red. Here's a look at the latest price action, and what could be dragging prices down.

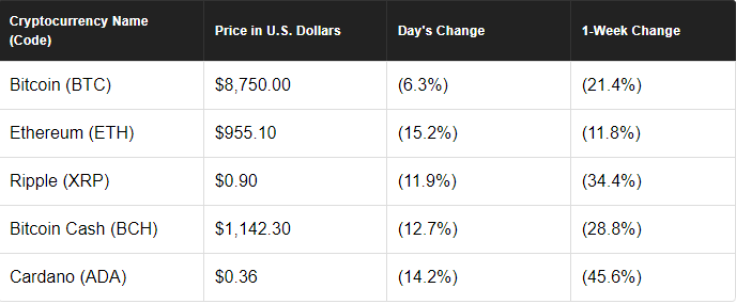

Today's Cryptocurrency Prices

Here's a look at the five largest cryptocurrencies by market capitalization, and how much each has changed over the past 24 hours and the past week.

The top five cryptocurrencies are down across the board, with weekly losses ranging from just under 12% to more than 45%. Bitcoin (BTC-USD) briefly sunk below the $8,000 price point for the first time since November, but has since recovered to $8,750 as of this writing. In all, over $100 billion in cryptocurrency market cap disappeared over the past 24 hours, fueled by the big losses in bitcoin, as well as Ethereum, Ripple, and virtually all of the other major cryptocurrencies.

What's Dragging Cryptocurrency Prices Down?

There's no single reason for the recent decline in bitcoin (BTC-USD) and other cryptocurrencies. Rather, the decline is the result of a steady flow of negative headlines having to do with regulatory concerns and potential price manipulation, combined with the relative absence of any positive catalysts.

In case you haven't been following the cryptocurrency headlines over the past few weeks, here's a quick rundown some of the recent negative news:

- South Korean regulatory fears have been going on for several weeks. While the nation now says that it has no plans to shut down cryptocurrency trading, it has imposed several new regulations, such as requiring exchange customers to use their real names when trading.

- On Wednesday, India's Finance Minister said that India would take action to eliminate the use of cryptocurrencies as part of the country's payment system, and said that cryptocurrencies are used for a variety of illegitimate activities.

- Also this week, Facebook banned all advertisements related to cryptocurrencies and initial coin offerings (ICOs).

- Cryptocurrency exchange Bitfinex was subpoenaed by U.S. regulatory authorities this week, and there are fears that the exchange has been artificially propping up the price of bitcoin and other cryptocurrencies.

- On Tuesday, the SEC halted the ICO of Dallas-based AriseBank and froze the bank's assets. The ICO had raised $600 million, and the bank is accused of selling unregistered securities to investors, as well as making false claims.

The bottom line is that all of these headlines create uncertainty, and as a result, it appears many cryptocurrency speculators are choosing to step to the sidelines instead of dealing with the unpredictable price moves in the market.

Matthew Frankel has no position in any of the stocks or cryptocurrencies mentioned. The Motley Fool has no position in any cryptocurrencies mentioned. The Motley Fool owns shares of and recommends Facebook. The Motley Fool has the following options: short March 2018 $200 calls on Facebook and long March 2018 $170 puts on Facebook. The Motley Fool has a disclosure policy.