Netflix (NFLX) Is Still Winning The Streaming Wars Against Hulu And Amazon, By A Country Mile

The Great Streaming Wars are far from over, but new information indicates just how much of an uphill battle awaits services like Hulu and Amazon Video.

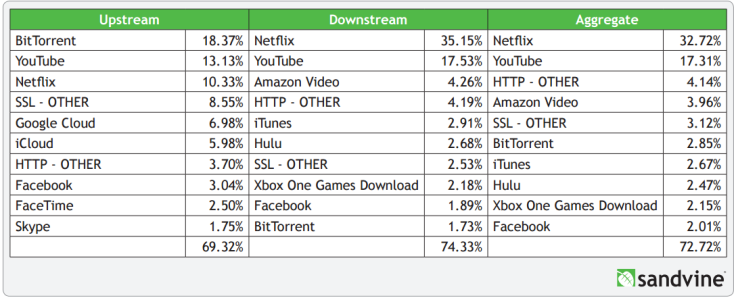

According to the latest data on streaming from internet traffic analyzer Sandvine, Hulu now accounts for just 2.7 percent of traffic in North America during peak hours, compared to Netflix’s massive 35 percent. Amazon Video is slightly ahead of Hulu, but still far behind Netflix, with 4.3 percent.

Of course, Hulu is available only in the U.S., which puts a bit of a damper on its potential traffic continentwide — Netflix is available in Mexico and Canada. Amazon Video suffers from the same geographic restrictions when it comes to North America.

YouTube, which, like Netflix, is available just about anywhere with an internet connection, comes in at No. 2 on Sandvine’s list of biggest traffic gobblers in North America, with 17.5 percent of traffic during peak hours. That seems like a big difference, particularly when laid against YouTube’s claims of billions of minutes watched and massive reach. However, it’s important to note that Netflix doesn’t just house mere videos — it’s for full-length HD movies and TV episodes, which tend to run at least 20 minutes and require a lot more bandwidth.

Hulu’s numbers might look very different starting in 2017, when the company is supposed to launch a true-blue live TV package delivered via the internet. Depending on how many people sign up for the as-yet unnamed package — rumored to cost around $35 a month and include broadcast networks and cable channels like AMC — that could goose Hulu up past Amazon.

The cautionary tale here is Sling TV, Dish Network’s TV-over-the-internet package. While it did find its way into the top 20, Sling traffic only accounted for less than 1 percent of the downstreaming happening during peak hours. Sling has been a reasonable success for Dish, with an estimated 500,000 subscribers.

© Copyright IBTimes 2024. All rights reserved.