Kindle Wars: The Fire is Out, So How Will Apple Keep iPad Users Loyal?

Consumers in the $186 billion U.S. consumer electronics market are about to get their fourth-quarter tablet wish lists. Amazon has taken the wraps off the Kindle Fire, while Apple next week may shed light on the much-anticipated iPhone5 and iPad3.

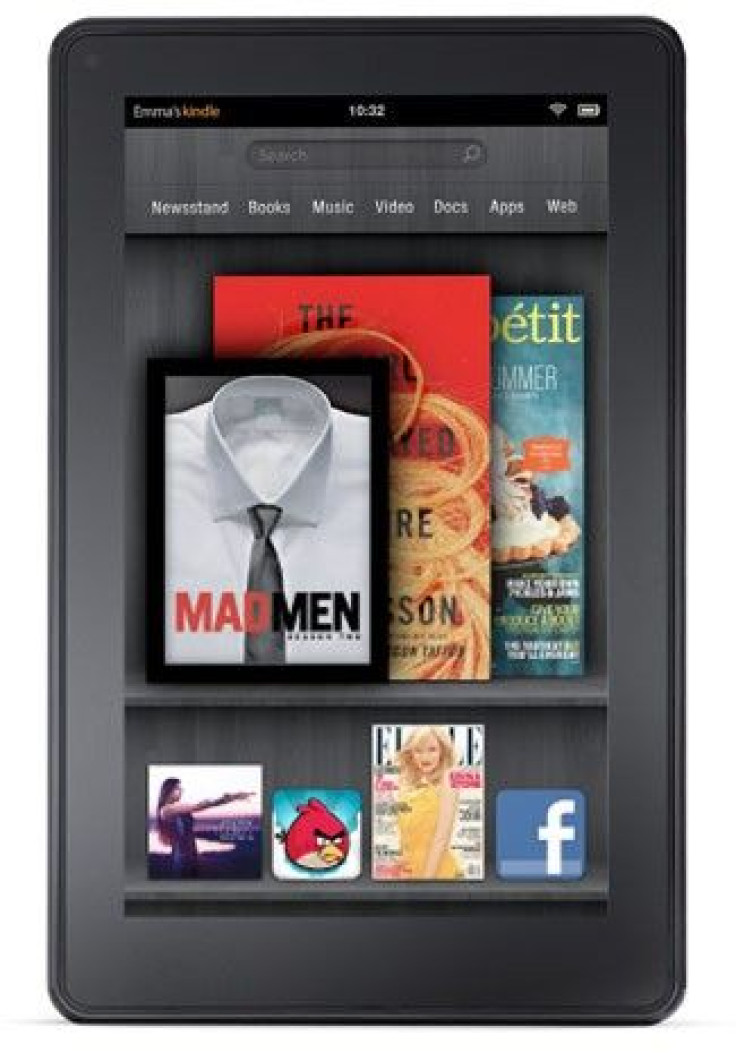

Amazon, the world's biggest e-retailer, won kudos for Kindle Fire, a major content platform priced at $199, less than half that of the iPad. The Seattle-based giant, which has already sold more than 17 million Kindles, has ordered as many as 900,000 units from Taiwanese maker Quanta.

Amazon maestro Jeff Bezos has acknowledged the huge success of the iPad, so he'll try to sell his Amazon version cheaper, faster and better than Apple's product. Like Apple, he's a shrewd retailer. With a smaller screen and with less functionaity than the iPad, Kindle Fire is aimed at a broader market, which means Apple may lose some share but not a loyal customer base.

Bezos, a champion retailer of books and electronics, watched as HP, undone by the TouchPad fiasco, sold out in August when it blew out its units in a $99 fire sale. That demonstrated a demand for an iPad that was cheaper, if not as beautifully designed and multifaceted as a Steve Jobs-influenced product.

Others are in the market for a less-expensive tablet, including consumer electronics giants Samsung Electronics and Sony. Sharp has already left the field, and Canada's Research in Motion, which has an apparent dud with its BlackBerry PlayBook, promises to have a QNX version soon that can handle e-mail.

Competition will be a boon to retailers as well as vendors, although a price war may hammer shares until leaders emerge. Apple shares fell 2.2 percent in September, while Amazon's leaped nearly 12 percent, but closed September up 2.5 percent.

