Oil Prices Hit 2015 Peak As Analysts Foresee Slowdown In US Drilling, China Economic Stimulus Package

Oil prices hit a 2015 high Monday, rising to $67 a barrel. An expected slowdown in U.S. oil drilling, and speculation on a Chinese economic stimulus plan, helped raise prices, which are still down by around 40 percent from last summer’s highs.

Brent crude, an international benchmark, rose to $67 a barrel Monday before settling at $66.85 at 6:46 a.m. EDT (10:46 GMT), Reuters reported. U.S. benchmark crude rose 22 cents to $59.37, down slightly from Friday's U.S. high of $59.90 a barrel.

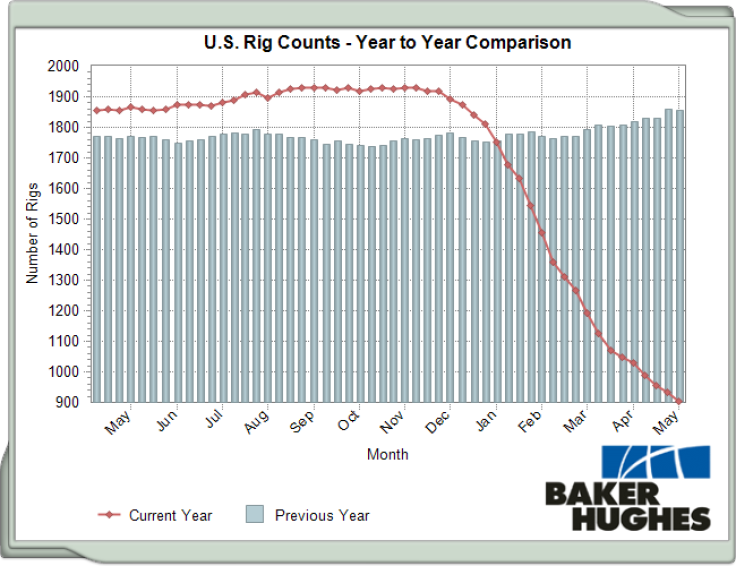

Analysts have cut their outlooks for U.S. crude production this year as lower oil prices make it harder for drillers to turn a profit. Baker Hughes Inc., a major oil services firm, on Friday reported the number of active U.S. rigs has fallen for a record 21 straight weeks to just over 900 rigs -- the lowest level since September 2010.

Declining U.S. oil production would help ease the global glut in crude supplies. OPEC nations, led by Saudi Arabia, have refused to cut output despite falling prices and waning demand in emerging economies like China. By standing its ground, OPEC is forcing newer competitors -- namely those in the United States -- to slow down drilling and cede their market share.

Oil prices also rose this week on news of weak Chinese factory activity, which reinforced analysts’ views that the country could adopt stimulus measures to boost the Chinese economy, Reuters reported. Activity at China’s factories shrank at its fastest pace for a year in April as new orders fell, a private business survey said.

Still, the effect of weaker Chinese data and slower U.S. production on global oil prices has been limited so far. “What the market really wants to see is supply being cut to match the demand level,” Ric Spooner, chief market analyst at Sydney’s CMC Markets, told Reuters.

© Copyright IBTimes 2024. All rights reserved.