HP: Does Whitworth Make a Difference?

Hewlett-Packard, the No. 1 computer services company, has elected Ralph Whitworth, a well-known activist investor to its board, its first election since new CEO Meg Whitworth was elected Sept. 25.

Will it make a difference?

Whitworth, 56, has made differences before, including in the technology sector. His Relational Investors bought into companies including National Semiconductor, ITT and the old Tyco International and helped shake them up.

Some, like National Semiconductor, are now part of Texas Instruments. And neither current version of ITT or Tyco resembles their forebears.

Shares of HP, based in Palo Alto, Calif., have already gained 22 percent since Whitman came in. Still, they are off 35 percent over the past year, lowering the company's market capitalization to $54.2 billion.

HP is scheduled to report fourth-quarter results next week.

Whitworth has skin in the game: Relational already owns 17.5 million shares. In Friday's early trading, HP shares were already up another 2.8 percent, to $27.29.

HP also elevated director Rajiv Gupta, the former chairman of Rohn & Haas before it was acquired by Dow Chemical, as its new lead director. He's also a director of Tyco International.

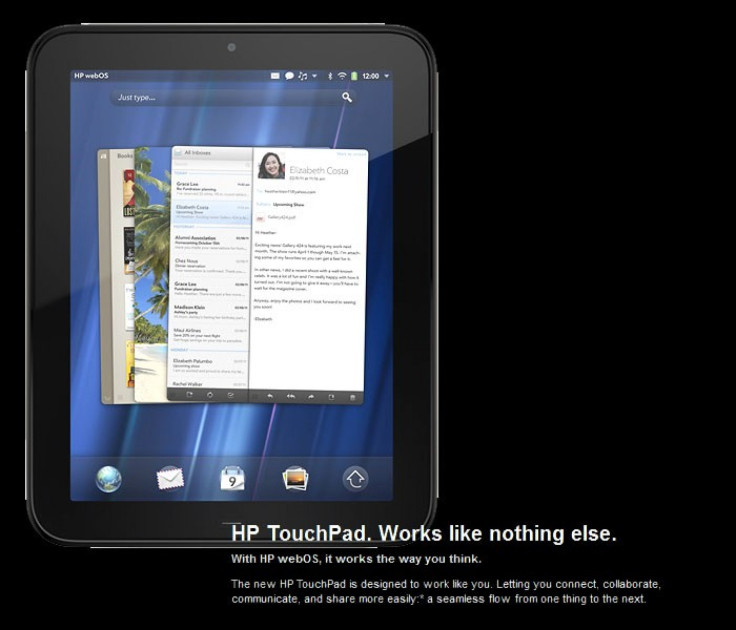

One of the problems HP has had under its past three CEOs --- Carly Fiorina, Mark Hurd and Leo Apotheker --- is a weak board of directors. This allowed for major acquisitions like Compaq Computer or or Palm or Autonomy to proceed without protest, although there are strong reasons justifying both giant purchases: HP got to be No. 1 in PCs buying Compaq and now will be better able to battle IBM, Apple and Oracle with Autonomy, which manages content. Palm's future value to HP has yet to be determined.

Indeed, as her first major decision, Whitman reversed a move to divest the HP PC division. Next week, during calls with investors, she'll be asked why and probably say it helps keep HP all all-in-one supplier to enterprises that is also able to benefit from massive deals on components from suppliers including Intel, Advanced Micro Devices and Tyco's AMP connectors unit.

Whitworth also learned part of the activist trade from an old master, T. Boone Pickens, the oil man who went after Gulf Oil and many other businesses. Pickens, 83, devotes his time now to new energy sources like wind turbines. He's a billionaire.

Ray Lane, HP's new Executive Chairman, as well as a former president of Oracle, said Whitworth will bring a constructive voice to the directors' table. Of course, part of the deal is that Relational Investors also has to hold its HP shares for at least two years.

That may give the new team of Lane and Whitman some breathing space as well as a valuable ally in their efforts to create wealth.

© Copyright IBTimes 2024. All rights reserved.