Amazon could provide a shot in the arm to the non-Apple tablet market, said J.P.Morgan's Mark Moskowitz, who believes total tablet shipments this year could reach 51.9 million. Market researchers IHSiSuppli think the market might reach 60 million, with Apple taking about a 75 percent share.

So how can Cupertino, Calif.-based Apple stand up to Amazon, as well as some of the others that have waded into the tablet pool like Research in Motion, Samsung Electronics, Sony and Dell?

One sure way is to ensure the iPad3 remains a classy product and is sticky, the term for making consumers so loyal they will stick by it, despite a higher cost. UBS analyst Maynard Um believes this is a critical aspect of Apple's overall strategy for all products.

A UBS market research survey found that 89 percent of Apple users want to remain loyal to the brand, a powerful cudgel to beat back Amazon, Sony and others.

Analysts have also suggested Apple might phase in a new iPad3 product quickly but around $799 for fourth-quarter sales, while chopping the iPad2's price from its current $499 starting price for a 16GB version and $699 for the 64GB mode. However, if Apple CEO Tim Cook believes the economy is easing, he could shave the price of any new iPad3.

That's because Apple could easily match the Amazon Kindle tablet's initial selling price and still profit. Engineers have reverse engineered the iPad2 and estimated its component cost around $178 -- which Apple sells for an average price of $368, according to IHSiSuppli breakdowns.

Apple now derives a 53 percent gross margin for the iPad2, which uses industry standard components from the likes of Texas Instruments, Micron Technology, Cirrus Logic, STMicroelectronics and ARM Holdings. The microprocessor, from ARM Holdings (actually made by a Chinese or Taiwanese factories) is about 26 percent of the component cost.

After shipping 9.25 million iPads last quarter alone, Apple's contract manufacturers should be able to squeeze more cost out of the product, allowing for an iPad2 discount. Then the iPad3 could be priced at a much higher list price and average sales prices for afficionados and must-have buyers.

The concept would change the strategy long used by Steve Jobs to tailor Apple products somewhat like a BMW in a Honda or Chevrolet market. But having a two-tier price, which analysts like Peter Misek of Jefferies expect, allows it to make money and keep selling a popular product for holiday sales in a period when consumers may feel stretched.

Apple's market share would fall, but still maintain something like 60 percent. That would leave Android-based tablets like the Kindle with about 30 percent, Windows-based ones with about 4.4 percent and RIM's BlackBerry PlayBook with about 3 percent.

The Kindle will resemble the iPad, likely have a 7-inch color touchscreen, which could also include a 10-inch version next year. Aside from direct sales, Amazon can use current retailers like BestBuy and Target.

Amazon is sweetening the deal, too, on entertainment, copying the Apple strategy. For movies and entertainment, it's offering offer free Amazon Prime subscriptions. A customer would get access to Amazon's Android App store. And with the same technology already delivering titles to Kindle users for the Kindle Tablet, content delivery ought to be fast.

To start, Apple will remain way ahead of any competitor with its huge library of applications. But if Amazon worked fast, added more content, perhaps acquired services like Hulu or tapped into some of its existing relationships with libraries, retailers and recording studios, its library could expand quickly. Amazon, though, may be positioning Kindle Fire as a lightweight entertainment and shopping platform.

Then both Apple and Amazon benefit, as do other buyers of tablets, as the device proliferates. Market researchers like Forrester suggest Amazon might ship as many as 5 million tablets in the launch.

In an otherwise slowing market for all manner of electronics, the tablet shift could be the start of something big: a further miniaturization of the PC business.

That could be one reason behind HP's move to spin off its PC unit to shareholders. Meanwhile forecasters like IDC expect middling PC growth around 3.8 percent this year. Tablets, though, are growing at rates exceeding 350 percent.

The risk is bigger for Amazon, whose gross profit last quarter was a mere 2.53 percent compared with Apple's 23.5 percent.

Generation Y has an altogether different view of client devices than older generations, said Ranjit Atwal, of IDC. Rather than buy a first PC, they'll opt for a tablet, taking advantage of portability, connectivity and entertainment capabilities not imagined when Apple was set up 35 years ago.

© Copyright IBTimes 2024. All rights reserved.