Markets Await Greek Elections

The tenuous situation in Greece has become a full-fledged national referendum on whether to stay in the euro zone and accept austerity for debt leniency. The situation has led to weaker countries with the currency bloc having to pay continually rising interest rates to fund their operations. Spain was recently unable to tap global investors to fund the recapitalization of its largest bank, Bankia, and may have to accept a bailout from the ECB in order to support the effort going forward. This has led traders and investors to build up a record short-position against the euro, betting that it will test its long-term support levels versus the USD in the coming months.

Send money globally with No Fee Options.

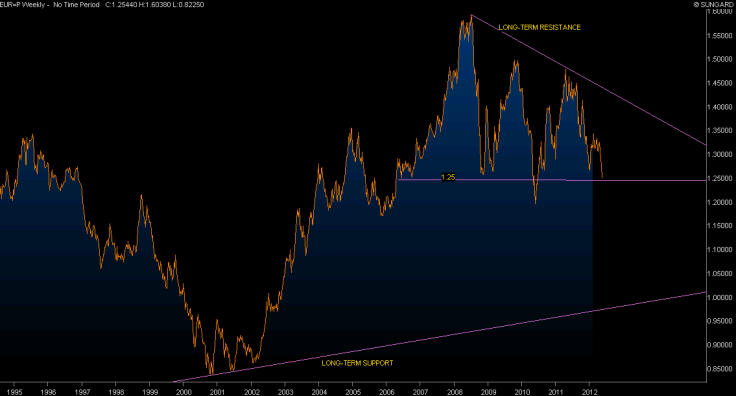

The chart below clearly shows that the line of demarcation has been drawn at 1.2500. Should we close below that level on a weekly basis, then expect losses to accelerate. That said, with so many people on the same side of the market, trading has become susceptible to violent reversals, as traders can be forced to quickly exit their positions by buying back the currency -- leading to swift gains before positions are then recalibrated. Considering the structural problems that exist with the euro zone, expect at least a test of recent years' lows before the market decides that enough has been done to avert a full-blown collapse of the euro.

Send money globally with No Fee Options with iMoneywire.