Millennials Will Need To Rely On Themselves In Retirement More Than Boomers Do, Says Report

Younger Americans are focused on their immediate needs: making rent payments, moving out of their parents’ homes, digging out from under a mountain of student-loan debt or simply trying to find a job. But they'd better start thinking a lot further down the road. A report released Wednesday by Merrill Lynch suggests that millennials will be relying on themselves in their retirement years more than any other generation since World War II.

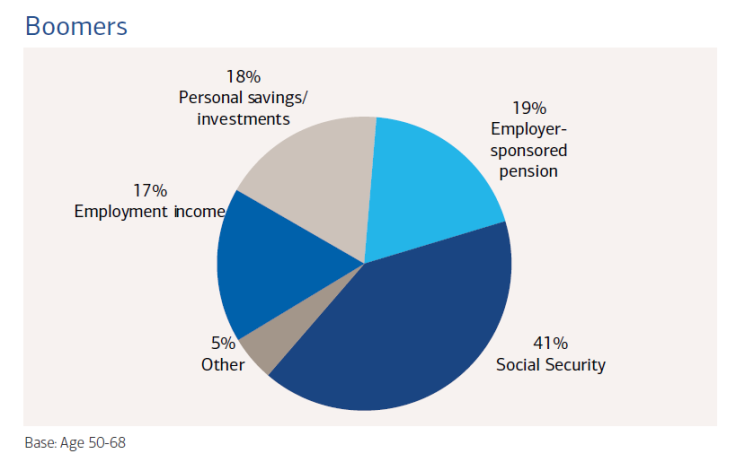

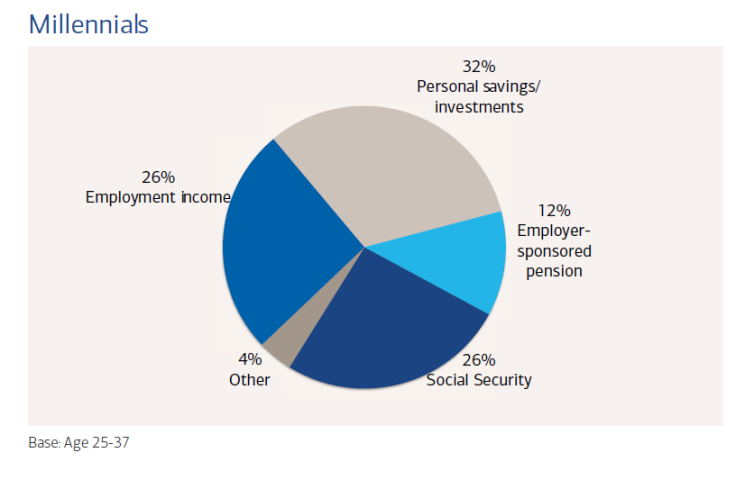

Americans born between the early '80s and late '90s have been hit hard by the last downturn. Ironically, their elders -- who caused the economic mess -- will benefit more than they will from federal Social Security and employer-sponsored pensions.

Millennials will work longer, will reap significantly fewer entitlements and will need to save a lot more money than the Baby Boomers had to in order to make ends meet in their older years. Young Americans who have entered the workforce since the Great Recession of 2007 to 2009 will also earn less and have fewer benefits if current trends continue.

"Retirement used to mean the end of work. But now we’re at a tipping point: a majority of people will be continuing to work after they retire -- often in new and different ways,” the report stated.

About 47 percent of Baby Boomers -- Americans born after World War II who are rapidly flooding the public social security system -- say they plan to work or are working in their retirement. A majority of pre-retirees, 72 percent, say they want to work in their retirement years, suggesting a growing perception that retirement is no longer viewed as period of decline.

But while many older Americans consider working in retirement as a perk, there are economic factors at play, including the elimination of employer-provided pensions. For many current and future retirees, working is not a matter of choice, and by the time millennials turn 64, or whatever number Congress decides is the retirement age in the future, they will have no choice but rely on savings and labor to avoid spending their final years in poverty.

Read the full report here.

© Copyright IBTimes 2024. All rights reserved.