March US New Auto Sales Forecast: Chrysler Sales Seen Rising, Market Share The Most; Nearly 1.5 Million Units Sold, Say Forecasters

Click here for the U.S. March 2014 U.S. new-auto sales live blog.

Auto manufacturers will report their March 2014 U.S. new-vehicle sales numbers on Tuesday, revealing whether unusually harsh weather remains a drag on the market, as it was in January and February.

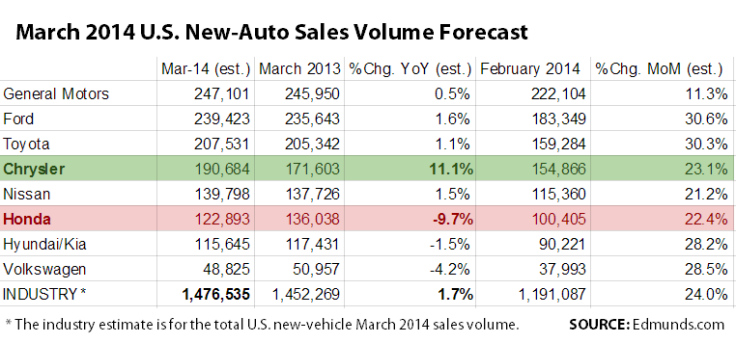

Estimates put U.S. passenger car and light truck sales at about 1.48 million. The seasonally adjusted annualized rate (SAAR), the key metric for measuring the health of the automotive market, is expected to be around 15.8 million, up from 15.3 million in February.

"Now that spring has arrived, weather conditions shouldn't have the impact on car shoppers it had at the beginning of 2014, and we'll be able to get a better sense of the true strength of the marketplace in the coming months," said Jessica Caldwell, senior analyst for Santa Monica-based automotive pricing and information provider Edmunds.com.

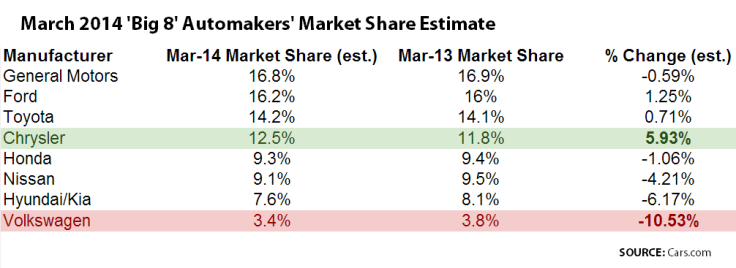

Most forecasters predict 2 percent year-over-year growth in sales as the U.S. automotive market continues to dig out from an historic slump in 2009 after the longest economic recession in U.S. history. But first-quarter U.S. sales are down for six of the top eight global automotive manufacturers, according to Cars.com estimates, which can be seen in the spreadsheet at the top of this article. Only Chrysler and Nissan are expected to have positive year-over-year growth in the first quarter.

Quarterly figures for the first three months of the year were hit by the harsh winter conditions that dipped into the deep southern parts of the country and dumped unusually large amounts of snow in the Northeast. The effect impacted some annual sales estimates, though demand for new vehicles is still predicted to top 16 million units, better than last year’s 15.6 million units.

“New vehicles sales are stuck in neutral so far this year,” said Jesse Toprak, chief analyst for Cars.com, the Chicago-based online automotive listing provider, which lowered its annual U.S. new-auto sales forecast to 16.1 million on Friday.

Weaker-than-expected SAAR in March could mean that factors other than the unusually cold winter are in play. U.S. manufacturing is expected to have rebounded in March on improved weather conditions, and analysts believe unemployment is ticking down, so a miss on expectations of new auto sales would likely be industry-related. Market growth is expected to slow this year, though industry watchers expect sales to be back to pre-recession levels by the end of next year.

"New light-vehicle retail sales are expected to reach 1.19 million units in March, a 7 percent increase compared with March 2013," J.D. Power and LMC Automotive said on Friday.

Fleet sales continue to be low, which indicate that there was sluggish demand from companies and government agencies. But as long as consumers continue their pace of demand, especially for larger margin vehicles, automakers will not miss much from sluggish demand for fleet cars, which offer slimmer profits than retail purchases.

Demand for the smaller, crossover SUVs continues at a robust pace, accounting for between 17 and 18 percent of total U.S. New-auto sales so far this year. Compact SUVs offer manufacturers significantly larger margins compared to sedans, by as much as $6,200 per sale. More than a third of all SUV models available in the U.S. have been completely or partially redesigned in 2014.

Kelley Blue Book forecasts that crossover sales grew by 15.4 percent in March, while all other main vehicle segments (mid-sized cars, compact sedans, full-sized pickup trucks and entry-level luxury rides) are expected to contract.

© Copyright IBTimes 2024. All rights reserved.