Iraq ISIS Crisis Driving Gas Pump Prices Higher But Global Economic Danger Low, For Now

Global oil prices have risen since the extremist Islamic State of Iraq and Syria seized Iraq’s second-largest, city Mosul, on June 10 and began advancing south toward Baghdad, but they aren’t yet sparking fears among economists of a major economic slowdown.

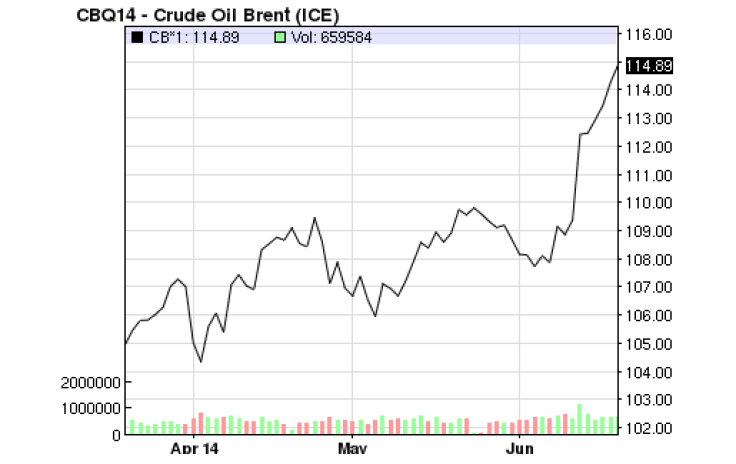

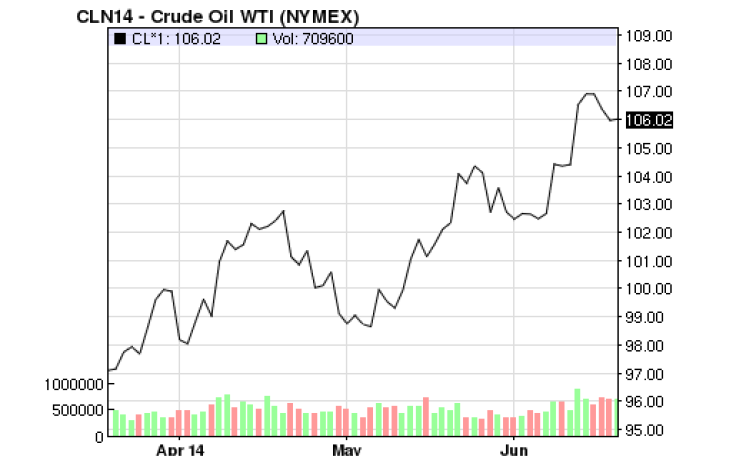

After the news of ISIS’s advance, the Brent crude oil price, the international benchmark, wavered around $109 per barrel, compared to the May average of $110 per barrel. The price of West Texas Intermediate crude, used in the U.S, paused around $104.35.

The next day, when it became more apparent that the attacks were escalating, WTI crude shot up past $106.50 per barrel, and Brent crude rose to about $112.50. Brent has since risen to more than $114 per barrel, hitting a nine-month high, and WTI has settled just over $106 after hitting $107 per barrel. And betting that oil prices will keep rising now costs more than it has in the past three years.

Highlighting the abrupt departure from expectations, the U.S. Energy Information forecast, just before news of the Iraqi crisis began taking headlines, that Brent prices would average $107.82 this year and WTI prices, $98.67.

The higher oil prices have already begun trickling down to American consumers, and there’s no relief in sight. Regular unleaded gasoline prices averaged $3.69 a gallon in the U.S. Wednesday, the highest for that day in six years, eight cents more than a year ago, and three cents more than a month ago. That’s a penny shy of this year’s high from April 28, according to AAA, the automobile club that tracks daily gas prices in the U.S. In May, AAA had predicted that gas prices would fall 10 to 15 cents this month, as prices often peak in the spring and fall in June.

"Despite hopes for a less expensive summer, it looks like Americans are stuck paying above-average gas prices," AAA spokesman Michael Green said. "If the situation continues to get worse, American consumers can expect to pay more at the pump.”

The last time gasoline prices were this high, in 2008, global oil prices were more than $150 per barrel.

Current prices are still only a little above the average $110 per barrel (for Brent) since the wave of revolutionary protests known as the Arab Spring swept through the Middle East and North Africa in 2011. While global economic growth has been slow since the Brent price rose above $100 per barrel, if history is any indication, oil prices would need to rise past $120 to sharply slow economic activity, Julian Jessop, chief global economist of macroeconomic think-tank Capital Economics said in a note Tuesday.

Generally, a $10 rise in oil prices slices 0.2 to 0.3 percentage points off of global growth, according to Jessop, which means so far, the uptick in oil prices may be causing a 0.15 percent decline in global GDP.

“In the event of widespread disruption, the West could decide to draw on ample stockpiles of crude oil held in strategic reserves in the U.S. and elsewhere,” Jason Tuvey, Middle East economist for the think tank, noted.

© Copyright IBTimes 2024. All rights reserved.