If U.S. Government Defaults, What Will the Fed Do?

Analysis

Assuming no agreement between President Barack Obama and Congressional Republicans, in less than eight days the unprecented, the unfathomable will happen -- a dreaded U.S. Government default.

A default by the U.S. Government. It still sounds funny. A default by the largest and most-technologically advanced nation in the world.

But that begs the question: what will the U.S. Federal Reserve do, if the U.S. Government defaults?

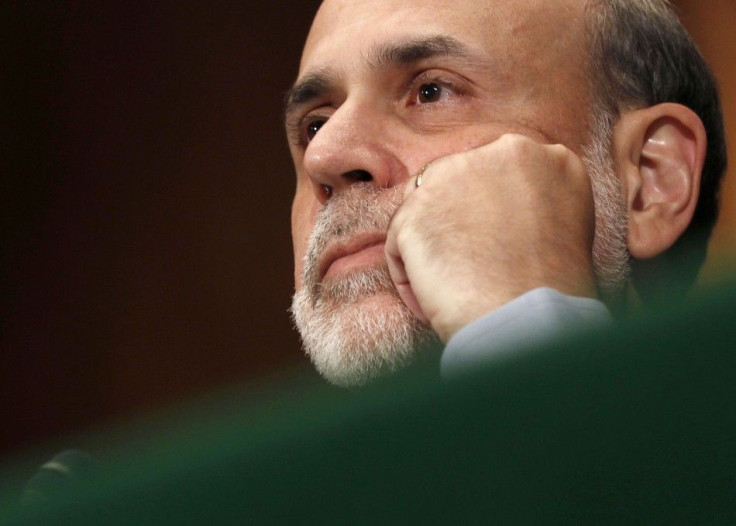

So far, officially what one has to go on is the one-sentence joint statement after Friday's meeting among U.S. Federal Reserve Chairman Ben Bernanke, New York Federal Reserve Bank President William Dudley, and U.S. Treasury Secretary Timothy Geithner.

"While we remain confident that Congress will raise the debt ceiling soon, officials from the Treasury, Federal Reserve Board and the New York Fed met today to discuss the implications for the U.S. economy if Congress fails to act," the joint statement released by the Treasury Department read.

No additional details were disclosed.

Dudley, as head of the New York Fed, leads the most important regional bank in the Federal Reserve System, as it's the regional branch through which the Federal Reserve executes monetary policy.

Bernanke, in testimony on July 14 before the Senate Banking Committee, said that he wanted to "eliminate any expectation that the Fed through any mechanism could offset the impact of a default on the government debt," sfgate.com reported.

However, Bernanke added, "we would do what we could to preserve the operationality of the system. You know, we participate in securities transfers and so on."

Monetary Policy Analysis: The Fed was not designed to pay the U.S. Government's bills: that's not the Federal Reserve's role.

That said, an unprecedented crisis requires an unprecedented response, and the argument forwarded here is that Fed Chairman Bernanke would do everything within his power to keep credit markets liquid and to prevent lateral markets from panicking.

Most of the Fed's response, possibly but not necessarily in coordination with other major central banks -- the European Central Bank, Bank of England, Bank of Japan -- would probably involve large amounts of liquidity and making guarantees.

In other words, faced with a choice between trying an unconventional, creative tactic or watching the global economy revert to the barter system, Bernanke will move the levers and do what he can do to keep credit markets liquid and keep interest rates from skyrocketing.

© Copyright IBTimes 2024. All rights reserved.