iPhone 6 Rumors: A Low-Cost iPhone Priced At $399 Could Boost Apple’s Profit Margins, Analyst Says

If Apple (NASDAQ:AAPL) releases the highly talked-about low-cost iPhone, usually referred to as the “iPhone 6,” at $399 without any carrier contract, the device would actually boost the company’s profit margins, according to an analyst.

Morgan Stanley analyst Katy Huberty, in a note to clients on Monday, wrote that there should not be any fear that Apple’s profit margins could be affected if the company launches a low-cost iPhone later this year. Instead, such a handset would help Apple's margins as more people will be able to own an iPhone.

Huberty estimated the cost to Apple (including bill of materials, manufacturing, warranty and other factors) of a 16GB version of the cheap iPhone at $244. According to her, if the low-cost iPhone is priced at $349, it would be neutral to Apple’s gross profits in dollars. On the other hand, a pricing of $399 would make it neutral to the company’s gross margin percentage.

Huberty believes that Apple will use the same strategy it employed while releasing the iPad mini in late 2012 for $329, which was $170 less than the existing full-size iPad. She expects Apple to launch the inexpensive iPhone toward the end of this year and discontinue the iPhone 4S and iPhone 4, Apple Insider reported.

"We now see the most likely starting price for the low-end iPhone at $399, as supply chain components appear similar to the current iPhone lineup and the low-end iPhone would replace the iPhone 4/4S sold in the $450-$549 range before recent discounts," Huberty wrote.

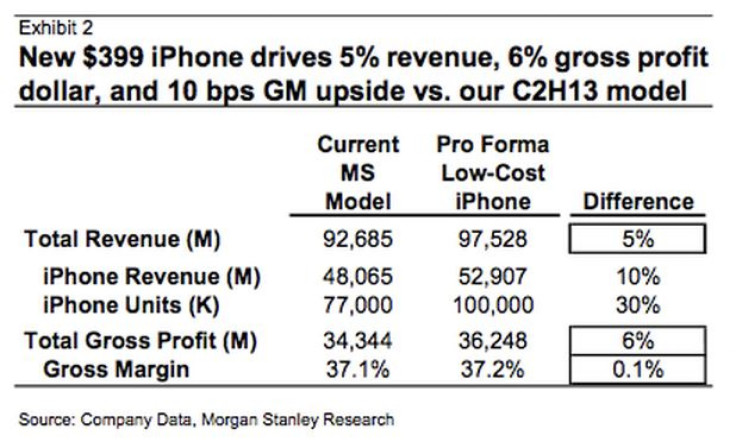

"At this price point, even with a 50 percent low-end volume mix, the low-end iPhone is 5 percent accretive (to) total company revenue, 6 percent accretive to gross profit dollars, and 10 basis points accretive to gross margin versus our current (second half of calendar 2013) estimates."

Based on Huberty’s estimates, the 16GB low-cost iPhone with a $399 price tag could have a gross margin of 35.7 percent, which is below Apple’s flagship iPhone lineup, but in proportion to the company’s other products. The profit margins could increase to 42.3 percent for a $499 32GB model and 44.9 percent for a $599 64GB model, Apple Insider added.

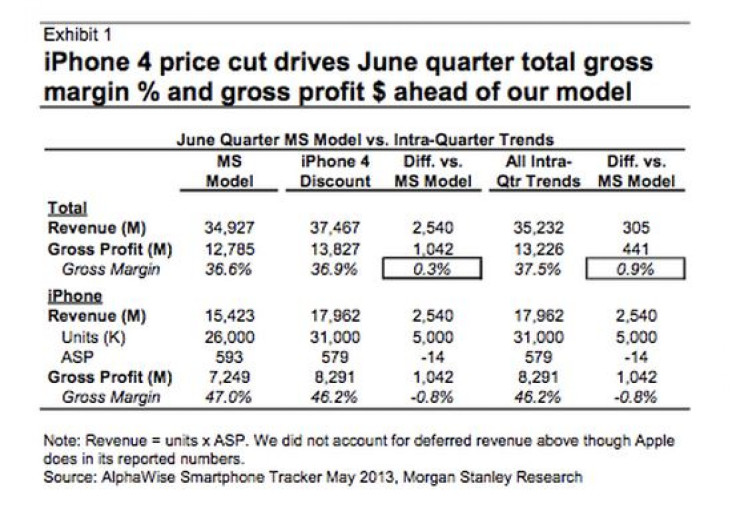

Huberty talks about Apple’s profit margins for the June quarter, saying it could also have a similar effect, “as Apple experiments with lower regional price points on the old iPhone 4,” Fortune reported.

She projected that iPhone 4 discounts may lower the handset’s average selling price by 14 percent, but the net effect of more devices sold would raise Apple’s gross margin for the June quarter by 0.3 percent. Take a look at the table below:

In addition, Huberty’s estimates also indicate that even as sales of iPad mini and Macs decelerate, iPhone sales could still help the company’s gross margins grow by as much as 0.9 percent for the June quarter.

If Huberty’s predictions are correct, there would be three iPhone models available for consumers by the end of 2013 -- the high-end “iPhone 5S,” the low-priced iPhone 6 and a new 8GB unlocked version of the current iPhone 5 at $549.

The price structure for the iPhone 5S will likely remain the same as the iPhone 5 lineup, i.e. $649 for the 16GB version, $749 for the 32GB version and $849 for the 64GB version, Huberty wrote.

© Copyright IBTimes 2024. All rights reserved.