OIL OUTLOOK: How long will it stay ranged? Will it rise above $100?

Dollar, Korea, Ireland, Asian demand, inventories and technicals - a lot of things are weighing on oil now. But market participants find the question if the commodity has reached its bottom technically and on robust demand in some regions, or will a dollar rally or geopolitical developments force it break below the current range, tough to answer.

Charts show that US crude for December delivery has been supported near $80 a barrel since early last year, and some people are busy drawing lines on the graph hopeful to predict the scale and timing of a possible break above or below the range. Others are seen lost in thoughts about the crises of Korea or Europe, sometimes turning hopeful about a QE and other stimuli helping demand for the commodity.

What will you do about oil during wartime?

The answer was simple and undisputed until a year or two ago -You can for sure buy US dollar, which is the safest shelter for any investor anytime and you can also invest in commodities but be careful about the pricing.

But the scene is different now with the greenback shining much less than most of the commodities. People are finding it difficult to believe that the greenback will shoulder the tough times for them anymore.

Tuesday's Korean strike saw safety seeking rally towards commodities and the US dollar but investors were visibly cautious on the currency this time, with negatives weighing on it like never before.

Yes, the choice of a safer investment avenue amid a crisis is a little too tricky these days, given the very special circumstances amid a fragile recovery (if there is one) from the global financial crisis of 2008.

The obvious fundamental is when you can easily print truckloads of papers and boast they all are worth 100 dollars or 50 euros, you are never in a position to increase the quantity or quality of real wealth in the belly of Planet Earth, nor you have developed any alternatives for the same.

Performance of metals, especially the precious ones, has underscored the fact that in the recent past oil mostly followed its fundaments, maybe because of the hangover of the big leap and a subsequent fall two years ago.

What will move oil then?

Over the long-term, the commodity will continue to follow the demand-supply matrix than depend upon relative gains with respect to the dollar, analysts say. The EIA series of inventory data will therefore remain important, just as the health of the global economic recovery is.

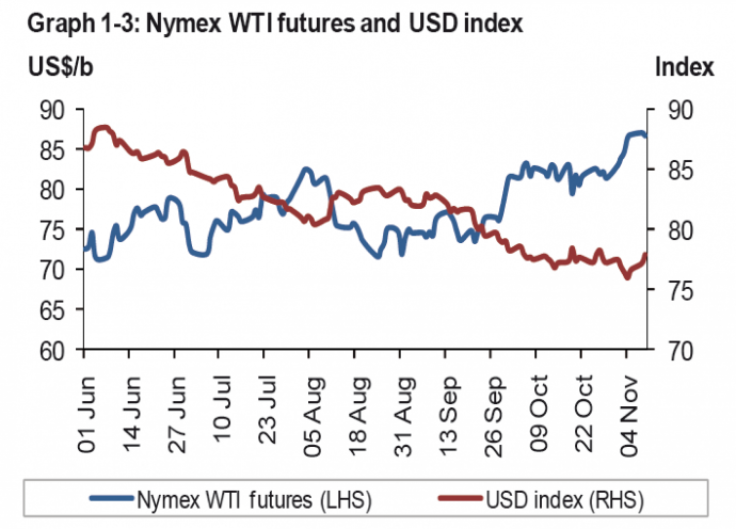

The dollar movement, however, will also impact the commodity, but for short-to-medium term. See image-1 for Nymex WTI futures performance versus USD index - OPEC data.

Wednesday's data showed an unexpected uptick in oil storage in the US last week but it extended gains after the news as market acted upon the fact that it was the strong demand for the commodity lead to higher imports and pushed up stocks. It clearly shows that oil investors will closely follow the pace and scale at which the economy is growing.

But then you have a less hawkish growth outlook shared by a group of policymakers to weigh on the other side - a view likely to remain relevant much more than a week and prevent sharper gains in the commodity.

The Fed said on Tuesday that it sees 2011 GDP growth at a more pessimistic 3-3.6 percent, versus prior estimate of 3.5-4.2 percent released in June. Unemployment is projected to be at around 9 percent by end of 2011, up from earlier forecast of 8.5 percent. Inflation is expected to stay below the informal target of 2 percent through 2013.

