How Financial Firms Can Avoid Drowning In A Data Deluge

ClearMacro CEO Mike Simcock, who has 25 years of professional asset management experience, says he started the company to help investment managers that were drowning in a deluge of data.

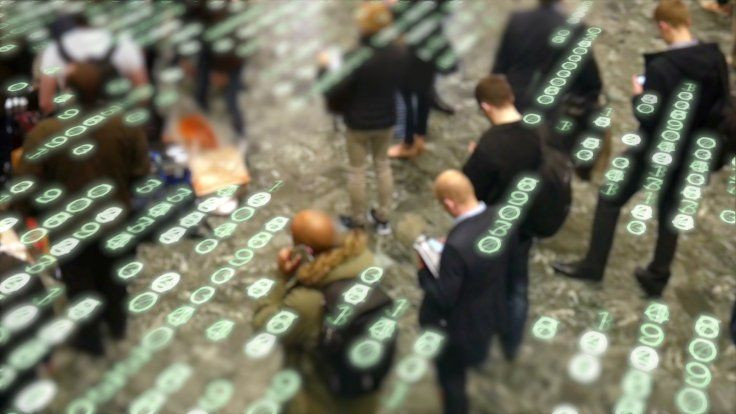

There has been a massive explosion in data sources, many offering the prospect of more timely information and more impactful signals.

But the big data revolution is actually compounding a problem that was already there, says Simcock. "If you are a chief information officer or a portfolio manager, not only have you got all of the traditional data sets to evaluate, but you have all of these new entrants coming in from satellites, Google trends, all different sources."

Advancements in technology are making analytical processes accessible beyond the world of hedge funds and CTAs; things like back testing tools and ways of aggregating information and visualising information in a really efficient way.

ClearMacro is building a "Wikipedia of investment strategies". It applies strategic, tactical and systematic asset allocation strategies, alongside a combination of select data sets providing real time macro insights, from text media and now-casting to cross border central bank liquidity statistics.

Simcock suggests a less is more approach to data. "We are not scraping the internet for data. We are doing aggregation in the sense that we are sourcing what we call the best quality data sets for the categories of information that we think decision makers care about holistically – as well as tools to back test and gain conviction over what works and what doesn't."

He said big data sets within the hedge fund space tend to be really focused on tactical, higher frequency, shorter term decision making, such as trying to gain an edge on payrolls or the next move in inflation, or company results.

"The ugly truth is that tactical asset allocation is really hard. Many investors do harm to their portfolio, exposing themselves to active risk positions where the rationale for the position was not completely well understood, or the decision behind it was based on faulty data or a faulty process.

"After fees tactical asset allocation is a loser's game. But it's very hard for us as human beings to avoid doing it. The reality is the vast majority of investment managers do tactical asset allocation. They know it's hard to do, but often they choose to ignore that fact – because we all like to have a view."

However, the industry is very quickly going to move much further towards data driven automated research and investible strategies. "Funds or products that are essentially driven more and more by rules, and can be delivered in different ways, whether it's an ETF structure or simply connecting to interactive brokers.

The smart beta world lays even more pressure on firms actively searching out novel sources of alpha. Suddenly all sorts of owners of data are realising the power of their data sets.

"Whether it's about getting near the exchange or some of the newer data sets like the satellite feeds, it's mainly hedge funds that are going to be able to pay for it.

"We are completely agnostic about whether we use traditional data or new data. If we can demonstrate it adds some value then that can justify paying for it."

Data does not come cheap: all sorts of entities are offering to sell their data, from anywhere between £25K and £250K, and upwards.

"The value of data is in the eyes of the beholder," said Simcock. "Typically I think the way that data sales work is that everything is up for negotiation," he said.

"Some of the things we are finding is a lot of the classic data sets are delivering better performance when you build them into strategies. The message I would give to someone asking how should I deal with this landscape – embrace technologies that can make your job easier and take your time."

This article was originally published on Nov. 24, 2016.