Nation's Largest Job Creator -- Private Businesses -- Doing Worse Now Than In January

Despite the billions of dollars in trades that occur every day on Wall Street, the engine that drives the U.S. economy isn’t rumbling within the secured perimeter that guards the New York Stock Exchange in lower Manhattan but rather the privately held businesses nearby: an Equinox Fitness Club, the New York offices of The Monitor Group, the famous Delmonico’s restaurant, the company that owns this website.

The state of these private job creators is the best gauge of the nation’s economic health because they produce a majority of the nation’s gross domestic product and employ more than six out of 10 workers compared to the government or the 0.8 percent of U.S. companies that buy and sell stocks to investors.

The sentiment of private business owners, while more difficult to determine than listed companies because private companies are not subject to disclosure rules, is an important indicator of the direction the economy is going.

But unlike publicly listed companies, private entrepreneurs cannot endure periods of unprofitability for very long. A few months of losses can shut a smaller company down. In a climate of uncertainty, private business owners are more risk-averse, preferring to eke out enough profit to cover their cost of living without hiring more employees.

According to the latest estimate from Raleigh, N.C.-based Sageworks, Inc., which provides financial data research and analysis on private companies, average annual sales from private companies have been cut in half since January, to 5.4 percent. They’re still making money, but not enough to hire.

“If these guys weren’t hiring with sales of 10 percent, what do they do when growth is 5 percent?” Sageworks CEO Brian Hamilton rhetorically asked a roomful of journalists in New York’s Harvard Club on Thursday. “How these private companies operate has important implications in the job market.”

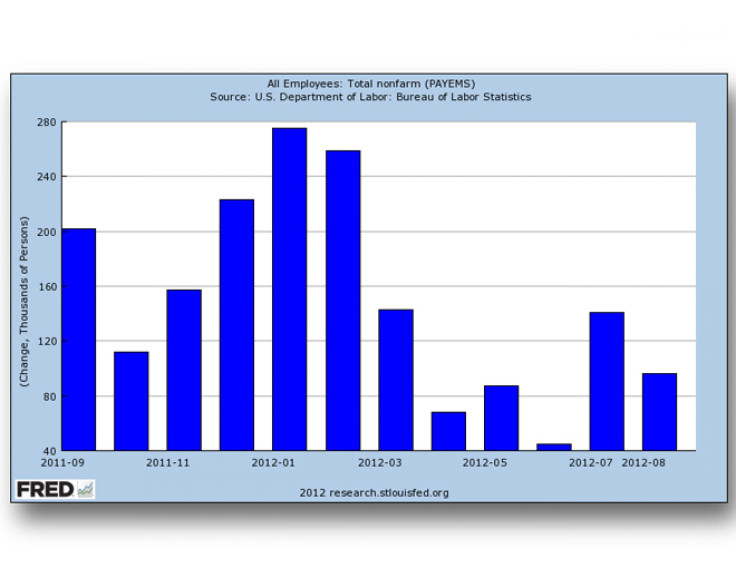

Recent nonfarm payroll figures support the data. January saw the most robust monthly hiring in the past year, with 243,000 hires. By August, that number fell to 96,000. Since January the U.S. has seen five month-to-month declines. May and July saw modest bounces, but hiring has slowed significantly since the start of the year. Friday’s September jobs report is expected to be 113,000, according to analysts polled by Thomson Reuters, not much higher than August’s disappointing number.

Hamilton says his company’s research found that profit margins for private companies have strengthened this year, to 9.1 percent on average from July to September and 7.9 percent for the year so far, compared to about 3.3 percent in 2009.

But he warns that a myriad of uncertainties in 2013 – what business tax rates will be, the effect of the Affordable Care Act on the cost of employing workers and whether smaller businesses will have adequate access to credit to invest in growth – is certainly causing America’s most important job creators to be more cautious.

One solution to the jobless recovery problem is to allay core concerns of private business owners. In essence, address the core uncertainties regardless of the policies put in place. Companies can adapt if they know what they’re adapting to, says Mark Jaffe, president of the Greater New York Chamber of Commerce.

“Uncertainty in health care policy and uncertainties in lending is leading to a lack of capital, which affects hiring,” said Jaffe. “If you don’t know how much your tax rate will be next year, it’s also hard to know how much to borrow.”

© Copyright IBTimes 2024. All rights reserved.