NVIDIA FY13 Guidance Focus on Long-Term Growth Potential: Analyst

Digital graphics chip maker NVIDIA Corp. (NASDAQ: NVDA) unexpectedly provided fiscal 2013 financial guidance, which Jefferies believes primarily to focus investors on its longer-term growth potential.

NVIDIA's fiscal 2013 revenue guidance of $4.7 billion to $5.0 billion is about 9 percent above the Street estimate of $4.45 billion at the midpoint and represents about 17 percent year-over-year growth relative to the Street estimate of $4.1 billion for fiscal 2012.

The company expects gross margins of 51 percent to 53 percent for the year, which appears roughly in line with Jefferies and the Street estimates.

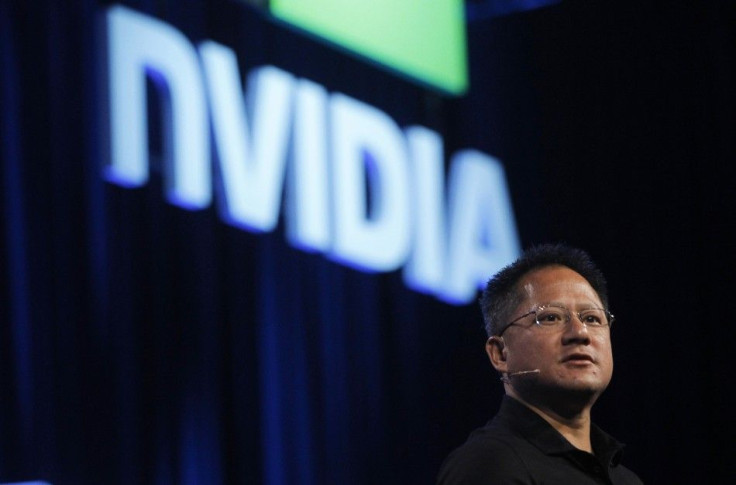

We see growth across our entire GPU and mobile-processor business. The future for computing is visual and mobile, and we are well positioned to lead in this new era, said Jen-Hsun Huang, Chief Executive of NVIDIA.

Nvidia also plans to spend in a range of $1.54 billion to $1.61 billion for operations, which represents about 5 to 10 percent year-over-year operating expense growth relative to Jefferies and the Street estimates.

Excluding stock based compensation expenses, amortization of acquisition-related intangible assets and other acquisition-related costs, operating expenses is expected to be $1.38 billion to $1.43 billion for fiscal 2013.

We believe the company is investing to deliver double-digit revenue growth, and there is risk the growth takes longer to materialize, said Mark Lipacis, an analyst at Jefferies. Our model remains unchanged, but we could become more constructive with visibility into Tegra ramp for Smartphone/Tablet, and/or ARM-based PC ramp for Windows 8.

As Sandybridge penetration of mainstream and low-end notebook increases in second half of 2011, and Intel and AMD aggressively transition to ultrabook form factors, Lipacis believes it will become increasingly difficult for original equipment manufacturers (OEM) to fit power-hungry GPU in notebooks, regardless of the traditional discrete GPU upsell opportunity the company argues, especially in China.

Separately, he models robust revenue growth for Tegra, but remains concerned his visibility into meaningful Tegra ramps is low. He believes there is elevated risk of near-term softness, and estimate cuts for second half of 2011 (second half of fiscal 2012).

Long-term, we think NVIDIA is arguably the best positioned semiconductor company to benefit from Windows-on-ARM deployments, especially if this architecture gains traction in notebook form factors, said Lipacis.

He believes no other ARM-based semiconductor company has the PC-systems capability (CPU, GPU, chipset, drivers) that NVIDIA has, and he would expect them to be a leading supplier to ARM-based PC OEMs.

However, the company positioned this as a late-calendar 2012 event, and he believes there are multiple schedule risks associated with introducing a new PC architecture.

NVIDIA stock is currently up 5.46 percent at $13.90 in the pre-market trading on the NASDAQ Stock Market.

© Copyright IBTimes 2024. All rights reserved.