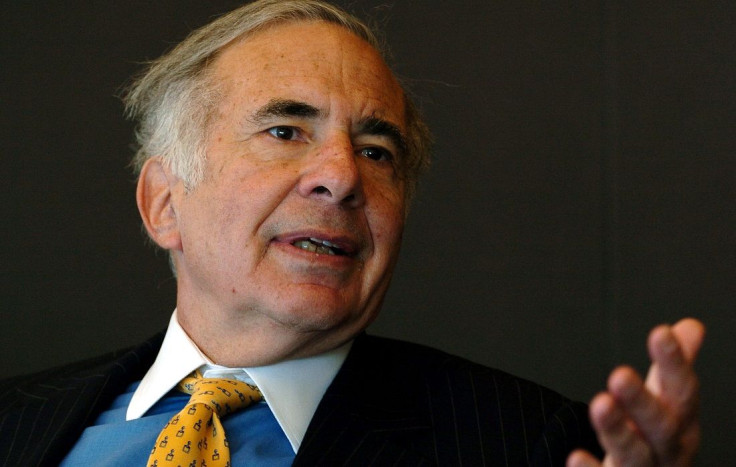

Icahn: Activist Investing Has Never Been Better

Influential billionaire investor Carl Icahn praised the benefits of “activist” investment in major U.S. companies during a regulatory filing on Monday, arguing that there has never been a better period for aggressive management takeover tactics.

So-called activist investors leverage large funds to buy major stakes in public companies, and then use those stakes to agitate for company-board and executive-leadership changes. Activist investors also fund acquisitions that shake up management teams.

"I believe that by far the best method to utilize in investing is the 'Activist model,'" said Icahn in a statement accompanying the latest earnings of his business Icahn Enterprises L.P. (NASDAQ:IEP). "I have spent a great deal of time and effort perfecting its use and I am happy to say that IEP has been a beneficiary of this."

“In my opinion there has never been a better time than today for activist investing, if practiced properly,” the statement continued.

Icahn cited “extremely” low interest rates as making acquisitions cheaper and more attractive. He also said that many institutional investors, like hedge funds and pension funds, are aware of “mediocre top management and non-caring boards” at many U.S. companies.

If that management culture prevails at U.S. companies, America will never end high unemployment or compete in world markets, said Icahn.

Examples of activist investor struggles in the past year include hedge fund manager Daniel Loeb’s attempt to get Sony Corporation (TYO:6758) to spin off its entertainment arm, and investment manager Nelson Peltz’s quest to have PepsiCo, Inc. (NYSE:PEP) acquire food company Mondelez International Inc. (NASDAQ:MDLZ) and split its food and drink units.

“An investment in IEP stock made at the beginning of 2000 has increased by approximately 1,500%, or an average annual return of 22%, through October 31, 2013,” added Icahn, in the quarterly earnings report, stressing the returns some of his followers have seen.

The company saw $472 million in net income for the third quarter, up from $84 million in the same period in 2012. For the year to Sept. 30, it earned $803 million, over double the $390 million earned from January 2012 to October 2012.

The company holds about $8 billion in net asset value, up from $6 billion at the end of 2012. Its broader balance sheet, with assets of $31 billion, includes $3.2 billion in cash and $12.2 billion in investments. Icahn himself is worth $20.3 billion, according to Forbes.

Icahn also hinted that low interest rates will “greatly increase the ability of the companies IEP controls to make judicious, friendly or not so friendly, acquisitions.” It indicates that Icahn’s track record as an activist investor may speed up.

The window for low interest rates may be limited, as markets expect interest rate hikes in coming years, as the Federal Reserve slowly ends its massive quantitative easing program.

Icahn has lost some activist investor fights in past years. In particular, he failed to block a buyout of Dell Inc. earlier this year, despite great efforts.

© Copyright IBTimes 2024. All rights reserved.