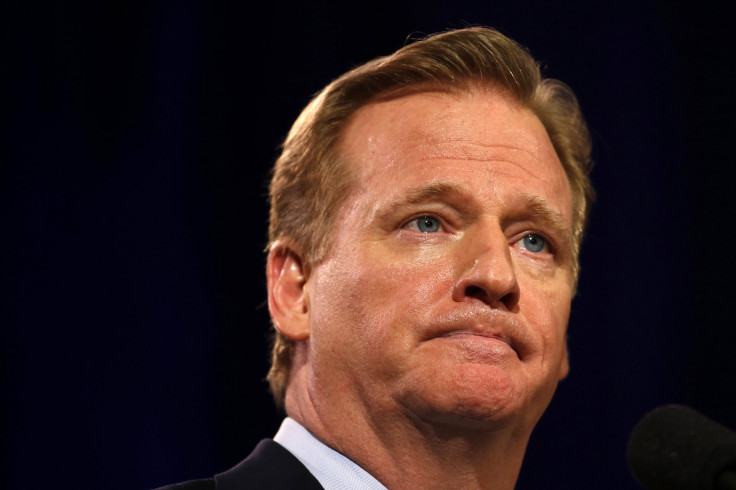

NFL Boss Roger Goodell Tells Congress League’s Headquarters Will Start Paying Taxes

The National Football League’s New York City headquarters will no longer be tax-exempt, a move NFL Commissioner Roger Goodell says is an effort to eliminate a “distraction.” The move is largely symbolic since most of the American football league’s taxable revenue goes to the 32 NFL member teams.

“The change in filing status will make no material difference to our business,” Goodell wrote in a Tuesday letter to team owners and members of Congress obtained by Bloomberg.

Goodell salary will be public one more time when the last public tax return is released next february

- daniel kaplan (@dkaplanSBJ) April 28, 2015The decision responds to increasing criticisms from lawmakers over the NFL’s tax-exempt status that dates back decades. "It's an issue of basic fairness," Rep. Jason Chaffetz, R-Utah, said in an interview with Reuters last month. "The National Football League should have to pay taxes like everybody else."

The congressional Joint Committee on Taxation estimates that the tax-exempt status costs taxpayers about $10.9 million a year. The NFL generates about $10 billion in annual revenues through the teams.

Once the NFL’s headquarters becomes taxable, it will no longer have to file as a nonprofit 501(c)(6) organization. This means Goodell’s salary will no longer be publicly available. The NFL boss earned $35 million plus bonuses in 2013, according to the latest regulatory filing.

© Copyright IBTimes 2024. All rights reserved.