Money For Developed Market Stocks Came From Emerging Market Equities, Not Developed Market Bonds: Citi

Investors poured money into riskier U.S. and developed-world stocks in 2013, shifting away from volatile bond markets where low yields and interest rates offered few attractive returns, according to one common market narrative.

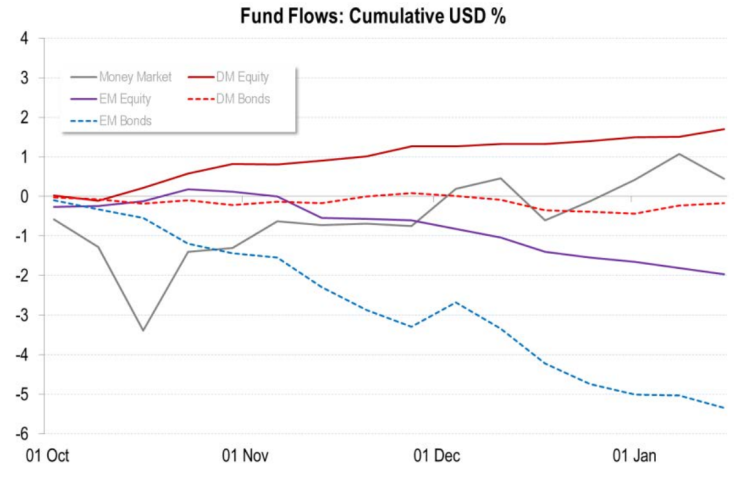

Not so, says Citigroup Inc. (NYSE:C) in a note Monday. Money for developed market equities came more from money that left emerging markets, and not from bond investors exiting their investments during a year when Federal Reserve remarks triggered wild fluctuations in U.S. bond markets.

“Flows out of emerging markets are more likely the source of demand for developed market equities than cyclical flows out of fixed income,” wrote Citi analysts. That’s meant to undermine belief in the traditional narrative, which sees investors switching from bonds to stocks as the U.S. economy strengthened and equity markets scored repeated all-time records.

“A closer look at the data shows that what is really taking place is an ongoing flow out of emerging markets into developed markets,” they said. “Capital flows from EM [emerging market] top DM [developed market] on shifting trade and current account patterns is the more likely driver of these trends.”

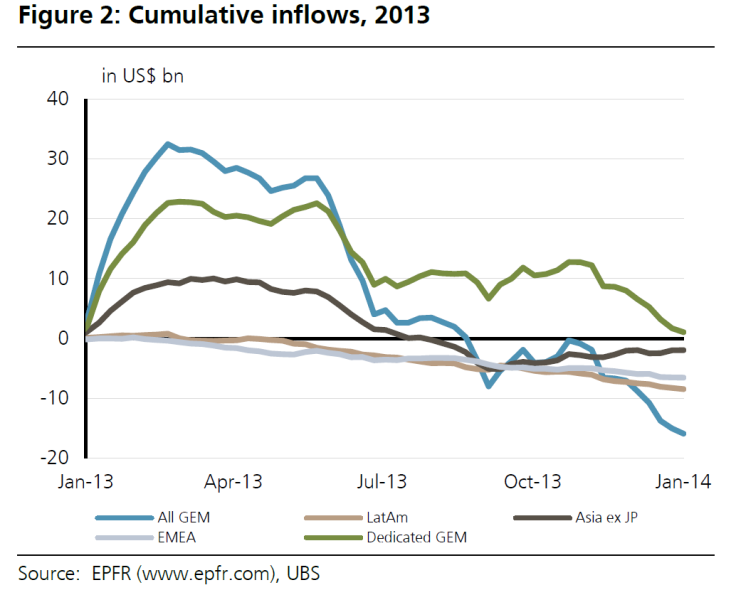

From emerging markets – classically taken as the BRICS nations, which include Brazil, Russia, India, China and South Africa, alongside others – money has left both bonds and equities. Swiss bank UBS AG (VTX:UBSN) estimates that global emerging market funds saw $15.9 billion of outflows in 2013, relative to inflows of $51.3 billion in 2012.

Emerging markets saw a discouraging 2013, as fears over U.S. monetary policy and a scaling back of quantitative easing caused emerging currencies, bonds and equities to slide.

Some analysts say, though, that 2014 should be better for these markets, as the U.S. buys more emerging country exports with a stronger dollar and economy. Others warn that countries with serious trade deficits, like India and Indonesia, will pay more to fund deficits, given higher U.S. interest rates.

Currencies remain key, wrote Citi analysts. “The selection of which equity market to buy may, however, be based more on a currency view than a specific equity view,” they said.

In early January, investors cut their positions in all emerging markets except Korea, Thailand, Turkey and Morocco, according to a Jan. 3 UBS note. The least crowded markets for such investors included Russia and India, said UBS analysts.

Bond yield rises of 1 to 2 percent over two quarters could lead to “a sharp reduction in capital inflows to developing countries” of up to 80 percent, the World Bank warned last week. Their report highlighted the risks advanced nations pose to emerging markets, if central banks unwind monetary stimulus.

© Copyright IBTimes 2024. All rights reserved.