Nvidia shares dip as investors eye mobile chips

Investors focused on slower-than-expected growth in chipmaker Nvidia Corp's (NVDA.O) mobile business following strong quarterly earnings and sent its stock lower.

Nvidia's shares were up 11 percent on Friday after the Santa Clara, California company's forecast beat expectations late the day before, but the stock later lost its gain and was down 5 percent.

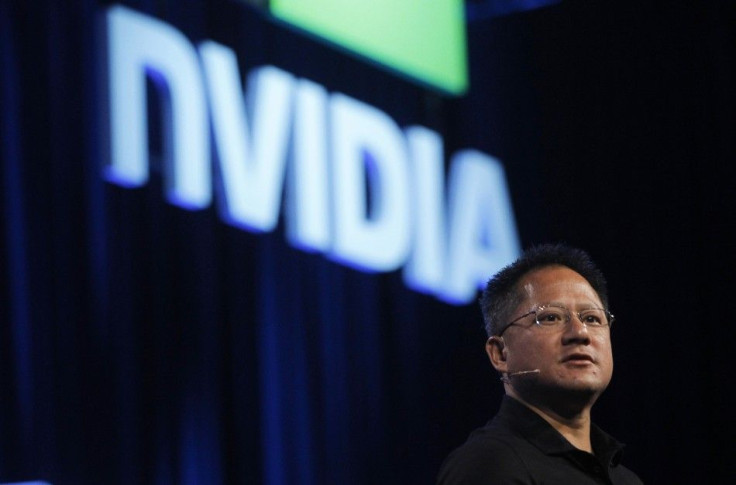

Many investors have turned to Nvidia because of its Tegra mobile processors for tablets and smartphones unveiled this year. But the Tegra business will be "steady as she goes" while Nvidia's other business segments will grow in the current quarter, Chief Executive Jen-Hsun Huang told analysts on a conference call on Thursday.

Some expected Huang to be more upbeat about Tegra's pace of revenue growth. Tegra sales are small now, but are expected to become a big chunk of Nvidia's business.

"Investors just assumed the product was going to ramp of its own accord. In fact, Nvidia is really beholden to its (manufacturing) customers," said MKM Partners analyst Daniel Berenbaum. "Management has not been particularly helpful in providing realistic revenue ramp plans."

Nvidia, whose name is well known to a community of gamers, graphic designers and other high-end users, this year made a splash at the Consumer Electronics Show in Las Vegas, where it unveiled a series of "design wins" -- electronics manufacturers agreeing to use its mobile chips in phones and tablets.

On Wednesday, Nvidia said Samsung Electronics (005930.KS) is using the Tegra in the new Galaxy R smartphone, the first time Asia's biggest electronics firm has used that chip in one of its phones.

Nvidia expects third-quarter revenue to rise 4 to 6 percent from the second quarter, equivalent to $1.06 billion to $1.08 billion.

But Wall Street analysts responded to the quarterly results and outlook with notes with titles like "Show me the Tegra," "Show me the money" and "As many questions as answers."

"We wonder when Tegra finally catches a wave and delivers the robust growth investors had been waiting for -- particularly as the competitive environment intensifies," Evercore analyst Patrick Wang said in note to clients, cutting his price target on Nvidia's stock to $11 from $12.

The stock was at $12.75 on Friday afternoon.

Stifel Nicolaus cut its price target to $25 from $29, citing research and development spending that was higher than its estimates.

Stifel said it continues to view Nvidia as providing disruptive technology in both mobile computing and data centers, and maintained its "buy" rating on the stock.

© Copyright Thomson Reuters 2024. All rights reserved.