Members Of Congress Often Back Legislation They Have Personal Stake In: Study

At this point, it’s common knowledge that the 112th Congress has some of the lowest approval ratings in recent history. But what would the American public think if they knew dozens of their elected representatives have supported legislation that directly benefited businesses or industries they are connected to?

It's an important question because, according to an investigation by The Washington Post, many elected congressmen do just that.

At least 73 members of Congress have sponsored or co-sponsored bills in recent years that, ultimately, financially benefited either themselves or family members, according to an analysis by the newspaper. For its report, the Post said it examined financial disclosure forms and public records for all 535 members of the House and Senate before coming to its conclusion.

This practice by many congressment is perfectly legal. Congressional ethics rules allow lawmakers to take actions that may benefit themselves or their families, as long as they are not the sole beneficiaries. The financial disclosure system currently in place also does not require legislators to identify potential conflicts when they take official stances that may align with their own personal investments.

“Ethics rules are supposed to make things clear and transparent,” Harvard public policy professor Dennis Thompson told the Post. “They should not require the public or media to go digging around to make the connections.”

Members of Congress have seen their net worth skyrocket in recent years. Congressional lawmakers had a collective net worth of $2 billion in 2010, according to a November analysis from Roll Call, nearly a 25 percent increase from 2008. During that same period, the average American household only saw its net worth increase by 12 percent.

The following is a short list of some of the lawmakers identified by the Post investigation.

Rep. Dennis Cardoza, D-Calif.

In the spring of 2008 the congressman -- who resigned from his office in August -- was appointed to a conference committee responsible for devising the final language of that year’s farm bill. Within weeks, the Post reported, a new version of the bill emerged that included a tax depreciation schedule for horse owners -- a provision the horse-racing industry had been trying to get through Congress for three years.

When the new depreciation schedule kicked in, Cardoza took the opportunity to purchase seven racehorses. Just after those purchases, Cardoza joined the Congressional Horse Caucus and began holding political fundraisers at race tracks, before eventually co-sponsoring legislation that would have reduced the taxes winners must pay on big wins at racetracks.

After resigning from office, Cardoza took a job with the lobbying firm Manatt, Phelps & Phillips, whose clients in recent years have included gambling companies that own racetracks.

“I have loved horses since childhood and regularly watched horse racing with my mother,” Cardoza said in an e-mailed statement to the newspaper “She passed away in 2007. I used some of my inheritance in 2009 to purchase animals that were a shared passion for us.”

Rep. Cynthia Lummis, R-Wyo.

When the House and Senate wrote their first set of modern ethics rules in the 1970s, they aimed to prohibit members from engaging in legislative activity that would financially benefit them. However, both chambers were soon forced to carve out an exception for lawmakers whose business interests align with the major industries in their states. Currently, dozens of congressmen and women fall into that category.

One of them is Wyoming’s Rep. Cynthia Lummis, who owns at least $1 million in her family’s multimillion-dollar livestock business. Lummis is one of 15 lawmakers co-sponsoring a bill that would double from 10 to 20 years the duration of federal grazing permits for livestock that feed on publicly held lands.

The Post reports Lummis’ husband currently holds a permit allowing cattle to graze on 675 acres of federal land through 2017.

The congresswoman also introduced a bill seeking to change how cattle are priced, to ensure that ranchers and farmers are fairly compensated, as well as another bill that would exclude livestock manure from being defined as a hazardous substance.

Rep. John Yarmuth, D-Ky.

Yarmuth, a member of the congressional Home Health Caucus, has as much as $5 million invested in his brother’s Louisville-based home health business Almost Family.

After taking office in 2007, the congressman reportedly asked the House Ethics Committee if he could vote on legislation that could potentially affect his own personal holdings. The panel said Yarmuth had a duty to vote, unless it would benefit his assets in a “direct and distinct matter rather than merely as a member of a class.”

