Maria Contreras-Sweet Could Soon Lead The SBA: Here's What She's Getting Into

The Senate will be meeting Wednesday to consider the nomination of Maria Contreras-Sweet to head the Small Business Administration.

It’s likely she’ll be approved, given her extensive political and corporate work in support of American small businesses. A lot of attention is on the sector, which the Obama Administration is optimistic about, given their proposed budget announced on Tuesday.

Contreras-Sweet moved to the United States at age 5 from Guadalajara, Mexico. She was one of six brothers and sisters supported by their mother, who worked at a packaging plant in California.

Today, at 58, she’s worked in the political and corporate world to support women, Latinos and small business.

She served as secretary of the California Business, Transportation and Housing Agency, appointed by the Senate to the Federal Glass Ceiling Commission and directed the Congressional Hispanic Caucus Institute.

Outside government, she served on the board of California Blue Cross,

In 2006, she founded ProAmérica Bank, a Latino-owned community bank that provides financial services to small- and medium-size businesses that would otherwise have trouble gaining access to larger institutions. She was also president and co-founder of Fortius Holdings, a private-equity and venture fund with a focus on small businesses in California.

In January, President Obama nominated her to take on the leadership position at the SBA, a spot open since August, when Karen Mills left to take two teaching posts at Harvard.

During her February nomination hearing, she promised to “make sure that the Small Business Administration is an even more significant force in expanding opportunities for all Americans, ensuring the economic strength of our country and the global economy,” according to the Washington Post.

If appointed to the position, she’ll be in charge of a proposed $710 million allocated to the SBA to “create jobs, invest in competitiveness, and grow America’s small businesses” in the budget plan Obama sent to Congress on Tuesday.

This should support more than $36 billion in loan guarantees for more than 55,000 loans. Among other things, this also includes fee waivers for very small businesses and veteran-owned enterprises plus a variety of training and mentorship programs.

Though the total amount is less than the $810 million promised last year, the decrease isn’t a bad thing. The numbers are based on the expectation that the sector will be improving.

For example, proposed allotments for the agency’s loan programs were $112 million last year and just $47.5 million this time around. It’s an expectation that there will be fewer loan defaults as the sector continues to bounce back, bolstering the American economy.

‘Small businesses are a big part of this economic recovery,” reads an SBA press release.

Indeed, small businesses typically account for the majority of job growth in the United States. The ADP Research Institute reported on Wednesday that 42 percent of new jobs in the country were in the small business sector.

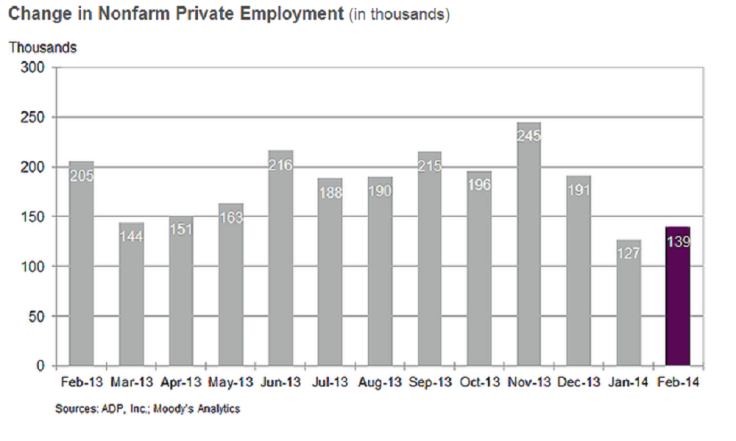

The U.S. added 139,000 jobs since January, far below the 12-month average.

But 59,000 of these jobs were in small businesses (1-49 employees) while just 35,000 medium-business (50 – 499 employees) jobs were added, along with 44,000 large business (500 or more) jobs.

© Copyright IBTimes 2024. All rights reserved.