Obama Will Highlight Job Creation On Monday, But U.S. Needs 1.9 Million Jobs Right Now Just To Get Back To Pre-Recession Levels Of Employment

It was five years ago Sunday that Lehman Brothers filed the largest bankruptcy case in U.S. history, the same day that Bank of America Corp. (NYSE:BAC) bought Merrill Lynch. The next day, on Sept. 16, 2008, the Federal Reserve authorized an $85 billion taxpayer-backed bailout of insurance giant AIG -- proving that both Democrats and Republicans support socializing the losses of gigantic multinational corporations considered too big to be forced to play by the rules small businesses face every day.

According to a White House press pool report, President Barack Obama is scheduled to "deliver remarks in the Rose Garden on Monday to mark the five-year anniversary of the financial crisis, discuss the progress we have made to grow the economy and create 7.5 million private-sector jobs, and highlight the work we still need to do to strengthen the middle class and those fighting to get into it."

On ABC’s “This Week” Sunday morning, Obama pointed to 42 consecutive months of job growth and a revitalized auto industry.

"We came in, stabilized the situation," he told the nation. "The banking system works. It is giving loans to companies who can get credit. And so we have seen, I think undoubtedly, progress across the board."

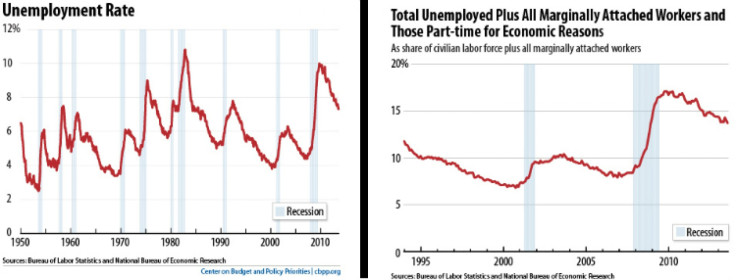

While much progress indeed has been seen since the president and Congress enacted the Recovery Act (the so-called "stimulus") in February 2009 — private sector employers have created an average of 177,000 jobs a month in since early 2010 – the supply of available jobs is still considerably lower than the demand. The 7.5 million jobs Obama will say has been created since early 2010 still falls short of the estimated 8.7 million jobs that were lost between the start of the recession in December 2007 and early 2010, according to the non-partisan Center on Budget and Policy Priorities.

And this doesn’t include the additional jobs needed for the people who have entered the workforce in the last five years. August nonfarm payroll employment is 1.4 percentage points below where it was before the last recession; to make up that difference the U.S. needs 1.9 million more jobs right now. Moving forward, 177,000 jobs created a month is simply inadequate.

© Copyright IBTimes 2024. All rights reserved.