Iraq To Become No. 2 Oil Exporter After Saudi Arabia By 2030s: IEA

Iraq is poised to become the world’s No. 2 oil exporter after Saudi Arabia within 20 years and double its output by 2020, the International Energy Agency said Tuesday.

Daily production could reach 6.1 million barrels by 2020, up from the current output of around of 3 million barrels, and top more than 8 million barrels by 2035, the Paris-based agency said in a special edition of its World Energy Outlook.

The expansion will make Iraq “"by far the largest contributor to global supply growth" over the next 20 years, taking the place of Russia as the world's second-largest oil exporter, it said.

Iraq’s oil production stagnated for years due to wars and sanctions. Living standards have fallen sharply, as Iraq’s per capita gross domestic product declined by more than one-fifth in real terms between 1980 and 2011, leaving this indicator as one of the lowest in the Middle East.

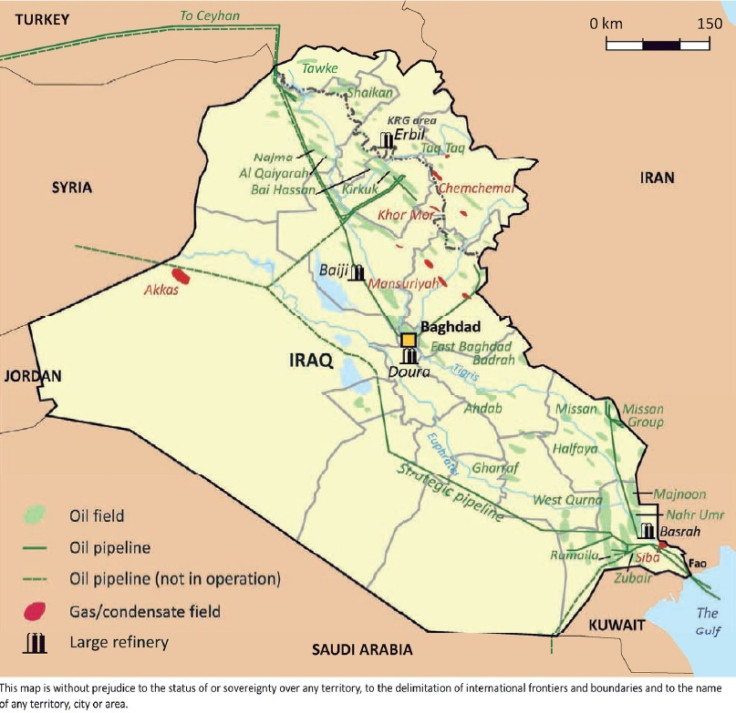

Yet Iraq is also a country of immense potential. It's estimated to have the fifth-largest proven oil reserves and 13th-largest proven global gas reserves, as well as vast potential for further discoveries.

Energy is already the cornerstone of Iraq’s economy, with oil exports accounting for 95 percent of government revenues and equal to over 70 percent of GDP in 2011. The pace of Iraq’s revival in the coming decades depends very heavily on the oil sector.

The leading global energy monitor reported that Iraq stands to gain almost $5 trillion in revenues from oil exports over the period to 2035, an annual average of $200 billion and an opportunity to transform the country’s future prospects.

"Developments in Iraq’s energy sector are critical for the country’s prospects and also for the health of the global economy," said IEA Chief Economist Fatih Birol, the report’s chief author. "But success is not assured, and failure to achieve the anticipated increase in Iraq’s oil supply would put global oil markets on course for troubled waters."

The country’s central government in Baghdad must overcome internal disputes over oil rights with the Kurdish regional authorities in the north and increase current investment from $9 billion in 2011 to $25 billion a year on average for the rest of the decade, the report warned.

Kurdistan this year has signed deals with Exxon Mobil Corp. (NYSE: XOM), Chevron Corp. (NYSE: CVX) and France's Total S.A. (NYSE: TOT) to explore for oil in its territory.

Significant delays in the development of Iraq’s reserves could cost $3 trillion in lost national wealth for Iraq and bring difficult times to international oil markets, the IEA said.

Should the low projection prove to be the more accurate, Iraq’s oil output would only rise to 4 million barrels a day in 2020 and to 5.3 billion barrels in 2035. Meanwhile, oil prices per barrel could reach nearly $140 in real terms in 2035, nearly $15 a barrel more than the IEA’s current central assumption.

In the U.S., the price of West Texas Intermediate oil rose $3.12 to $92.45 a barrel in Tuesday trading.

© Copyright IBTimes 2024. All rights reserved.