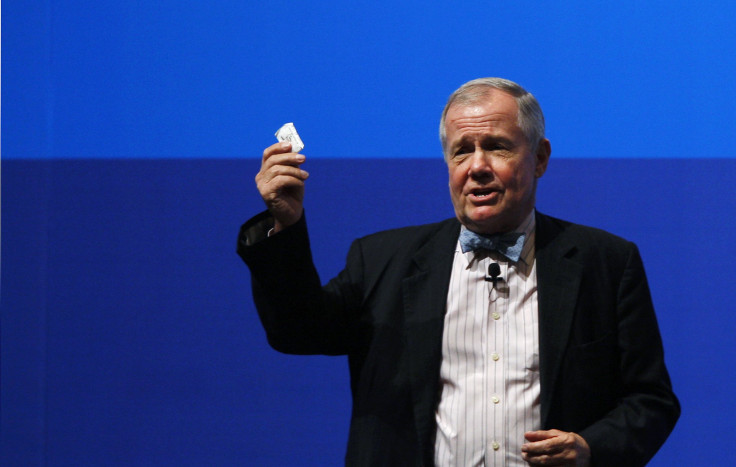

Influential Investor Jim Rogers Talks Commodities And Japanese Stocks (Q&A)

Maverick investor Jim Rogers founded the Quantum Fund hedge fund in 1973 along with George Soros. Rogers made his fortune early and retired at 37. He later traveled on a motorbike around the world in 1990, and then visited six continents over three years in 2003, chronicling his adventures in books.

Around 2005 he relocated with his family to Singapore, partly so his daughters could learn Mandarin Chinese during childhood. In talks, Rogers emphasized China’s rise to economic dominance in the early 2000s and penned "Hot Commodities" (2004), which painted China as a massive consumer of natural resources in coming years.

In "Hot Commodities," Rogers argued that commodities, which include oil, metals, agricultural goods and other natural resources, would boom for at least a decade. He started his own commodities index fund in 1998, known as the Rogers International Commodity Index.

Now 71, Rogers is a well-known investment pundit still sought after by media and investors for his views on markets and the global economy. He spoke with IBTimes by phone from Singapore about commodities, the global economy and where he sees investment opportunities.

Q: You’ve argued that commodities are always driven fundamentally by supply and demand. But have commodity prices been swayed lately by apparently external factors, like U.S. monetary policy or bond tapering?

A: Ultimately everything is supply and demand. If tapering occurs, that certainly influences demand, if nothing else. So ultimately it’s all supply and demand. Different things affect supply and demand. War affects demand, for instance. It also affects supply. Money printing affects demand certainly, though it doesn’t affect supply so much.

In the end, whatever happens, most things affect and influence supply and demand, including tapering.

Q: Strong Chinese physical demand for gold didn’t stop gold’s fall in 2013. Why did gold fall so hard in 2013?

A: One, we had an anomaly in the gold market. Gold went up 12 years in a row, which is very strange and unusual for any market. When the correction came, it too was an anomaly. At the same time, the Indians – who were the largest buyers of gold in the world – Indian politicians started blaming their problems on gold. So they took many measures to cut back their demand for gold, successfully.

Gold is still going down. India was a much bigger buyer than anyone else – so obviously when you take out demand from the largest buyer of anything, it causes a correction. That’s what been happening. Nothing unusual about it.

At the same time, many speculators and investors were cutting back after the 12-year bull market. That plus the Indians overwhelmed Chinese demand.

I still am not buying gold in any big way yet, because there are still too many mystics, too many people who think that gold is holy. I don’t see how the markets can make a bottom until a lot of those mystics get shaken out of the market. Once they throw in the towel, then gold will make a significant bottom, and I hope I’ll be buying a lot more at that time.

Q: What are your thoughts on developments in recent years that have unlocked shale oil and gas? Some have said the U.S. energy boom is the most important development in political economy in decades.

A: I would urge people to go out and see what’s happening in the field. Yes, it was all very exciting in the beginning. But now we’re finding out that those wells are very short-life wells. Production dropped by 40 to 60 percent in the first year, and the demand for rigs to drill in the shale fields is down 75 percent in the last couple of years. The demand for pumps is down 50 percent.

So it’s not as much fun as we’d hope it would be. In some countries such as Poland, people have given up their shale leases, because they’ve realized it’s just not so simple. I read all the hype, but again I’d urge people to go into the fields and see what’s actually happened, rather than reading what journalists hype.

Natural-gas prices have quadrupled since the bottom. They’re not quadrupling because this is the most important thing in several decades.

Q: But if the U.S. can become self-sufficient in an energy or a net exporter, as some foresee, won’t that be very significant?

A: Well, if cows can fly, that’s very significant too. But present indications are that’s not going to happen. But if that happens, sure. That would change things dramatically. Like if Germany became a net exporter of energy, my God! That’d be one of the most significant things of the century, not of the decade.

