Netflix Beware: Amazon Doubles Share Of Streaming Video Over Past 18 Months

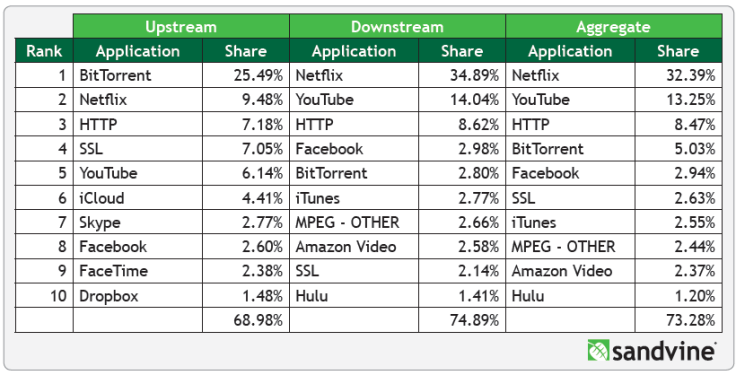

It’s widely known that Netflix accounts for the largest share of streaming bandwidth consumption during peak periods in North America. But it’s starting to see some new competition from Amazon Instant Video, according to the latest report from broadband network solutions provider Sandvine.

To be clear, Amazon Instant Video is still tiny. Yet over the past 18 months its share has more than doubled, to 2.6 percent -- without a presence in Canada. It's not known precisely how many Prime -- Amazon’s prepaid shipping and movie service -- subscribers the company has, but RBC Capital analyst Mark Mahaney pegs that number somewhere between 30 million and 40 million in the U.S. and growing, according to Re/code.

The online retail giant has been making moves over the past year to diversify the content selection on its streaming service with original series and a deal with HBO to provide content to the Amazon Instant Video library. It's about to have even more competition next year when HBO Go is released as a standalone product. The new service’s small (1 percent) share is expected to grow as a result.

“With both Netflix and Amazon Instant Video gaining bandwidth share in North America during 2014, it will be fascinating to see how a standalone HBO Go streaming option will impact networks when it launches in 2015,” Sandvine CEO Dave Caputo said. “The dynamic streaming video market underscores how important it is that operators around the globe have the business intelligence and big data solutions in place to understand the ever-changing behavior of their subscribers.”

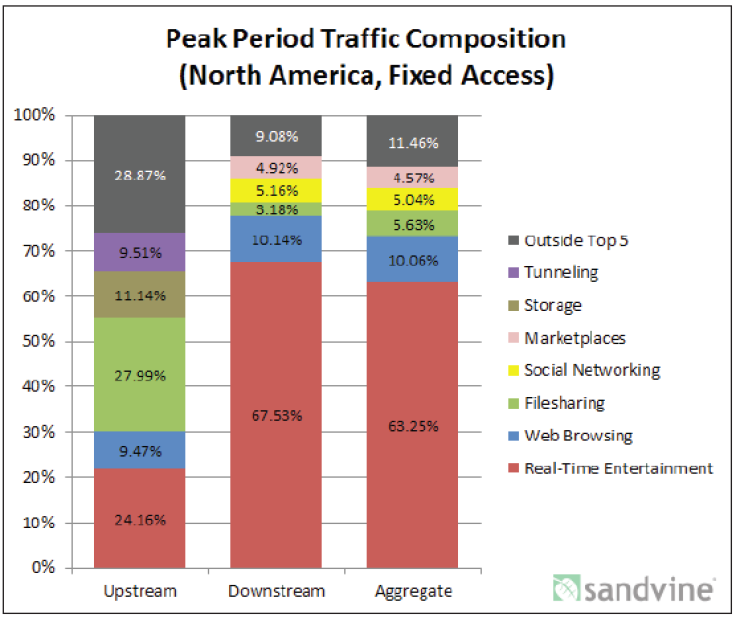

Facebook’s autoplay videos were also cited as a contributing factor to growing bandwidth usage, with a 200 percent increase in traffic on fixed networks over the past year. On average, fixed broadband consumption has grown to 57.4 gigabyte per month across North America, a 13GB increase from same period last year. Overall, streaming video and entertainment continues to consume the vast majority of peak bandwidth usage in North America, followed distantly by Web browsing, file sharing and social networking.

© Copyright IBTimes 2024. All rights reserved.