Fed members supported the $600 billion bond buyback with a 10-1 vote and most of them expected the program to help promote a somewhat stronger recovery in output and employment while also helping return inflation. But some participants noted concerns that additional expansion of the Fed's balance sheet could put 'unwanted' downward pressure on the dollar.

Some people bought dollars on the Fed comments but more remained cautious because the time is bad for the world's largest economy as well, for which many 'unwanted' are actually 'wanted'.

Beyond US

Wednesday's German IFO data showed better business climate in the country but it could not help the single currency recover from 2-month lows against the greenback on worries the business earnings could well be eaten up by the region's debt-laden members.

Sovereign bonds of the developed and 'matured' European economies are now sold at lowest ever prices and those of the so-called peripheral ones are finding it really difficult to get buyers without burdening the exchequers with sharply higher interest liability.

As Europeans are advised to follow unforeseen austerity practices to help their cash-strapped nations recover from the crisis no one is expecting them to burn more fuel and drive their cars those extra miles to a more comfortable holidaying spot.

Moving on to Asia, investors are certain about a second round of policy rate hike by China with the uncertainty only seen about the timing. And until we get the evolving demand scenario for the world's second largest economy, expectations on the PBoC will all likely lead the demand outlook for the commodity in the region.

See image-2 for OPEC data on China's oil consumption

OPEC Projection

The Organization of Petroleum Exporting Countries (OECD) has revised up the world oil demand for 2010 by 190 tb/d (thousand barrels per day) to 1.3 mb/d (million barrels per day). They revised it for the OECD nations where various stimulus plans helped consumption outpace expectations. But the forecast for world oil demand growth in 2011 has been revised up by a lesser 120 tb/d to 1.2 mb/d.

See image-3 for OPEC projection for world oil demand

See image-4 for OPEC projection for refinery capacity versus world oil demand

Now, for a fact that a big chunk of Asian growth so far is also funded through various stimulus programs, monetary or fiscal, what applies for OECD must be true for Asia as well.

While India has already raised its key rates five times this year the fiscal freebies announced at the height of the crisis more or less remain. Similarly, analysts believe that the measures China has so far taken to tighten credit and liquidity in the banking system is not enough to cool down the 'dragon' that reels under inflation fire.

The fact that both the countries have not yet normalized their policy rates and liquidity levels counters the argument that the region's oil consumption will continue to rise at the current pace.

Finally, what to expect?

Despite the latest Fed remarks that echoed concerns over dollar's recent losses, there is a strong view that the US has no other way but to let its currency further weaken in order to shore up the economy. That should strengthen oil.

Also, many parts of the world may continue to have easy monetary and fiscal conditions for a considerable period, helping the physical demand for the commodity.

But given the long period of a 'comfortable' range of $70 to $90 oil settled into since early last year, it seems 'technically' hard for the commodity to break above the range. See image-5 for crude oil performance in recent years

Saudi Arabia's Oil Minister, Ali Al-Naimi, said earlier this month that a range of $70 to $90 a barrel should be satisfactory for consumers. OPEC's secretary-general later said the group was satisfied with a range of $70 to $85.

If you can believe analysts like Francisco Blanch of Bank of America Merrill Lynch, Al-Naimi could even go for a production regulation to see that his prediction realizes.

That said, in whatever circumstances, crude oil rising above the psychologically important $100 level in 2011 could really be difficult as suppliers may not get adequate demand at very high prices when the whole world is struggling to see the recovery really happening.

Remarks by OPEC's general secretary Abdulla al-Badri on Wednesday underscored the same. He said oil producers and consumers are comfortable at current prices and it is all likely that next month's group meeting in Ecuador's Quito will be smooth.

The producer group has kept its output target unchanged for two years and analysts do not see any chance of reviewing the same at its December meeting and force them sit long hours again to re-work their price projections.

© Copyright IBTimes 2024. All rights reserved.