But while Yarmuth has since co-sponsored a handful of bills of interest to the home health industry, his communications director Stephen George pointed out that some of the congressman’s votes have run counter to the home health industry’s broader interest. For instance, Yarmuth notably helped draft and pass the Affordable Care Act, which hit the home-care industry with reduced reimbursement rates and new regulations.

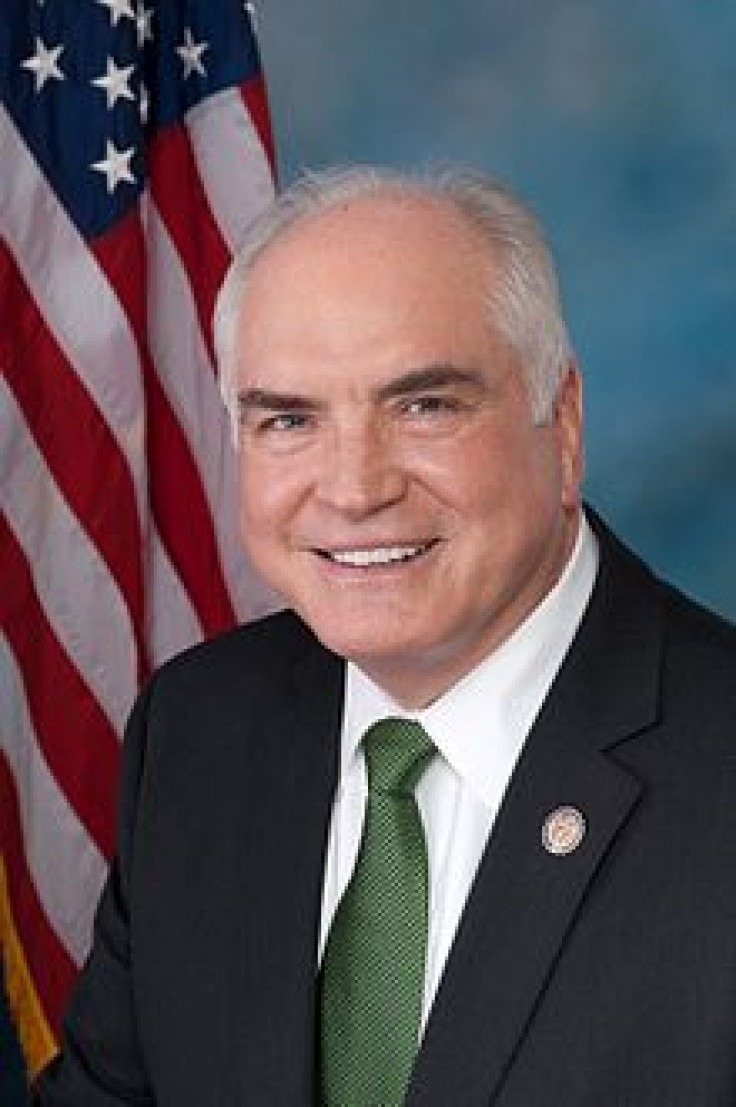

Rep. Mike Kelly, R-Pa.

When Kelly filed his candidate papers for Congress in 2010, he listed his shares in two privately held natural gas companies -- founded by his wife’s great-great-grandfather -- at between $2,000 and $30,000.

His wife’s shares, on the other hand, were valued at between $1.5 million and $6 million.

Kelly was a fierce advocate of Marcellus Shale gas development at a time when Exxon Mobil was purchasing the two natural gas companies, Phillips Resources Inc. and TWP Inc., he and his wife owned shares in. The couple -- whose holdings included 317,000 acres in the gas-rich Marcellus Basin -- made anywhere between $10.1 million and $50.2 million on the sale.

In June, Kelly co-sponsored a natural gas bill that would have provided between $5 billion and $9 billion in federal tax credits for a variety of initiatives designed to increase the number of passenger vehicles and long-haul trucks fueled by natural gas. Kelly and his wife continue to hold stakes in two natural gas companies: Campbells Gas Partners and PC Exploration Ltd., both of which also have land along the Marcellus Shale.

© Copyright IBTimes 2024. All rights reserved.