But the fundamentals indicate it’s not going to happen, despite the current hype. Demand for drilling rigs is down 75 percent. Why do you think the rigs are down? If it was so wonderful, everybody would be drilling like crazy. Gas prices have quadrupled. People would be out there drilling like crazy people, when prices have quadrupled. The facts on the ground are: these [developments] are not as exciting as we thought at first.

Now, hopefully, mankind will figure out a way to overcome the technological problems. Mankind always has. But so far we have not been able to figure that out.

The same applies to shale oil. Shale oil production drops even faster than shale gas. This doesn’t even get into the whole environmental question of water, etcetera. [e.g. concerns over environmental damage caused by fracking]. I have no idea whether the environmentalists are right or not.

Q: Have commodities fallen away from that multi-year bull market you predicted back in 2004? Or are recent slumps merely temporary corrections in a longer upward trend?

A: It’s a normal temporary correction, which happens in all markets. The bull market in stocks between 1982 and 2000 had many significant corrections. In 1987, stocks went down 40 to 80 percent. 1989, 1990, 1994, 1997, 1998 – these were several very significant corrections in the price of stocks.

Back then many people said: Aha! Now the bull market is over. Well, they were wrong. In my view, this is what’s happening in commodities.

I do not see enough significant permanent new supply in almost anything, which can cause the end of the bull market [in commodities]. Rio Tinto PLC (NYSE:RIO) and BHP Billiton Limited (NYSE:BHP) and others have cut back substantially on their capital spending programs because they think they should not be bringing a lot of new [mining] supply on stream yet. So until we have significant permanent new supply, I don’t see the bull market coming to an end.

The bull market will end, I assure you, it will end someday. But not yet.

Q: What about demand for natural resources? The talk of a Chinese economic slowdown, could that alone derail commodities?

A: Well, if you take out a big buyer of anything, of course it has an effect. You cut demand anywhere, and it hurts. But remember, the Chinese economy is one-tenth the size of Japan’s, Europe and America [combined]. The Chinese have done a brilliant job. But America, Europe and Japan are 10 times bigger than the Chinese economy.

The Japanese, the Americans and the Europeans are moving heaven and earth to increase demand in those countries. Those countries as a group are more significant than China.

China is trying to cool off, and it should. My gosh, it should – I hope they do cool down. But that’s not the end. That’s not the whole demand story in anything, and certainly not in commodities.

Q: You’re an investor admired by a lot of investors, professional and otherwise. Which investors in 2014 do you admire or follow?

A: I’m afraid I don’t pay much attention to other people. I’m pretty much a loner. I have found in my career that when I listen to other people I usually make mistakes and lose money. So I try not to pay much attention to other people. There are plenty of smart investors in the world, but I just don’t move in those circles.

Q: What are some stock markets you’re interested in?

A: First, the plenary session in Beijing in November – the Chinese say it’s one of the three most important things in the past 35 years of Chinese history. So I’m doing what they’re doing. I’m started to look for investments in the area where they’re going to put money. If the Chinese government is going to put a lot of money into something, I should, too. They have a lot more money than I do. They’re smarter than I am.

I started buying Russia in recent months. Yesterday [March 5] and the day before, I bought more. I haven’t bought too much, but have been looking for things to buy in Russia. I bought shares in the Moscow Stock Exchange. I bought Aeroflot. I own airlines around the world. And I’m looking to buy more in Japan, if given the chance.

I like to buy things that are depressed. Agriculture is very depressed. The American stock market is hitting all-time highs. I don’t find that particularly attractive.

Q: Why Japan?

A: First of all, the market is down 70 percent or so from its all-time high. But Mr. Abe has said he’s going to print unlimited amounts of money. Those were his words. So he’s going to ruin Japan. Twenty years from now, we’re going to look back and say: that was the death knell for Japan.

But in the meantime, if you print unlimited amounts of money it’s got to go somewhere. The market is down dramatically in 24 years. And Abe also passed a law giving tax incentives for ordinary Japanese to invest in the stock market. I’ve seen that happen many times in history, and it always gets people to invest.

For those reasons, I’m investing in Japan. I repeat: this is all going to be a disaster in the end. Printing unlimited amounts of money is terrible. Running up staggering debt is terrible. But that’s what Mr. Abe is doing. He’s going to ruin Japan. But he might make the stock market go higher.

Q: On a personal note, what are you up to nowadays on a daily basis?

A: I make a lot of speeches around the world, which I love doing. For some reason, people keep inviting me. But more importantly than that, I have two little girls that I spend as much time with as I can. I came to parenthood late in life, so I spend as much time with my kids as I can, not making speeches, or investing or whatever.

Q: Any last thoughts?

A: Agriculture is very exciting for many reasons. We’re running out of farmers worldwide. More people in America study public relations, not agriculture. The average age of farmers in America is 58. In Japan, it’s 66. So if you want to get rich, become a farmer, not a stock broker.

Stock brokers will be driving taxis in the next few years. The farmers are going to be driving Lamborghinis. Sugar prices, for example, are down 75 percent from all-time highs. Learn about agriculture, don’t learn about finance.

© Copyright IBTimes 2024. All rights reserved.