Icahn Offers to Buy Commercial Metals for $1.73 billion

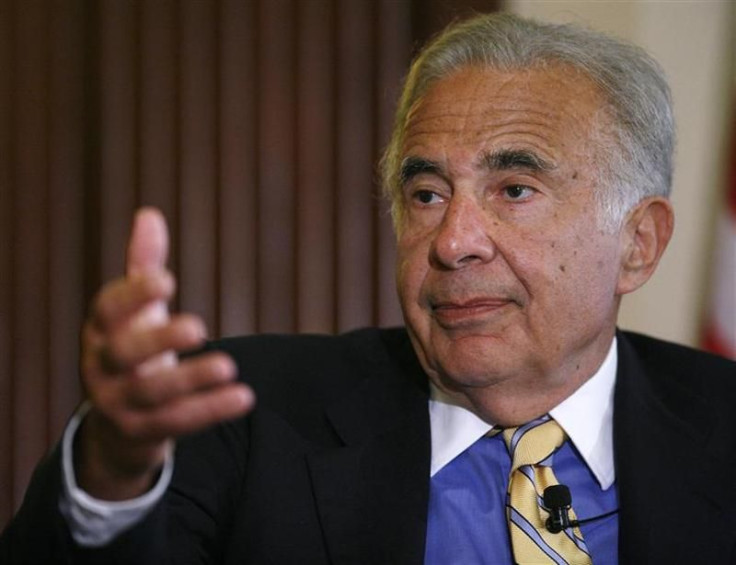

Carl Icahn offered to buy Commercial Metals Co (CMC.N) in a $1.73 billion deal that would combine the metals recycler with the billionaire investor's PSC Metals Inc.

The offer price of $15 a share from Icahn Enterprises LP (IEP.N) represents a premium of 31 percent to Commercial Metal's Friday close. However, the stock was trading nearly $1 short of the bid price, indicating investor skepticism that a deal would go through.

The Irving, Texas-based company had adopted a poison pill shortly after Icahn announced his stake in it in July.

In a letter to shareholders, Icahn, who with a 9.98 percent stake is Commercial Metals' largest shareholder, said he didn't have any confidence that the board will ever hold management accountable for poor performance.

Icahn said he plans to merge Commercial with PSC Metals, which he acquired from Philip Services Corp for $335 million in 2007.

On October 20, Commercial said it was willing to consider any recommendation by its largest shareholder when he nominated three people to its board.

Earlier the same month, the company said it would cut 1,480 jobs, or about 13 percent of its global workforce, resulting from the closure of some of its facilities.

(Reporting by Sumit Jha and Arup Roychoudhury in Bangalore; Editing by Joyjeet Das, Anthony Kurian)

© Copyright Thomson Reuters 2024. All rights reserved.