South Africa's Impala Platinum Holdings Ltd. said Friday an illegal strike at its key Rustenburg operation has now cost it 120,000 ounces in lost platinum group metals production, which equates to 2.4 billion rand ($322 million) in lost revenue.

Gold rose 1.5 percent on Thursday, rebounding above $1,700 an ounceas the previous session's 5 percent plunge induced investors to buy at lower prices on hopes the tumble was a healthy correction rather than the start of a bear market.

Copper miner Kazakhmys posted a flat core profit for 2011 as stronger metal prices were offset by an 18 percent rise in production costs, including soaring wages for skilled workers in Kazakhstan, home to its core operations.

Russian precious metals miner Polymetal is eyeing acquisitions in Kazakhstan, Armenia, Ukraine, the Russian Far East and Urals, chief executive Vitaly Nesis told Moscow's RBC Daily in an interview published on Thursday.

Gold rebounded on Thursday as physical bullion investors were tempted back to the market by the previous session's 5 percent price plunge, its biggest one-day drop since before the collapse of Lehman Brothers in October 2008.

Spot gold rose more than 1 percent Thursday, recovering from its biggest fall in more than three years in the previous session when U.S. Federal Reserve Chairman Ben Bernanke failed to signal further monetary easing.

Gold fell 3 percent on Wednesday for its biggest one-day drop in 2-1/2 months, as a dollar rally following U.S. Federal Reserve Chairman Ben Bernanke's comment on an encouraging job recovery prompted funds to heavily unwind bullish bets.

Impala Platinum, the world's second-largest platinum producer, said on Wednesday that it would not exit Zimbabwe despite the demands being made by the government that it hand over majority stakes in its local operations to Zimbabweans.

Gold plunged 3.8 percent Wednesday after the dollar firmed and investors took profits from a recent jump in the price of the yellow metal.

A Zimbabwean minister launched a verbal attack on Impala Platinum Chief Executive David Brown, saying on Wednesday he was sick and tired of the mining group's failure to comply with local black ownership laws.

U.S. stock index futures pointed to a firmer open on Wall Street on Wednesday, with futures for the S&P 500, Dow Jones futures and Nasdaq 100 futures rising 0.1-0.2 percent at 4:58 a.m. ET.

Shares of silver mining company shot up Tuesday, riding a jump in the price of silver as well as a wave of optimism that lifted most equity indexes.

Impala Platinum , the world's second-largest platinum producer, said on Tuesday the costs of an illegal strike at its key Rustenburg operation in South Africa have reached 100,000 ounces and a loss of income of 2 billion rand ($263.66 million).

Indian gold futures, which struck a two-month high last week, could extend gains to top 29,000 rupees, a level keenly watched by the market, due to higher crude oil prices and weakness in the dollar versus the euro, analysts said.

Mexican billionaire Carlos Slim's mining company Frisco said on Monday its fourth-quarter net profit had nearly quintupled from a year earlier.

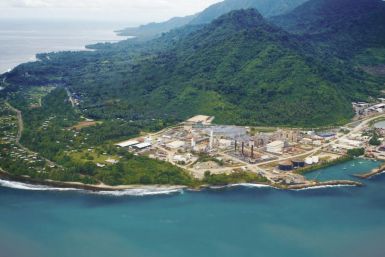

Freeport McMoRan Copper & Gold Inc.'s Indonesia has told workers at its Grasberg mine not to work due to safety concerns linked to labor unrest, a union official said on Sunday.

Sweden said on Monday it had not added to its gold reserves in January, even though data from the International Monetary Fund on Monday showed a sharp rise in Stockholm's bullion holdings.

Gold prices fell 1 percent on Monday, in line with the euro, stocks and other commodities, as worries over the euro zone debt crisis and the impact of high crude oil prices on the fledgling economic recovery fuelled risk aversion.

HSBC Holdings, Europe's biggest bank, said paying rising wages in Brazil, China and other emerging market is the price of avoiding the slowdown being felt by most of its rivals as it posted the largest 2011 profit by a western bank.

Newly listed Russian gold miner Nord Gold may pay its first dividend this year after net profit rose 89 percent in 2011, driven by higher demand for the precious metal.

Impala Platinum, the world's second largest platinum producer, said on Friday the Zimbabwean government had rejected part of an empowerment plan submitted by its unit Zimplats.

Stocks were little changed on Friday, hovering around highs not seen since June 2008, while energy shares gained alongside crude oil prices.

Gold retreated on Friday, shrugging off gains in the euro and struggling to maintain traction after this week's already hefty price climb, as buyers favored assets seen as higher risk such as stocks and industrial commodities.

Newmont Mining said it expects a rise in costs for gold and copper in 2012, mainly due to higher labor and power prices and estimated lower production at a mine in Indonesia.

Gold traders in India, the world's biggest buyer of bullion, were reluctant to enter the market on Friday as the prices remained elevated, though off their 10 week highs.

Canadian miner Alamos Gold reported a 16 percent rise in fourth-quarter profit, helped mainly by robust gold prices, and raised its semi-annual dividend by 43 percent.

Gold rose to a three-month high on Thursday and headed for its biggest one-week rally in a month, spurred on by the strength in the euro following Europe's bailout deal with Greece, ahead of an options expiry later in the day.

Indian gold imports in 2012 could fall by a fifth for the first time in three years to 770 tonnes as investors chase better accruals from equity markets and other financial instruments, possibly ceding the position of top consumer to China.

Coeur d'Alene Mines Corp. swung to a profit in the fourth quarter on increased silver production, higher selling prices and higher selling prices, the Idaho-based miner said Thursday.

Gold jumped to a three-month high on Wednesday, reversing early losses after bullish technical factors triggered fund buying, and platinum prices hit their highest in five months on supply worries.