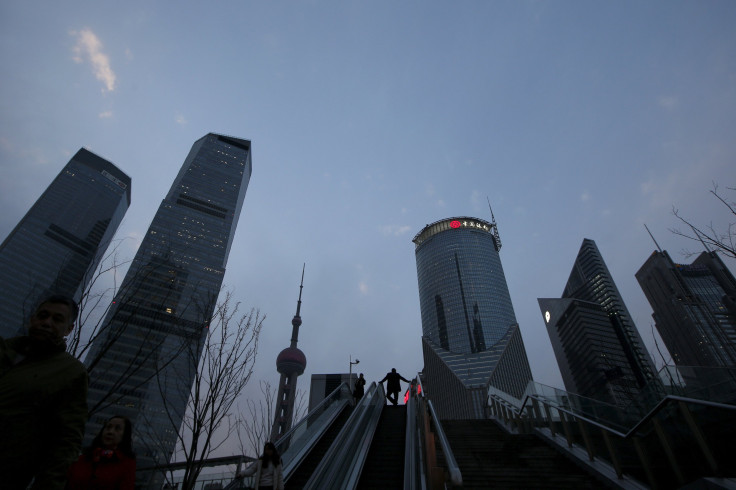

Home Prices In China Are On Fire, Rising At Their Fastest Pace In Almost Two Years In February

China's home prices rose at their fastest clip in almost two years in February thanks to red-hot demand in big cities, but risks of overheating in some places combined with weak growth in smaller cities threaten to put more stress on an already slowing economy.

Average new home prices in 70 major cities climbed 3.6 percent in February from a year ago, quickening from January's 2.5 percent rise, according to Reuters calculations based on data released by the National Statistics Bureau (NBS) on Friday.

That was the quickest year-on-year increase since June 2014, and encouragingly, 32 of 70 major cities tracked by the NBS saw annual price gains, up from 25 in January.

Ordinarily, that should be welcome news for policymakers who have rolled out a raft of stimulus measures to support an economy growing at its slowest pace in a quarter of a century.

But the divergence in home prices - surging values in bigger cities and depressed markets in smaller cities plagued by a supply glut - makes Beijing's job harder as it looks to reanimate growth without inflating asset bubbles.

"The government's all-out encouragement of housing sales seems to be working, but at the cost of surging prices in big cities," said Rosealea Yao, an economist at Gavekal Dragonomics in Beijing.

"These surges in big cities are not sustainable and would increase uncertainties and instability in the overall housing market."

The data showed tier 1 cities, including Shenzhen, Shanghai and Beijing, remained the top performers, with prices surging 56.9 percent, 20.6 percent and 12.9 percent respectively.

"Prices in first-tier cities are very expensive now, it's hard for new families to afford a home," said Tan Huajie, vice president China's biggest property firm Vanke.

The trouble is that speculators and ordinary investors, who have been shaken by the summer crash in mainland stock markets, are increasingly ploughing their money into the housing market - most of it going to the frothy sector in big centers.

A slowing economy has also meant most jobs are in the biggest cities, drawing more people into these places and feeding the insatiable demand for homes.

A breakdown of NBS data showed that a slew of government measures and increased lending has failed to arrest persistent softness in property markets in smaller cities where a glut of unsold houses have weighed on prices.

Most third-tier cities still saw on-year prices drops in February, though the declines eased from the previous month.

With the broader economy decelerating amid weak exports, factory overcapacity, slowing investment and high debt levels, authorities are hoping the property market will help stabilize growth.

But signs that some places may be overheating even as prices remain depressed in smaller cities complicate matters for policymakers.

While fears of a hard landing for China's economy have abated in recent weeks, Beijing cannot afford a housing market crash in the big cities given the real estate industry and related investment activities account for 15 percent of gross domestic product.

Underscoring the importance of the sector to the $10 trillion economy, Friday's home data helped fuel strong gains in steel and iron ore futures in Shanghai.

Senior Chinese officials raised alarm over the country's overheated housing market during an annual parliament meeting this week.

In an effort to deter speculation, some officials have suggested the release of more public land for sale in areas with the hottest price rises, while others have vowed to crack down on players illegally lending home-buyers to make downpayments.

China's housing Minister Chen Zhenggao acknowledged on Tuesday that price divergence in China's big and small cities poses a challenge for housing market policy controls.

"Now one important task for us is to stabilize home prices in tier 1 cities and some tier 2 cities," said Chen.

© Copyright Thomson Reuters 2024. All rights reserved.