Nook Color 2 Must Hit $200 Price Point to Succeed

Opinion

It's just days before Barnes & Noble, the retail bookstore behomoth, the company that operates roughly 1,300 bookstores nationwide, will make a special announcement at a New York City press conference and, already, the publishing world is speculating about the second generation Nook Color, the company's popular e-reader device, that has been prematurely dubbed the Nook Color 2 by many media outlets.

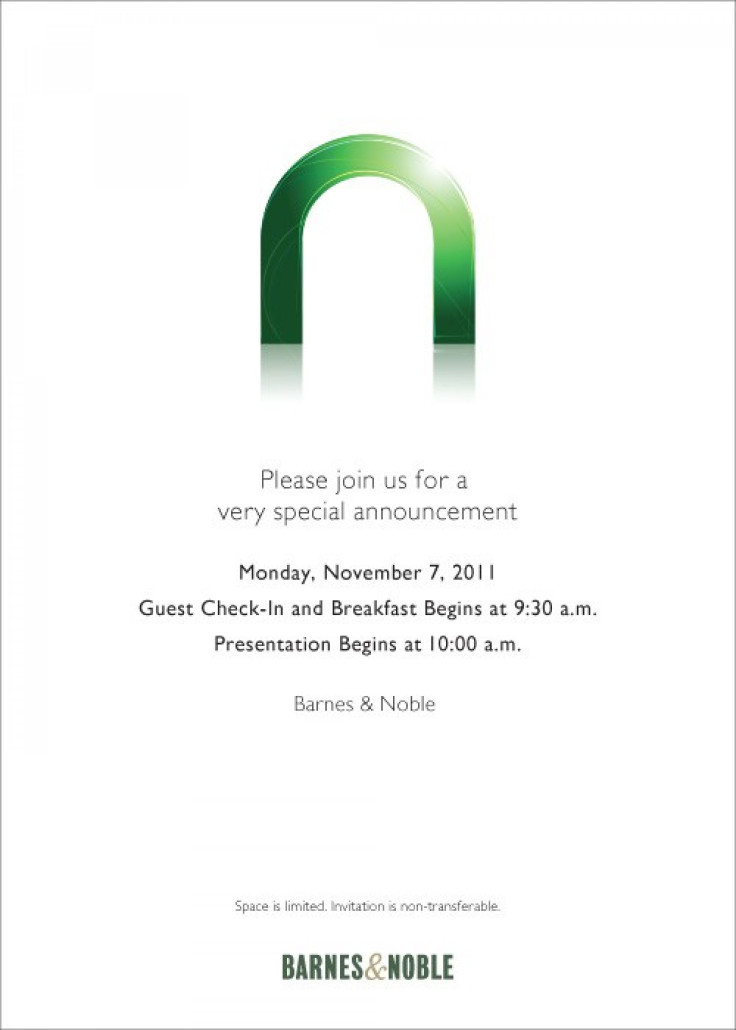

There are several reasons the Nook Color 2 is likely to make its first public appearance at the event: First, Barnes & Noble wouldn't lure dozens of journalists out to a press conference to announce a new website or a new store design. Second, it's fair to assume they're not going to be shifting business models or acquiring any new properties (the company has remained loyal to the publishing community, even in the most dire times). Finally, and, most importantly, the invitation (Full disclosure: I received an invitation as I was writing this column.) that was sent out for their special announcement has the trademark u-shaped N that's synonymous with the Nook e-reader placed at the top. In fact, the Nook logo is the most prominent part of the invitation -- much larger than any other text and even larger Barnes & Noble logo. This may give some indication about how important the company sees its pending announcement.

While the Nook Color 2 will undoubtedly be a monumental announcement for Barnes & Noble, regardless of the tech specs, there's one thing that everyone (from publishers to investors and beyond) will be watching closely--the price of the device.

In my estimation, the Nook Color 2 must be sold at the $200 per unit or it will be trounced by competitors that are now firing from all angles. The publishing industry is in a time of flux, a time when tech companies are eagerly disrupting outdated pricing models that have been in motion for decades, and, for incumbent publishing industry companies to keep up, especially bookstores, they'll need to introduce new marketplaces and pricing models that can compete in the digital arena.

There are several reasons one can assume that the tipping point for tablet sales is a $200 price point: The most obvious is the Amazon Kindle Fire, which will be released November 15 and is expected to be one of the largest holiday gift items of the year, will be sold for $199.

Amazon's pre-order sales indicate that the Kindle Fire is on pace to outsell the most prolific tablet in the world, the Apple iPad, which has sold more than 15 million units of its first generation device. Though the first generation iPad has dropped in price since its debut, it was initially released at a base price of $499. That's more than double the Amazon Kindle Fire, albeit, one year earlier.

Apple has historically been able to sell devices as an ultra-high premium because of their emphasis on design, power, high-quality pre-installed applications and easy-to-understand ecosystem. That's held true with the Apple iPad.

During Steve Jobs' announcement of the Apple iPad, he directly criticized netbooks, saying Netbooks aren't better at anything... They're just cheaper. It's been clear over time that Apple has never been concerned about pricing, so long as the device they're selling is a complete device and offers several valuable things to the consumer.

That announcement of the first generation iPad, however, was more than a year ago, and, in the rapidly changing marketplace of mobile technology, much has happened. Several Android-based tablets and other touchscreen devices from large tech companies that many expected to be iPad killers sold miserably. The Motorola Xoom, for instance, had few applications made for it and started at a base price of $799. Similarly, the Blackberry Playbook had a shortage of developer support and a high price tag.

From all the failed tablets, or rather failed iPad Killers, one particularly interesting phenomena emerged. When the price of the HP Touchpad dropped to $99, it sold out quickly. Investors, publishers and hardware manufacturers all took note, and that's become the new benchmark if you're not Apple. While Apple's fans may remain loyal to the company regardless of the price, some may be lured by Android-tablets that are beginning to find their niche.

Enter the Nook Color 2: Barnes & Noble was one of the first publishing companies to embrace LCD screens as e-readers and low-budget tablets (long before Amazon had, while Amazon was still touting the benefits of e-ink). The first generation of the Barnes & Noble Nook Color sold extremely well, and, in the same tradition, I expect that the Nook Color 2 to sell well. It will likely be affordable, slim, lightweight and support a large bank of applications. My greatest hope is that it sells for under $200. That would make it a game-changer.

© Copyright IBTimes 2024. All rights reserved.