Cue the Fail Whale. IBTimes rounds up the most offensive, most invasive, most ill-conceived tweets of the year. It’s racism. It’s misogyny. It’s half-baked marketing ploys. It’s Twitter.

The world's largest online storefront doesn't operate like a typical business. It doesn't need to make money.

From Central America to Asia, warming temperatures are threatening the world's banana crops.

Nigerian Aliko Dangote plans to invest $16 billion across infrastructure projects in the energy, agricultural and construction sectors in Africa.

A plaintiff's attorney for claimants criticized strict documentation standards needed for claims on BP’s oil spill fund, arguing that thousands are left unpaid even if they suffered damages.

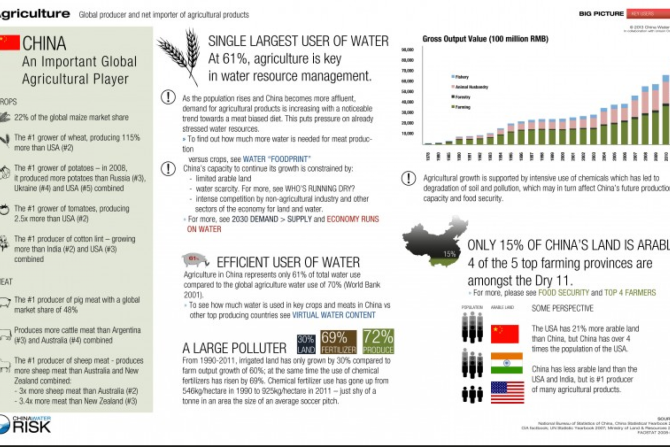

GDP growth will slow just a little more in China, but that pace is in-line with the nation's plan for reform.

The 2-year-old Upworthy has generated phenomenal social traffic with its emotionally driven headlines, but not everyone thinks they’re worth the click.

Chinese consumer demand for gold may reach the highest ever for any country in 2013.

A fall in imports of the precious metal helped Asia's third-largest economy post a sharp annual decline in its trade deficit.

Obama and three former U.S. presidents were among the thousands who paid tribute to Nelson Mandela in Soweto, outside Johannesburg.

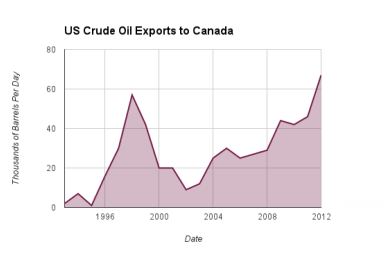

A record number of oil companies got licenses to ship U.S. crude oil this year, according to government data.

In a bid to win over the Chinese market with its rampant food safety scares, Tyson is leaving behind a decades-old strategy.

Even with a Chinese economic slowdown, China's total power demand is expected to hit a remarkable level in 2035.

In spreading a phony quote about Nelson Mandela, Twitter user @DeletedTweets inadvertently proved the powerful allure of the almighty screenshot.

Should gold miners bet on gold price upswings in the face of rising production costs, or instead protect themselves from volatility?

With clashes turning violent in southern France, could a simple tourist boycott be the coup de grace for a centuries-old blood sport?

A leading metals and mining company said the Russian government may no longer have any palladium under its belt.

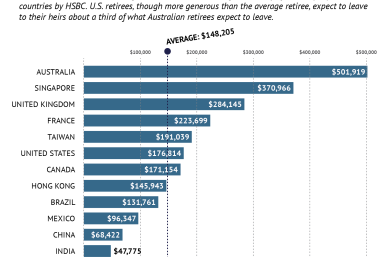

Not only do more than half of U.S. retirees expect to leave an inheritance, they expect to leave a considerable one.

The nation has made relatively few strides in carrying out the WHO's guidelines.

David Cameron has pushed through a deal to export pig semen to China.

After 30 years in charge, Peter Munk is handing the chairmanship to former Goldman Sachs banker John Thornton, who has long experience in China.

It's getting harder and harder to make a believable case against genetically modified crops.

Has Vladimir Putin overplayed his admittedly powerful hand in dealing with a major southwestern neighbor?

The bank said this top trade for 2014 best framed risks and rewards related to Chinese economic growth and commodity market risks.

Geopolitics could trump supply-and-demand fundamentals in determining the price of crude oil.

Despite public outcry, anger in Congress and efforts to rein in the embattled VA, veterans care continues to worsen.

Wal-Mart is notorious for low wages. Could the principles of Fordism ensure a better deal for both?

Northern Dynasty CEO Ron Thiessen spoke with IBTimes about the Alaskan copper mine proposal.

Oil prices were initially pushed lower, but they quickly recovered after details of the U.S.-Iran nuclear pact were announced.

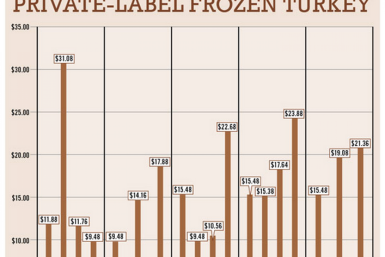

Frozen turkey prices have reached lows not seen in recent memory, which means large holiday season discounts.