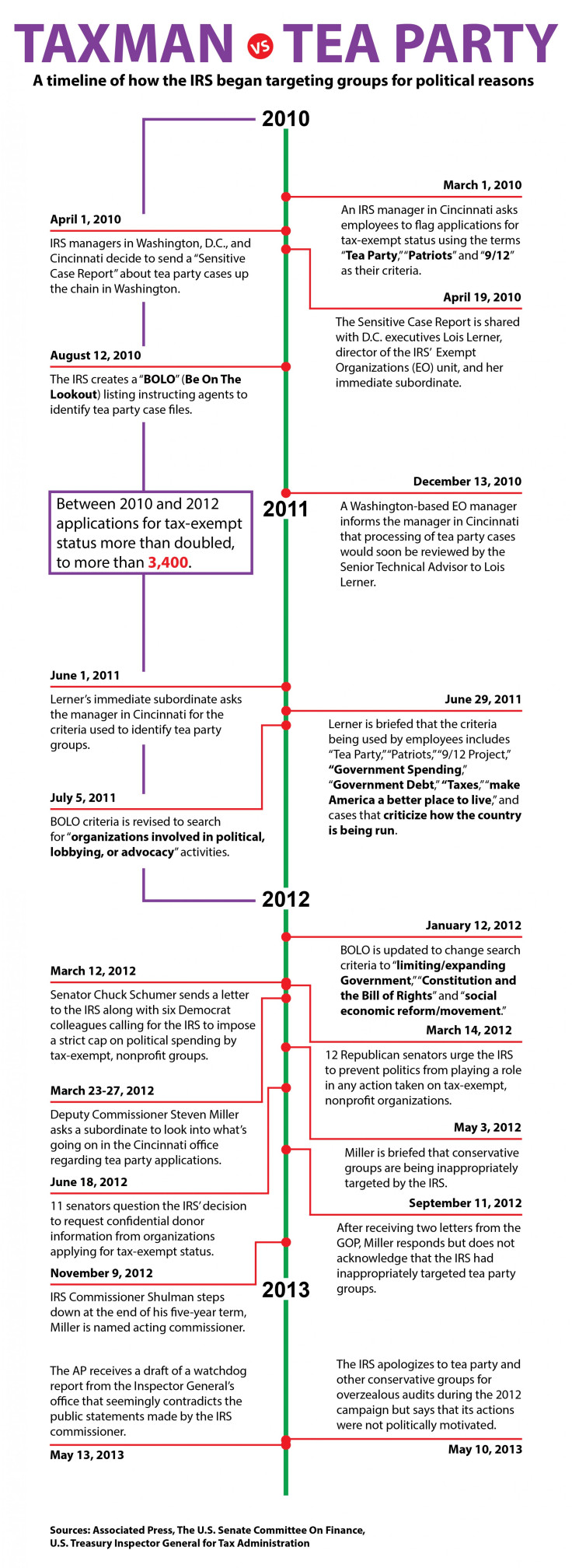

How The IRS Began Targeting Conservative Groups: A Timeline

On Friday, the Internal Revenue Service apologized to tea party groups and other conservative organizations that applied for tax-exempt status for subjecting them to extra scrutiny.

On Monday, the Associated Press got its hands on a watchdog report from the IRS inspector general that seems to contradict statements by former IRS Commissioner Douglas Shulman about certain groups getting audited more closely.

According to the report, senior IRS officials in 2010 or 2011 were asked to flag and target groups if their case file referenced phrases such as “Tea Party,” “Patriots” or “9/12 Project”; criticized how the country was being run; talked about government spending, government debt or taxes; or lobbied to “make America a better place to live.” Shulman had said at a 2012 congressional hearing that the IRS’ actions were committed by low-level employees and were not politically motivated.

According to the report, Lois Lerner, director of the IRS' tax-exempt organizations unit, "raised concerns" and instructed that the criteria be immediately revised, as reported by AP.

On Jan. 22, 2012, the IRS changed its criteria, asking employees to flag “political action-type organizations involved in limiting/expanding Government, education on the Constitution and Bill of Rights, social economic reform/movement.”

Check out this timeline of how the IRS began to target groups based on their political leaning:

© Copyright IBTimes 2024. All rights reserved.