How Has Costco Outsmarted Walmart?

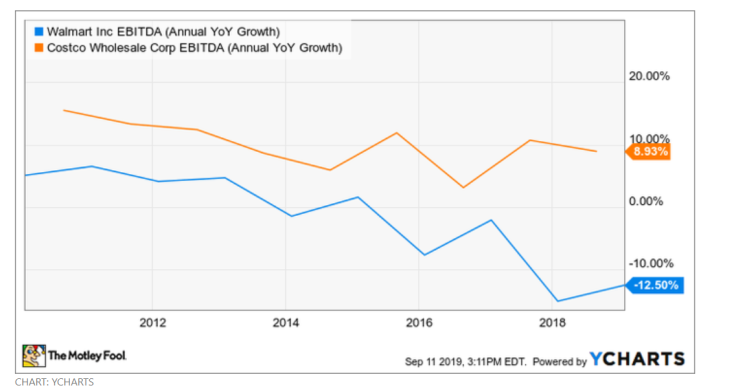

In the last decade, e-commerce has been weighing down the retail sector. Big-box retail chains, in particular, have been feeling the pressure on their margins. Take Walmart (NYSE:WMT) as an example. The company's annual growth rate in earnings before interest, tax, depreciation, and amortization (EBITDA) was -12.5% in 2019 and has been declining steadily in the last 10 years.

In such a high-pressure market condition, Costco (NASDAQ:COST) has found a way to succeed, even without a substantial investment in its e-commerce operations.

In the fiscal year 2018, Costco sold $138 billion worth of goods and services to 52 million households, and only 4% was through the company's online channel. Not investing significantly in e-commerce operations has helped the company to steadily grow its EBITDA by more than 8%. In contrast, Walmart has allocated close to $10 billion in capital to e-commerce, technology, and supply chain, and has doubled its e-commerce sales in the last two years. However, doubling its e-commerce revenue has also halted the company's EBITDA growth to -12.5%. How did Costco outsmart Walmart?

The magic of membership

Customers love Costco because they can get high-quality products in bulk at a low cost. Electronics, wine, and jewelry are all among such products at Costco's warehouse-style, no-frills stores. However, selling products is not how Costco makes money. Costco applies a fixed mark-up to the products it sells and uses its immense buying power to ask for lower prices from its suppliers. Such strategies help Costco keep costs low, and the profit margin stable. However, what makes Costco money is not its retail operations' margin, rather its the membership fees.

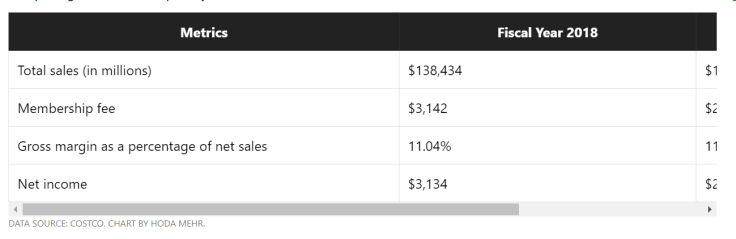

More than 50 million households are members at Costco, and they pay $60 per year in the U.S. and Canada (the membership fee varies in other countries) to enjoy the benefits of shopping at Costco. According to the company's latest quarterly earnings report, more than 90% of these households renew their membership every year. Thus, for Costco, there is no significant cost to generate a consistent stream of membership fee revenue. The company simply covers its operating costs through its relatively stable 11% gross margin and makes money via membership fees. In the table below you can compare the membership fee revenue with net income. These two figures are very similar, and this is no accident. The revenue from the membership fee simply glides through the income statement and into the bottom line. The company's unique business model keeps the customers loyal even if Costco doesn't offer a compelling e-commerce option yet.

The psychology of shopping

There is a pervasive myth in the retail industry that customers prefer to have options. When you walk in a typical grocery store -- Walmart included -- there are rows and rows of canned brands, cookies, and coffee bean packages just to name a few. Contrast that with Costco's shopping experience. There is one type of canned tuna and one brand of middle-roast coffee beans. Customers have limited options at Costco but they don't seem to mind. What you see on the shelves is all there is, and if you do not rush to buy it today, it may be gone tomorrow. According to Costco's 2018 annual report, the company keeps about 4,000 variety of stock-keeping units (SKUs) which is significantly lower than other retailers. In contrast, Walmart offers more than 100,000 SKUs. Regardless of the number of SKUs, Costco is able to outgrow Walmart. In the fiscal year ending January of 2019, Walmart grew its comparable sales in the U.S. by 4%. However, Costco grew its U.S. comparable sales by 7.8% during the 52-week period ending September 1, 2019. Fast-retail is the name of the game at Costco, customers love the sense of discovery, and sales are growing.

E-commerce will come eventually

Outsmarting Walmart and not jumping on the e-commerce bandwagon as fast as others don't mean that Costco will never invest in its online operations. The company's monthly sales report says Costco's online sales grew more than 23% in August 2019. It's expanded its e-commerce operations in Japan and Australia, and it is partnering with the grocery-delivery app Instacart in Toronto and even offers a free 2-day delivery option. Considering the customers' loyalty to Costco, it is not difficult to imagine that they end up taking Costco on the e-commerce offer with minimal friction.

Final takeaway

When online shopping started to take off, many people doubted Costco. At the time, investors were worried that Costco's customers may end up canceling their memberships to gain the freedom of hassle-free shopping online. However, not only is Costco outsmarting its rivals, including Walmart, but it's also continuing to grow its revenue, albeit slowly and steadily. The company's membership-based business model and its deep understanding of the psychology of shopping have created a resilient company in the face of intense competition in the retail sector. To add a cherry on the top, the company is now expanding its online operations. It shouldn't surprise anyone if Costco outsmarts Walmart yet again, this time in the battle for customers' loyalty online.

Hoda Mehr has no position in any of the stocks mentioned. The Motley Fool has the following options: short January 2020 $180 calls on Costco Wholesale and long January 2020 $115 calls on Costco Wholesale. The Motley Fool recommends Costco Wholesale. The Motley Fool has a disclosure policy.

This article originally appeared in The Motley Fool.