‘Last-Chance’ Debt Deal May Be Only Deal

Analysis

The debt limit issue is proceeding on two paths in Washington. Neither is ideal, but each looks like the best the nation's lamentable lawmakers can muster, given the large ideological gulf between the two political parties.

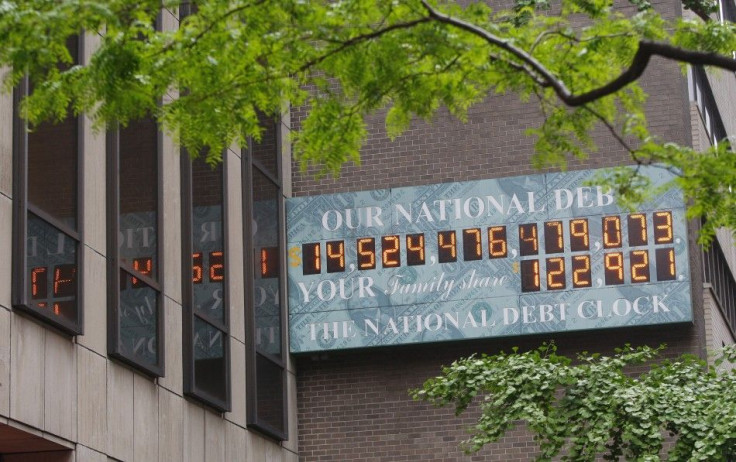

In the 'wasting-valuable-time' department, Congressional Republicans are moving forward with their plan to limit spending. The Cut, Cap, and Balance Bill would cut federal spending by more than $100 billion in fiscal 2012, cap future annual spending at a level equal to 18 percent of U.S. GDP, and would prohibit raising the debt limit unless Congress sends to the states a proposed balanced-budget constitutional amendment.

The bill wastes valuable time because it has almost no chance of approval in the Senate, where Democrats hold a majority and will not support a cap on federal spending at 18 percent. Federal spending has averaged 20 percent of U.S. GDP for decades, and will likely rise as Medicare service costs increase with the retirement of the Baby Boom generation.

As such, the bill amounts to theatrics at the very worst time. The nation is about two weeks away from a default, if the debt ceiling is not raised, and for Congress, in this case the House led by the Republicans, to spend time on a bill with almost no chance of passage and that does not address the debt ceiling issue shows a coalition more-interested in appealing to its conservative base than governing by consensus. That decision by House Republicans may come back to haunt them, if market and economic disruption occurs following a default.

In the 'doing-the-minimum-necessary' department, Senate Majority Leader Harry Reid, D-Nev., and Senate Minority Leader Mitch McConnell, R-Ky., are attempting to put together a last-chance deficit reduction option, in the event President Barack Obama, D-Ill. and House Speaker John Boehner, R-Ohio, cannot forge a grand bargain deficit reduction plan and debt ceiling increase.

And, as of Tuesday at mid-day, it appeared that the chances of Obama and Boehner achieving an historic agreement, are, as the joke goes, 'slim and none...and Slim is out of town.'

Reid and McConnell's complex proposal would let the president increase the debt limit by $2.5 trillion by the end of 2012, provided a veto is not overridden in the House and Senate. The measure could come to the Senate floor as early as Wednesday.

Political/Public Policy Analysis: The House Republicans' plan is a colossal waste of time, and reflects poor judgment on the part of GOP leadership: the House GOP still is in ideology dissemination mode when what the caucus needs to do is put the national interest first.

Meanwhile, Senators Reid and McConnell do deserve some credit for working on the last-chance option -- it may prove to be the only deficit reduction / debt ceiling raise package that Congress is capable of approving this year.

Still, if Congress opts for the Reid/McConnell 'last-chance' option, it would represent a substantial underachievement. Investors and the markets are looking for a bipartisan deficit reduction pacakge that signals that the U.S. is on-track to balance its budget in the decade head. But that can't be achieved without a revenue increase/tax increase, so the best one can hope for, at this stage of the talks, is 'modest progress' on deficit reduction. Here's hoping the markets view that as enough, and not as Washingtion again playing 'kick the can down the road.'

Even so, we're not even at the point of a vote on the last-chance option, and another day on the calendar has passed, Therefore, we're keeping the risk barometer, on a scale of 0 to 100 percent, of the likelihood of a U.S. Government default, at 40 percent heading into Wednesday, the same percent level as Monday.

© Copyright IBTimes 2024. All rights reserved.