Indian banks tapping overseas depositors perform better despite high domestic rates

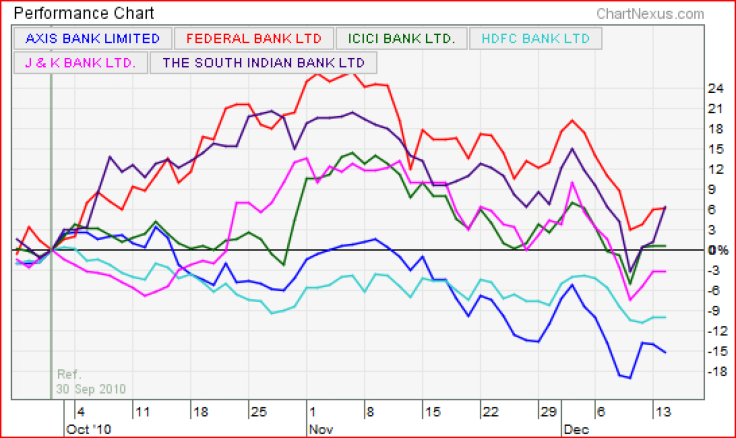

It is inevitable for Indian banks to compromise on margin as the country is going through a rising interest rate scenario, which has pushed most banks' stocks below their end-September levels, but at least three main private banks are still selling at a higher price, probably helped by valuation advantage and mostly steady pricing of deposits by Indians residing abroad.

The Federal Bank Ltd, India's fourth largest private bank in terms of assets, topped the list among non-state banks, which at close of Tuesday December 14, was 6.15 percent higher from its September 30 level. The South Indian Bank Ltd, another bank based out of southern state of Kerala, stood just behind with a 5.85 percent premium. See the illustration.

"The time is difficult for the entire sector as the cost of deposits is rising. And apart from cheaper pricing, I don't think stocks of Federal Bank and South Indian Bank have got any other special advantage," Mumbai-based Vaibhav Agarwal, Vice-president (Research), Angel Broking, told IB Times.

A senior official at South Indian Bank's headquarters said that since most NRI (Non-resident Indian) deposit rates are linked to Libor (London inter-bank offered rate), which is not rising like India's rates, Kerala-based banks have an advantage. "These two banks (South Indian Bank and Federal Bank) get 10-15 percent of their deposits from NRIs. Also, the quality of assets and the rate of growth of credit disbursals are at satisfactory levels here."

ICICI Bank, India's second largest lender, also managed to stay just above the reference level, with a 0.77 percent difference.

Analysts said many banking stocks, including those of bigger ones like ICICI Bank and HDFC Bank are good buys now, especially after the recent fall.

"I am positive on these banks. Federal Bank may rise 15-20 percent from current levels before a correction," Agarwal said.

India's main share index Sensex has fallen more than 1.3 percent while Bankex, an index for banks, dropped more than 6.3 percent during the same period, highlighting the value of the gains by those remained firm in this tough time.

India's central bank that raised its key lending rate by 150 basis points in six tranches to 6.25 percent since mid-March is expected to stay put at its mid-quarter policy review on Thursday.

See the table below for a study on India's major private banks' stocks since end-September. (South Indian Bank is ranked 11th in terms of assets but has been included to study the Kerala factor):

© Copyright IBTimes 2024. All rights reserved.